Domestic gold price today March 28, 2025

At the time of survey at 4:30 a.m. on March 28, 2025, domestic gold prices increased slightly. Specifically:

The price of SJC gold bars was listed by Saigon Jewelry Company at 97.4-98.9 million VND/tael (buy - sell), an increase of 700 thousand VND/tael for buying and 500 thousand VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed the price of SJC at 97.4-98.9 million VND/tael (buy - sell), an increase of 700 thousand VND/tael for buying and 500 thousand VND/tael for selling. The difference between buying and selling prices is 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.5-98.9 million VND/tael (buy - sell), an increase of 700 thousand VND/tael for buying and 500 thousand VND/tael for selling. The difference between buying and selling prices is at 1.4 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 97.2-99.5 million VND/tael (buy - sell); increased by 500 thousand VND/tael for both buying and selling. The difference between buying and selling is listed at 2.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.6-99.7 million VND/tael (buy - sell); increased by 800 thousand VND/tael for buying and increased by 600 thousand VND/tael for selling. The difference between buying and selling is 2.1 million VND/tael.

The latest gold price list today, March 28, 2025 is as follows:

| Today (March 28, 2025) | Yesterday (March 27, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 97,400 ▲700 | 98,900 ▲500 | 96,700 | 98,400 |

| DOJI HN | 97,400 ▲700 | 98,900 ▲500 | 96,700 | 98,400 |

| DOJI SG | 97,400 ▲700 | 98,900 ▲500 | 96,700 | 98,400 |

| BTMC SJC | 97,500 ▲700 | 98,900 ▲500 | 96,800 | 98,400 |

| Phu Quy SJC | 97,400 ▲700 | 98,900 ▲500 | 96,700 | 98,400 |

| PNJ HCMC | 97,400 ▲700 | 99,400 ▲500 | 96,700 | 99,000 |

| PNJ Hanoi | 97,400 ▲700 | 99,400 ▲500 | 96,700 | 99,000 |

| 1. DOJI - Updated: March 28, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 97,400 ▲700K | 98,900 ▲500K |

| AVPL/SJC HCM | 97,400 ▲700K | 98,900 ▲500K |

| AVPL/SJC DN | 97,400 ▲700K | 98,900 ▲500K |

| Raw material 9999 - HN | 97,200 ▲500K | 98,600 ▲500K |

| Raw material 999 - HN | 97,100 ▲500K | 98,500 ▲500K |

| AVPL/SJC Can Tho | 97,400 ▲700K | 98,900 ▲500K |

| 2. PNJ - Updated: March 28, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 97,400 ▲700K | 99,400 ▲400K |

| HCMC - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Hanoi - PNJ | 97,400 ▲700K | 99,400 ▲400K |

| Hanoi - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Da Nang - PNJ | 97,400 ▲700K | 99,400 ▲400K |

| Da Nang - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Western Region - PNJ | 97,400 ▲700K | 99,400 ▲400K |

| Western Region - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Jewelry gold price - PNJ | 97,400 ▲700K | 99,400 ▲400K |

| Jewelry gold price - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Jewelry gold price - Southeast | PNJ | 97,400 ▲700K |

| Jewelry gold price - SJC | 97,400 ▲700K | 98,900 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 97,400 ▲700K |

| Jewelry gold price - Jewelry gold 999.9 | 96,800 ▲400K | 99,300 ▲400K |

| Jewelry gold price - Jewelry gold 999 | 96,700 ▲400K | 99,200 ▲400K |

| Jewelry gold price - Jewelry gold 99 | 95,910 ▲400K | 98,410 ▲400K |

| Jewelry gold price - 916 gold (22K) | 88,560 ▲370K | 91,060 ▲370K |

| Jewelry gold price - 750 gold (18K) | 72,130 ▲300K | 74,630 ▲300K |

| Jewelry gold price - 680 gold (16.3K) | 65,170 ▲270K | 67,670 ▲270K |

| Jewelry gold price - 650 gold (15.6K) | 62,200 ▲260K | 64,700 ▲260K |

| Jewelry gold price - 610 gold (14.6K) | 58,220 ▲240K | 60,720 ▲240K |

| Jewelry gold price - 585 gold (14K) | 55,740 ▲230K | 58,240 ▲230K |

| Jewelry gold price - 416 gold (10K) | 38,960 ▲170K | 41,460 ▲170K |

| Jewelry gold price - 375 gold (9K) | 34,890 ▲150K | 37,390 ▲150K |

| Jewelry gold price - 333 gold (8K) | 30,420 ▲130K | 32,920 ▲130K |

| 3. SJC - Updated: 03/28/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 97,400 ▲700K | 98,900 ▲500K |

| SJC gold 5 chi | 97,400 ▲700K | 98,920 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 97,400 ▲700K | 98,930 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 97,200 ▲600K | 98,700 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 97,200 ▲600K | 98,800 ▲500K |

