Domestic gold price today March 31, 2025

At the time of survey at 04:30 on March 31, 2025, the domestic gold price was at nearly 101 million VND. Specifically:

The price of SJC gold bars is listed by Saigon Jewelry Company at 98.4-100.7 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions. The difference between buying and selling prices is at 2.3 million VND/tael.

The price of SJC pieces listed by DOJI Group is at 98.4-100.7 million VND/tael (buy - sell), unchanged in both buying and selling directions. The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.5-100.7 million VND/tael (buy - sell), unchanged in both buying and selling directions. The difference between buying and selling prices is at 2.2 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.4-100.7 million VND/tael (buy - sell); unchanged in both buying and selling directions. The difference between buying and selling is listed at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.9-100.9 million VND/tael (buy - sell); unchanged in both buying and selling directions. The difference between buying and selling is 2 million VND/tael.

Domestic gold prices have increased continuously this past week, despite a decline in the world market. At the end of the week, the prices of SJC gold rings and gold bars both reached new peaks. Specifically, the price of SJC gold bars increased by a total of VND3.3 million per tael. Meanwhile, the price of gold rings also increased by VND2.5 million per tael compared to the end of last week.

The latest gold price list today, March 31, 2025 is as follows:

| Today (March 31, 2025) | Yesterday (March 30, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 98,400 | 100,700 | 98,400 | 100,700 |

| DOJI HN | 98,400 | 100,700 | 98,400 | 100,700 |

| DOJI SG | 98,400 | 100,700 | 98,400 | 100,700 |

| BTMC SJC | 98,500 | 100,700 | 98,500 | 100,700 |

| Phu Quy SJC | 98,400 | 100,700 | 98,400 | 100,700 |

| PNJ HCMC | 98,400 | 100,700 | 98,400 | 100,700 |

| PNJ Hanoi | 98,400 | 100,700 | 98,400 | 100,700 |

| 1. DOJI - Updated: March 31, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 98,400 | 100,700 |

| AVPL/SJC HCM | 98,400 | 100,700 |

| AVPL/SJC DN | 98,400 | 100,700 |

| Raw material 9999 - HN | 98,400 | 99,800 |

| Raw material 999 - HN | 98,300 | 99,700 |

| 2. PNJ - Updated: March 31, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,400 | 100,700 |

| HCMC - SJC | 98,400 | 100,700 |

| Hanoi - PNJ | 98,400 | 100,700 |

| Hanoi - SJC | 98,400 | 100,700 |

| Da Nang - PNJ | 98,400 | 100,700 |

| Da Nang - SJC | 98,400 | 100,700 |

| Western Region - PNJ | 98,400 | 100,700 |

| Western Region - SJC | 98,400 | 100,700 |

| Jewelry gold price - PNJ | 98,400 | 100,700 |

| Jewelry gold price - SJC | 98,400 | 100,700 |

| Jewelry gold price - Southeast | PNJ | 98,400 |

| Jewelry gold price - SJC | 98,400 | 100,700 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,400 |

| Jewelry gold price - Jewelry gold 999.9 | 98,100 | 100,600 |

| Jewelry gold price - Jewelry gold 999 | 98,000 | 100,500 |

| Jewelry gold price - Jewelry gold 99 | 97,190 | 99,690 |

| Jewelry gold price - 916 gold (22K) | 89,750 | 92,250 |

| Jewelry gold price - 750 gold (18K) | 73,100 | 75,600 |

| Jewelry gold price - 680 gold (16.3K) | 66,060 | 68,560 |

| Jewelry gold price - 650 gold (15.6K) | 63,040 | 65,540 |

| Jewelry gold price - 610 gold (14.6K) | 59,020 | 61,520 |

| Jewelry gold price - 585 gold (14K) | 56,500 | 59,000 |

| Jewelry gold price - 416 gold (10K) | 39,500 | 42,000 |

| Jewelry gold price - 375 gold (9K) | 35,380 | 37,880 |

| Jewelry gold price - 333 gold (8K) | 30,850 | 33,350 |

| 3. SJC - Updated: 31/3/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,400 | 100,700 |

| SJC gold 5 chi | 98,400 | 100,720 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,400 | 100,730 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,200 | 100,400 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,200 | 100,500 |

