|

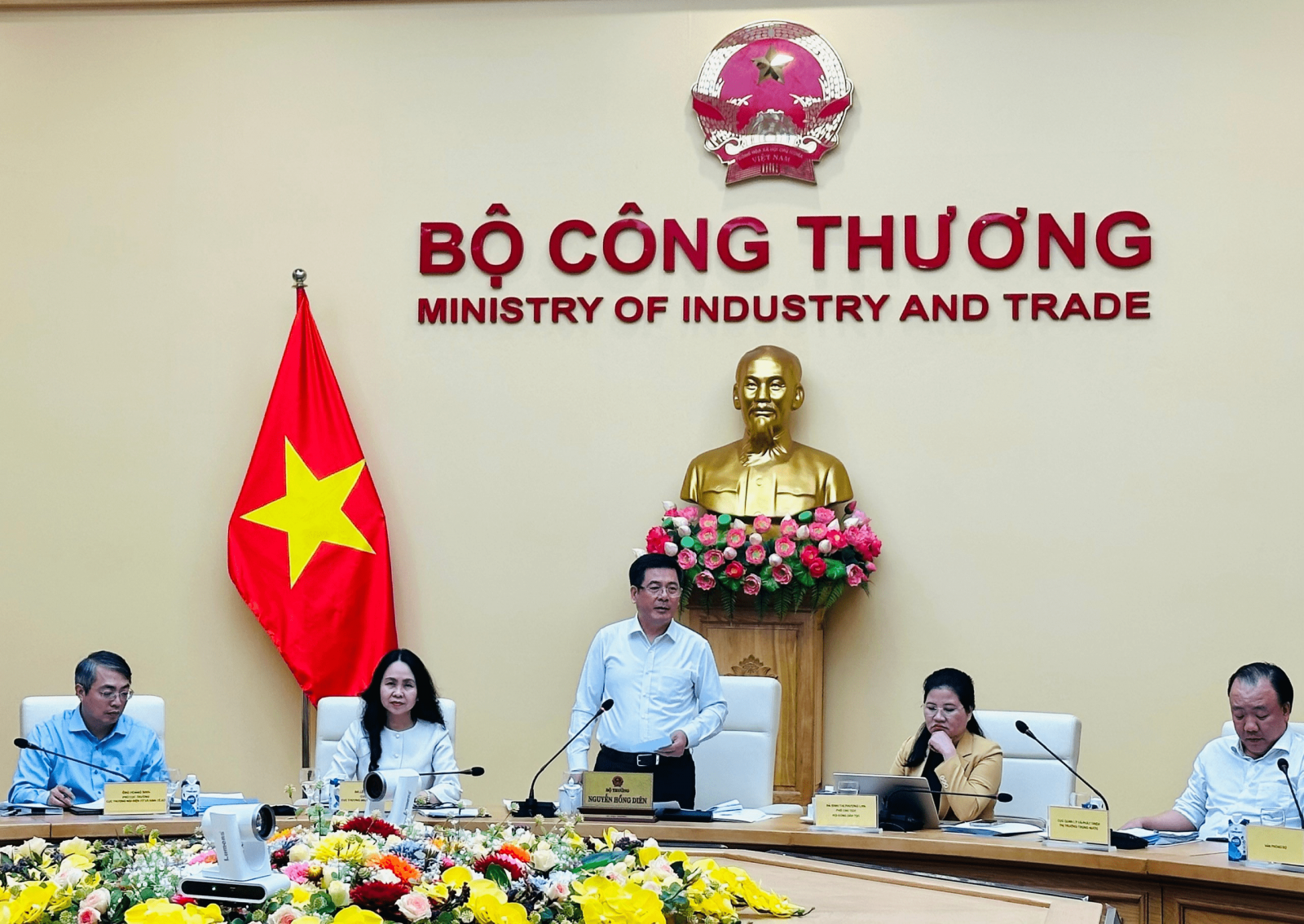

| Experts say that lowering interest rates is only a necessary condition, not a sufficient condition, to boost Vietnam's economic growth. Illustrative photo. (Source: Gutina) |

However, lowering interest rates is only a necessary condition, not a sufficient condition, to boost Vietnam's economic growth.

The State Bank of Vietnam has just issued a decision to reduce operating interest rates by another 0.5% per year from May 25.

Lowering the operating interest rate creates conditions for interest rates to fall, helping to keep the cost of capital low.

As a result, businesses can improve their business performance. At the same time, people can decide to consume more with low borrowing costs. This phenomenon will stimulate economic growth and increase the volume of orders for businesses.

Accordingly, a number of industry groups are expected to benefit, including those with high total outstanding short-term and long-term loans.

Based on the closing data of 2022, the group of experts identified 5 industries that currently have high debt levels and are expected to benefit in the short term from this interest rate cut decision, including: real estate, steel, food, agriculture and seafood farming, and construction.

According to experts from Mirae Asset Securities Company, if using pre-tax profit in 2022 as the basis for estimation, with the most neutral scenario of reducing lending interest rates to 0.5%, it will help the steel industry to improve the largest increase in pre-tax profit at 4.2%, and the food group will have the lowest fluctuation at 1.1%.

On the other hand, in the short term, the reduction in interest rates may partly help improve the profits of the above-mentioned industries, compensating for the negative impact of input factors on the 3% increase in electricity prices.

For the stock market, the operating interest rate and the VN-Index often have opposite trends. When the State Bank lowers the operating interest rate, the Vietnamese stock market often tends to go up afterwards and vice versa.

Statistics from BSC Securities Company show that the three most recent times the State Bank announced a reduction in operating interest rates, on September 30, 2020, March 14, 2023 and March 31, 2023, in general, all industries responded positively in the short and medium term to this news. In particular, Financial Services and Telecommunications are the two groups with the most positive growth after one month, after the State Bank lowered operating interest rates.

The above data shows that lowering interest rates is only a necessary condition, not a sufficient condition, to promote Vietnam's economic growth.

Manufacturing and consumption are two important sectors in the Vietnamese economy, and both are currently facing a decline in activity. Therefore, people will not have the need to borrow to spend more and businesses will not intend to borrow to expand production activities.

Therefore, cutting interest rates may not have much impact without growth in demand for production and consumption.

Source

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)