Many mixed opinions

Experts are giving mixed views on the short-term price of gold. Everett Millman, chief market analyst at Gainesville Coins, predicts that gold will remain stuck until "something shakes up the market as a whole."

Millman said investors are certainly mindful of economic data that could impact gold as most of the important data is released on Wednesday, followed by the July 4 holiday, then the markets reopen for the jobs report early Friday morning, which is a risky scenario for traders and investors.

In the medium term, markets will continue to parse the implications of mixed inflation data from around the world, Millman said.

On the contrary, Marc Chandler - General Director at Bannockburn Global Forex said that after a solid performance this week, gold will likely increase in price next week.

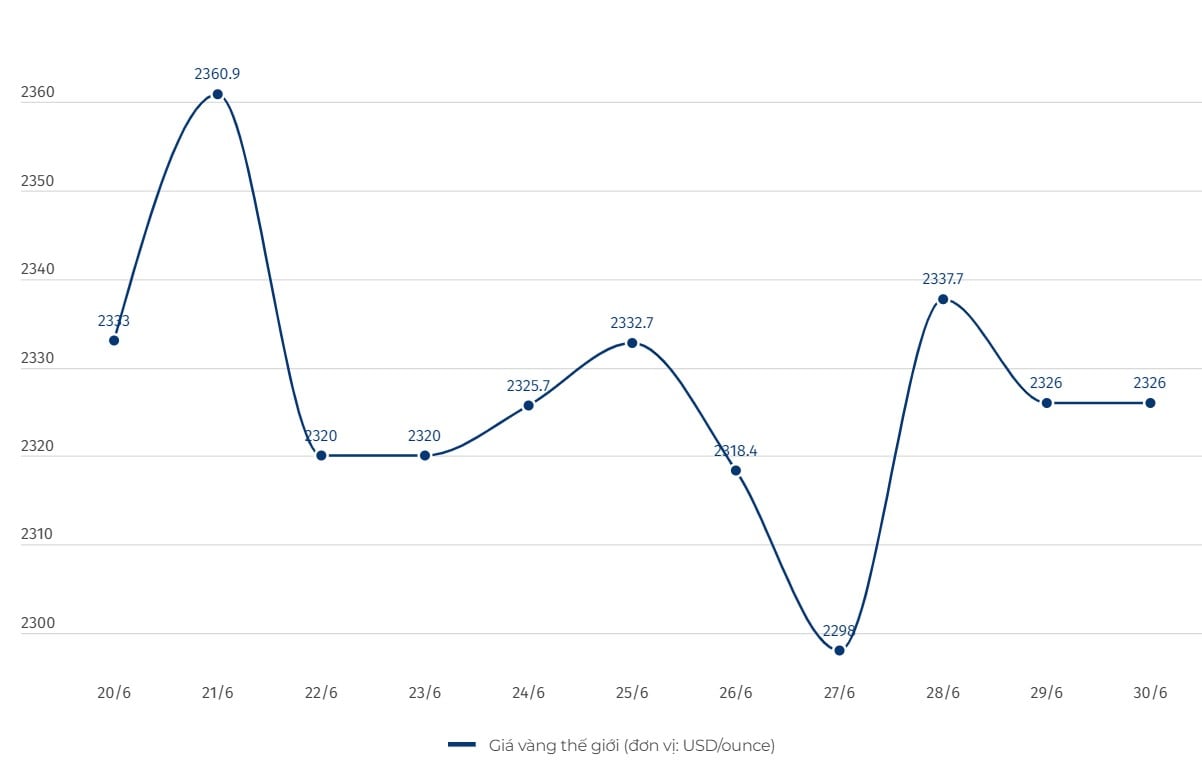

“Gold recovered from below $2,300 an ounce last Wednesday to Thursday to recover back to $2,340 an ounce by the end of the week, which has completely erased last week’s losses.

This move was enough to extend gold’s rally into a fifth consecutive month. I believe gold is poised for further gains in the coming days. A correction above $2,350-2,360 an ounce would lift the bar and could signal a return to $2,400 an ounce.

Two macro developments that could support gold are the results of the first round of the French election, which makes a hung parliament more likely, and the US jobs report next weekend,” the expert said.

Sharing the same view, James Stanley - senior market strategist at Forex.com expressed support for the view that gold prices will increase in the short term.

Meanwhile, Darin Newsom - senior market analyst at Barchart.com also expressed optimism about gold prices next week: "I will continue to express optimism about gold prices this week because it seems there is still room to extend the short-term uptrend."

Not the time to invest

Phillip Streible, chief market strategist at Blue Line Futures, is bullish on gold, but says now is not the time to invest. "Don't chase the market at these levels," Streible said.

Alex Kuptsikevich - senior market analyst at FxPro gave a bearish forecast for gold as the price of the precious metal fell below the 50-day moving average.

“Gold could be at the intersection of weak economic data (slow growth and weak inflation) and a less dovish Federal Reserve. This could trigger a broad-based sell-off,” Kuptsikevich said.

Notably, Christopher Vecchio, director of futures and foreign exchange strategy at Tastylive.com, expressed neutrality on gold next week. This expert also advised investors not to sell at this time: "If you are holding gold for the long term, there is no reason to sell because the price is still above $ 2,200 / ounce" - he said.

Twelve Wall Street analysts participated in the Kitco News gold survey this week. Four analysts, or 33%, see gold prices higher next week. Two analysts, or 17%, see prices falling. The remaining six, or exactly 50%, are neutral on gold prices in the short term.

Meanwhile, 178 votes were cast in Kitco's online poll. Main Street investors have mixed views on gold's near-term outlook.

Eighty-six retail traders, or 48 percent, expect gold prices to rise next week. Another 50, or 28 percent, expect the precious metal to fall. Forty-two, or 24 percent, expect gold prices to remain flat next week.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-nhan-du-bao-trai-chieu-co-nen-dau-tu-1359335.ldo

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

Comment (0)