| Jewelry 99.99% | 98,200 | 100,100 |

| Jewelry 99% | 96,109 | 99,109 |

| Jewelry 68% | 65,225 | 68,225 |

| Jewelry 41.7% | 38,896 | 41,896 |

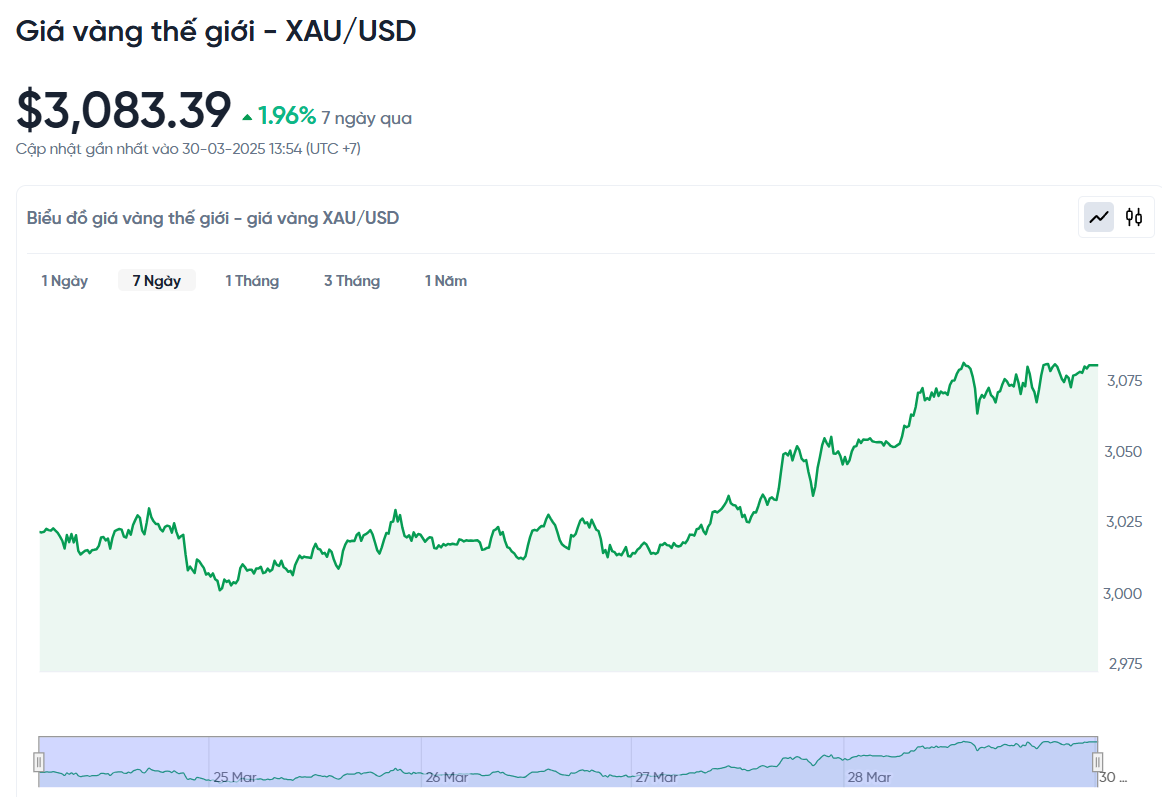

World gold price today March 31, 2025 and world gold price fluctuation chart in the past 24 hours

In the international market, the spot gold price was recorded at 3,083.39 USD/ounce, unchanged from the previous session, but up 59.13 USD/ounce compared to last week. Converted at the current exchange rate, the world gold price is equivalent to about 97.56 million VND/tael (excluding taxes and fees), lower than domestic gold bars by nearly 3.14 million VND/tael.

The world gold price only decreased in one session last week on March 25, while the other sessions increased sharply. This was due to the market continuously receiving economic information from the US and Europe, including both positive and negative.

Earlier this week, the US announced that its consumer confidence index for March fell to 92.9 points, lower than forecast and also down significantly from February. At the same time, US durable goods orders increased by 0.9% in February, higher than forecast but much lower than January.

In the middle and end of the week, the US economic growth (GDP) figures for the fourth quarter of 2024 were released, showing an increase of 2.4%, higher than the previous forecast of 2.3%. However, the GDP price index, a measure of inflationary pressure, was lower than expected, suggesting that the USD may weaken in the near future.

The Personal Consumption Expenditures (PCE) price index, a key US inflation gauge, showed signs of accelerating inflation. The core PCE index rose 2.8% in February, higher than forecast and the previous month. This shows that US inflation is returning after the new tariff policies took effect.

