Discount from luxury apartments to villas

Real estate brokerage firms in Vietnam often provide reports on price trends in many areas such as rental, transfer, etc. However, the figures only show the general level, without going into detail about each specific segment.

For example, not long ago, batdongsan.com.vn released statistics on rental prices in the first months of 2023. Accordingly, the average rental price of apartments increased by 8% compared to 2022. According to the survey, the average rental price is currently around 13 million VND/month.

However, that is the general level, but in reality, the high-end segment shows the opposite. On social networks, some homeowners even advertise discounts of up to 25% for high-end apartments, even "promoting" parking spaces.

Rental prices for luxury apartments in Hanoi have dropped dramatically. Illustrative photo.

According to a survey by reporters from the Journalist and Public Opinion Newspaper, currently, apartments in a luxury project on Lieu Giai Street have decreased significantly.

Specifically, an apartment of about 86 square meters in the project is being rented for about 20 million VND/month. Previously, in October 2021, an apartment of only 85 square meters had a rental price of up to 28 million VND/month. Thus, after more than 2 years, the rental price has decreased by 28.6%.

Villas and townhouses are no better off. Speaking with reporters, Ms. H., the owner of two villas in a project in West Lake, said her family is living in a completed villa. The one right next door is still in the rough construction stage. She wanted to complete it for rent, but after considering, she decided to stop the plan because the finishing price increased but the rental price decreased.

“To complete the villa, I have to spend a few billion more, but the current rental price is only 65 million VND/month, a decrease of nearly 10 million compared to before. If I do that calculation, I will lose money,” Ms. H. shared.

Rents in many cities are "heating up"

While luxury real estate rental prices are falling sharply in Hanoi, in some cities around the world, including Asia, they are "heating up" every day.

According to CNBC, a new research report by real estate services firm Savills shows that rents in prime residential areas increased the most in Singapore, Lisbon and Berlin in the first half of this year.

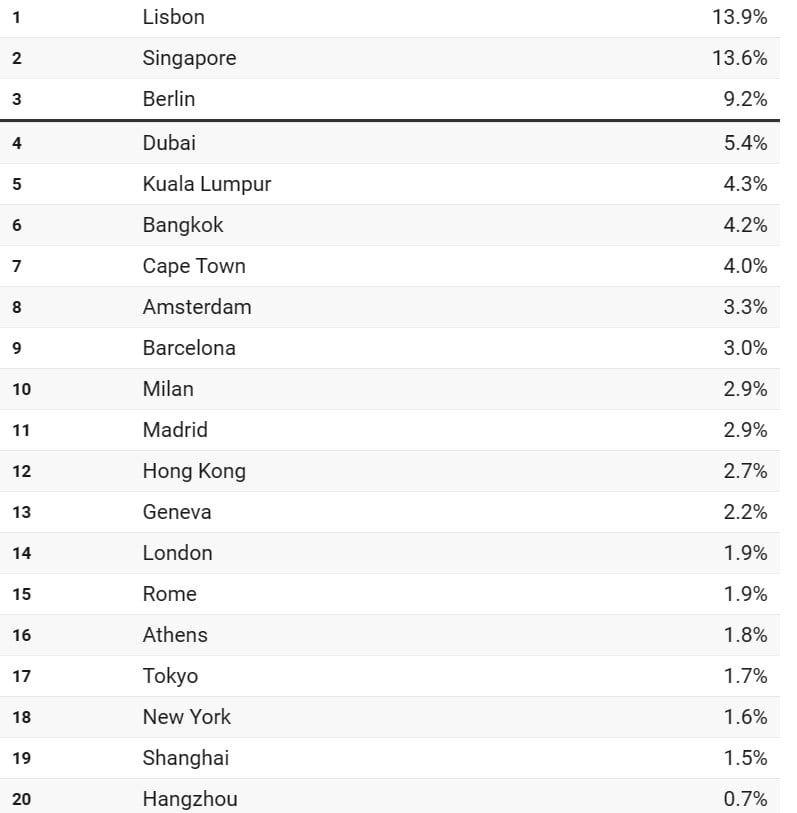

Growth in prime rents across cities from December 2022 to June 2023. Source: Savills

Data from the UK firm shows prime rents in Lisbon rising the most by 13.9% from December 2022 to June 2023, followed by Singapore at 13.6% and Berlin at 9.2% over the same period.

The Lisbon and Singapore rental markets have experienced high price growth over the past 18 months, with rents rising by more than 40%, Savills said, driven by increased demand for luxury homes from international tenants.

However, Berlin's main rental growth is due to an influx of wealthy residents, the study said.

Singapore’s prime rents have risen significantly due to construction delays during the Covid-19 pandemic. However, with 18,000 private housing units due to be completed this year, a slight correction in prices is expected, said Alan Cheong, managing director of Savills Research and Consulting.

However, Cheong stressed that high-end luxury rents in the city-state could still increase by around 15% year-on-year with the immediate increase through the first half of 2023.

“Hot spot” in Asia

According to Savills research, 11 of the 30 cities with the highest rental growth are in the Asia-Pacific region.

After Singapore, Kuala Lumpur takes the fifth spot with apartment rental growth of 4.3% from December 2022 to June 2023, and Bangkok follows with a 4.2% increase.

Building for rent in Kachidoki area, Tokyo, Japan. Photo: Getty Images

Hong Kong came in 12th place with a 2.7% increase, followed by Tokyo five places lower with a 1.7% price increase.

The report said the rental markets in Kuala Lumpur and Bangkok are “gaining momentum not seen since before the pandemic.” Hong Kong’s prime rents are rising due to increased demand after Covid-19 restrictions are lifted by the end of 2022, and Tokyo is benefiting from people returning to the city, it said.

Prime residential supply is expected to remain tight in many cities, said Paul Tostevin, head of Savills World Research, pointing to headwinds such as high construction costs, development challenges and rising debt costs.

“Looking ahead, we expect rents to continue to outperform capital values for the remainder of 2023 and over the medium term, as supply remains tight in the face of growing demand, with positive rent growth in the majority of Index cities for the remainder of 2023,” Tostevin said.

Source

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)