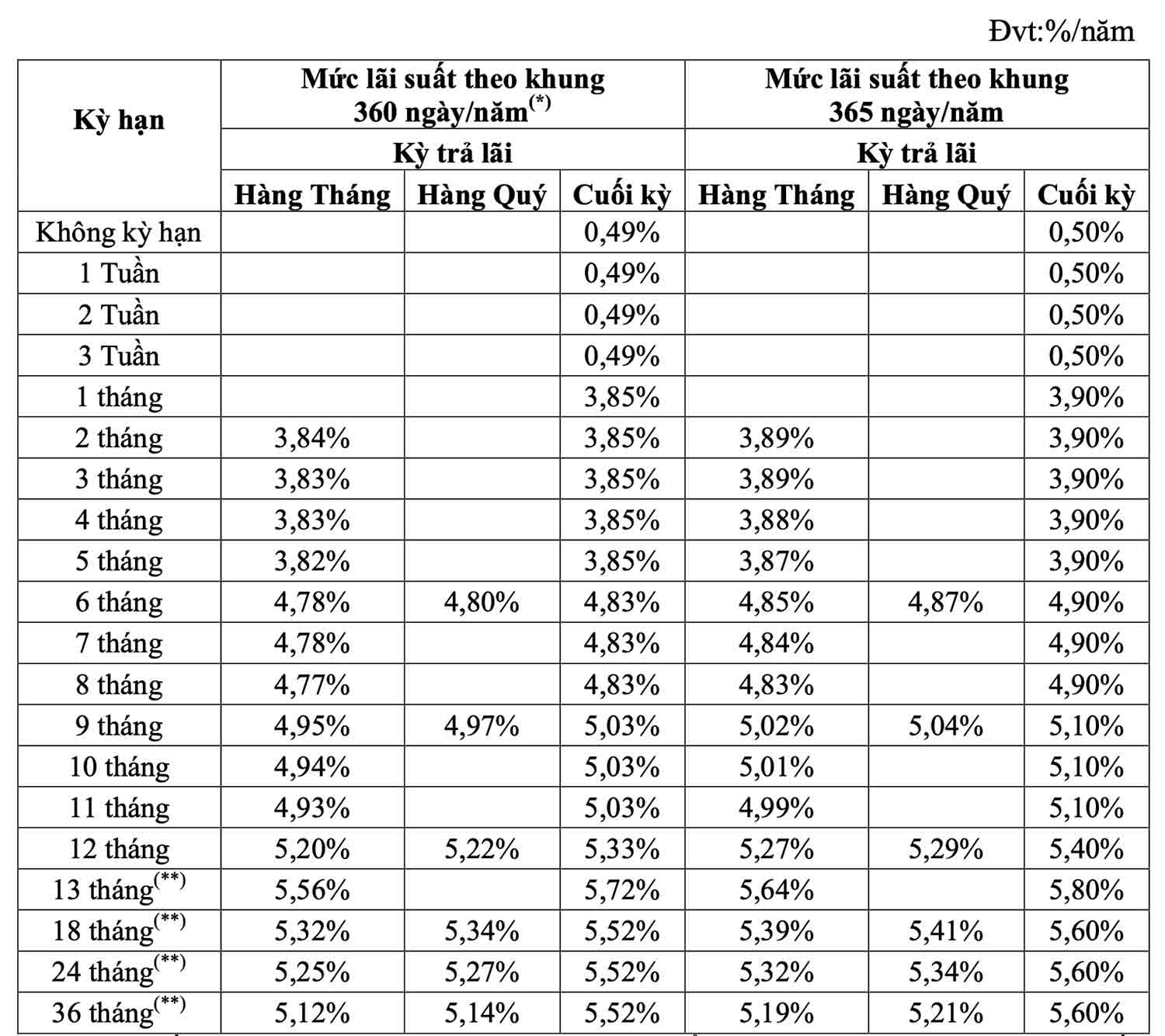

In December 2023, savings interest rates at DongA Commercial Joint Stock Bank (DongABank) fluctuated between 0.5% - 5.6% / year.

Accordingly, if people deposit savings for a term of 1 month to 5 months, the interest rate will be applied at 3.9%/year.

If you deposit money for a term of 6 to 8 months, the interest rate received is 4.9%/year. A higher interest rate of 5.1%/year will be applied for terms from 9 to 11 months. DongABank is currently applying an interest rate of 5.4%/year for a term of 12 months. Meanwhile, the term of 13 months or more is applied an interest rate of 5.8%/year - the highest interest rate in the interest rate table of this bank.

The interest rate of 5.6%/year will be applied for terms of 18-24-36 months. In particular, if customers deposit for a term of 13 months or more, the interest will be calculated at the end of the term with a deposit of VND 200 billion or more: The interest rate will be 7.5%/year for the 365-day/year period and 7.4%/year for the 360-day/year period.

Readers can quickly calculate bank interest using the following formula:

Interest = Deposit x interest rate (%)/12 months x number of months of deposit.

For example, you deposit 500 million VND into DongABank with an interest rate of 5.8% for a term of 13 months. The interest you receive is estimated as:

Interest = 500 million VND x 5.8%/13 x 13 months = 29 million VND.

At DongABank, if you deposit a savings product in VND with a term of 12 months or more, the interest rate is at maturity and you continue to deposit this product with the interest payment at maturity, you will enjoy an additional margin of 0.2%/year.

Before making a deposit, readers should compare savings interest rates between banks and interest rates between terms to get the highest interest.

Source

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)