Amid volatile financial markets, gold’s year-to-date performance is now the third-best since 1980. According to analysts at TDS, the performance is now just a hair’s breadth away from its 44-year all-time record.

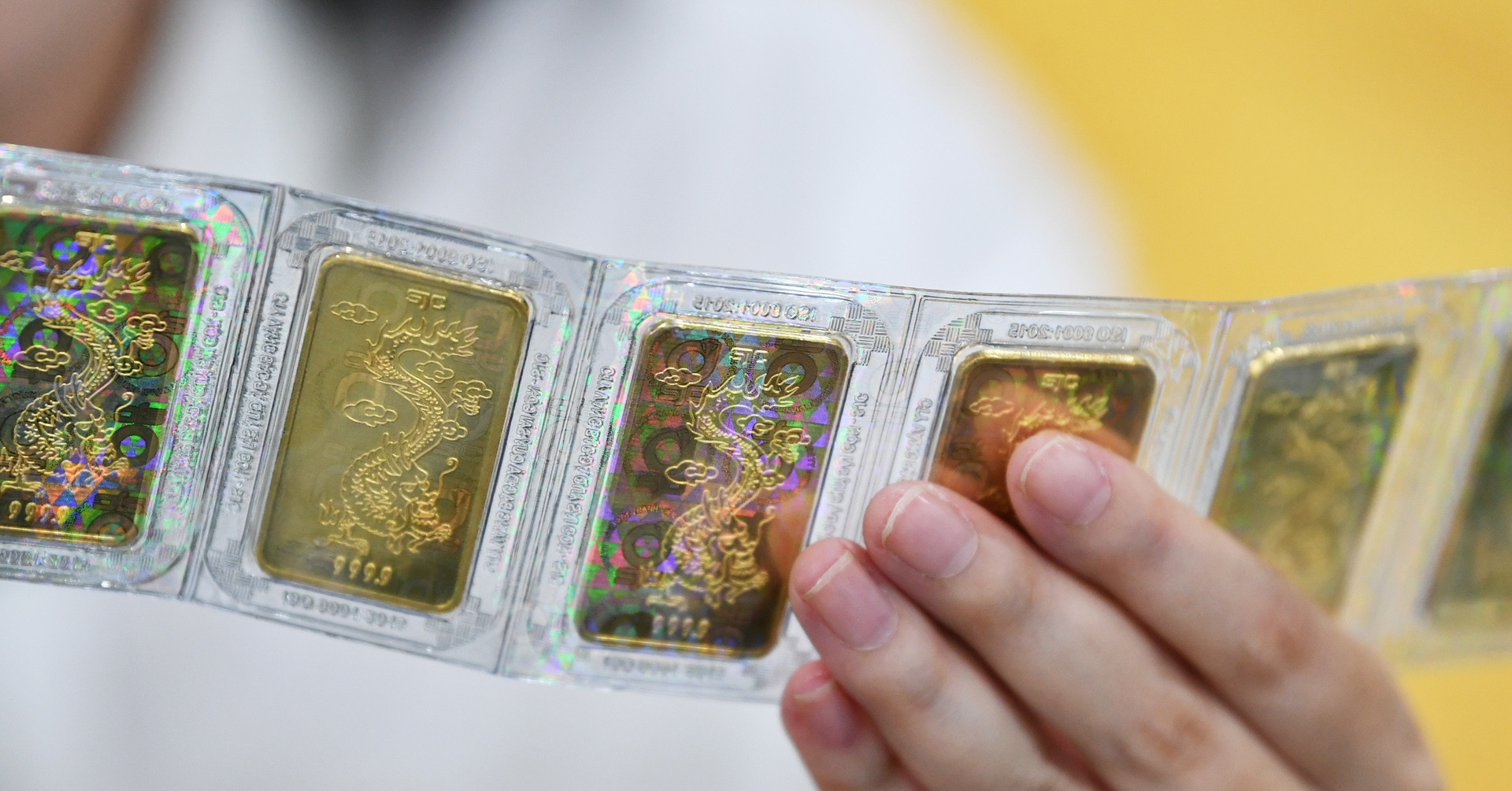

Photo: FocusMalaysia

The report points out that while there are differing views on how difficult it is to measure FOMO (fear of missing out) among hedge funds, there are signs of significant interest in the physical market.

This is reflected in the steady trading of Bank of England (BOE) gold. Since the US Federal Reserve (Fed) began its easing cycle with a 50 basis point cut, commodity prices, inflation swaps and long-term US interest rates have all risen in unison, in some cases even outpacing the gains in risk assets.

On the other hand, commodity prices continue to signal a significant improvement in demand expectations. Despite declining consumer confidence surveys, consumer spending patterns remain strong. If this trend continues, it could be a worrying sign that the Fed will not be able to cut interest rates easily without triggering a re-inflationary spiral.

Conversely, if these trends simply reflect an overreaction to the start of the easing cycle, it is also worth noting that in the years following the record performance in the gold sector, the average decline in the following year was -27%.

The development of the gold market in the coming time will be very remarkable, especially in the context of macroeconomic factors that continue to deeply influence investors' decisions. Investors need to be careful, as these fluctuations can greatly affect their investment strategies in the future.

Dung Phan (According to FXSTREET)

Source: https://www.congluan.vn/hieu-suat-kinh-doanh-vang-dat-ky-luc-trong-44-nam-qua-post314063.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)