Another notable point is that personal income in February increased by a strong 0.8%, exceeding initial expectations. However, personal spending increased more slowly than expected. Combined with the decline in consumer confidence, it is clear that Americans are becoming more cautious in spending in the face of increasing economic risks.

Experts say that signs of instability in the US economy after the imposition of import taxes are causing investors to increase their purchases of gold to protect their assets.

In Europe, the economic confidence index also fell to 95.2 points in March, much lower than forecast and the previous month. This is a clear sign that the European economic outlook is becoming less optimistic, increasing the demand for safe-haven gold.

Gold Price Forecast

Domestic gold prices are forecast to continue to rise next week, following the strong increase in the world market. Currently, the gold market is still in a state of scarcity of goods for sale, while investors and people are actively buying and limiting sales. This is the main driving force helping gold prices remain high.

According to forecasts, gold prices will continue to fluctuate at high levels, possibly reaching $3,100-3,200/ounce by mid-April if trade and geopolitical tensions show no signs of cooling down.

However, experts also note the possibility of large fluctuations: gold prices could fall sharply to the $2,950-3,000 range if the Fed suddenly raises interest rates or major conflicts in the world are eased.

According to Kitco experts, gold prices will continue to strengthen in April. The next target for gold is $3,042/ounce and then $3,050. However, the $3,100 price mark is considered a strong resistance level and could be a temporary peak for the gold market in the near future.

Ilya Spivak, global macro director at Tastylive, stressed that the $3,057 level is the key level to watch in the immediate future, followed by $3,100. These are the levels that will determine the next trend of the market.

Overall, gold prices are being supported by geopolitical uncertainties and growing trade tensions, especially as the US implements its “America First” strategy by imposing high tariffs on imported cars and many other goods from other countries. If this situation escalates, central banks around the world will continue to buy gold to reduce their dependence on the USD.

In addition, tensions in Ukraine and the Middle East are also contributing to the rise in gold prices. Meanwhile, the US economy is under significant pressure due to new tariffs, increasing the risk of inflation. Although the US Federal Reserve (Fed) has kept interest rates steady, they have left open the possibility of cutting interest rates this year if inflationary pressures increase.

In the long term, Goldman Sachs still forecasts that gold prices will increase to $3,300/ounce by the end of 2025, thanks to stable gold demand from central banks and ETF investment funds.

Source: https://baoquangnam.vn/gia-vang-hom-nay-31-3-2025-gia-vang-trong-nuoc-va-the-gioi-du-douan-tang-len-ky-luc-moi-3151763.html

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

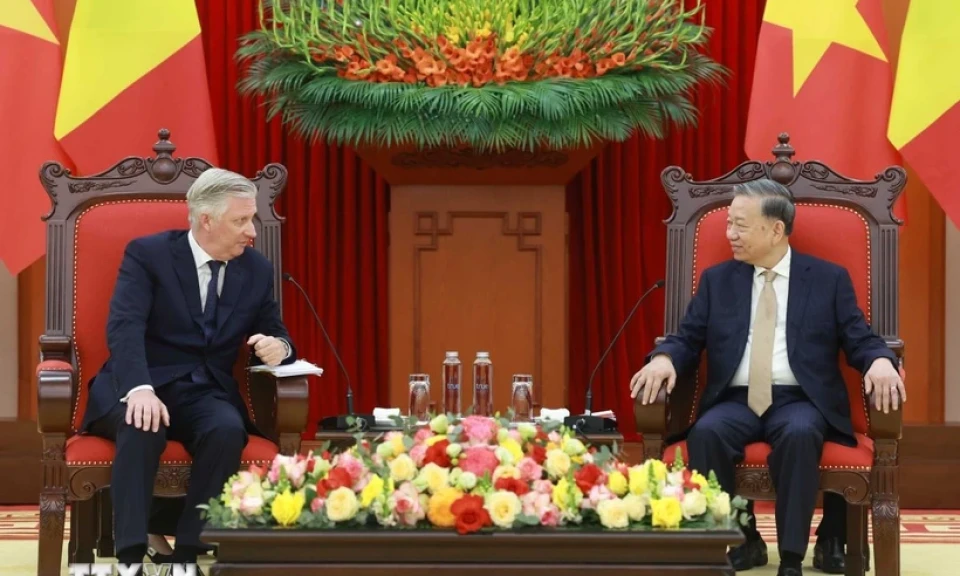

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)