| Jewelry 99.99% | 97,200 ▲600K | 98,400 ▲500K |

| Jewelry 99% | 94,425 ▲494K | 97,425 ▲494K |

| Jewelry 68% | 64,068 ▲339K | 67,068 ▲339K |

| Jewelry 41.7% | 38,186 ▲208K | 41,186 ▲208K |

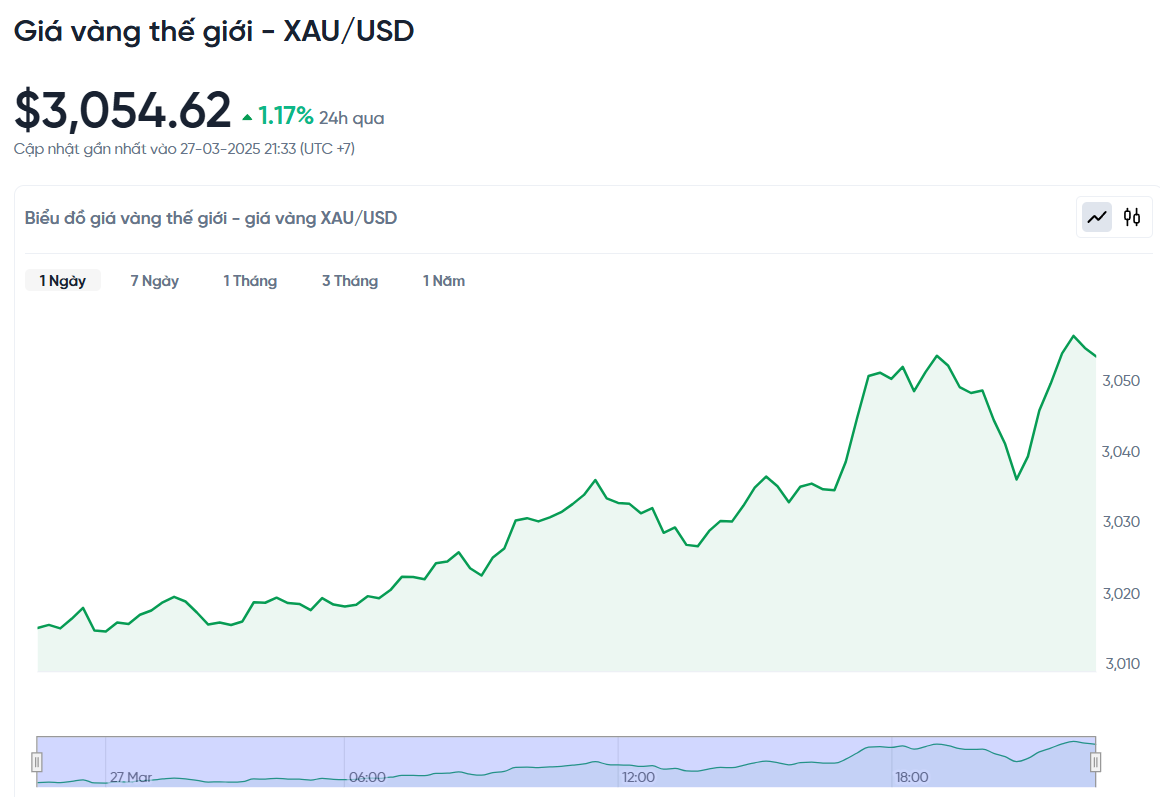

World gold price today March 28, 2025 and world gold price fluctuation chart in the past 24 hours

In the international market, the spot gold price was recorded at 3,054.62 USD/ounce, up 35.43 USD/ounce compared to the previous session. Converted at the current exchange rate, the world gold price is equivalent to about 96.55 million VND/tael (excluding taxes and fees), nearly 2.35 million VND/tael lower than domestic gold bars.

Gold prices have surged to a record high as investors flock to gold as a safe haven. The main reason is the escalating tensions between Russia and Ukraine, when both sides accused each other of violating the agreement to stop attacking energy infrastructure. Immediately after reaching an agreement to stop the attacks for 30 days, major airstrikes broke out again, making market sentiment more unstable.

In addition to geopolitical factors, positive US labor data also contributed to supporting gold prices. The number of initial unemployment claims in the week ending March 22 reached 224,000, lower than forecast and down slightly from the previous week. At the same time, the number of people continuing to receive unemployment benefits also decreased to 1.856 million. This shows that the US labor market is still stable, but also makes investors worry that the Fed may be slow to cut interest rates, thereby boosting demand for gold as a precautionary measure.

Global trade tensions are also pushing gold prices higher. Ahead of April 2, the day US President Donald Trump is expected to impose a new series of reciprocal tariffs, markets are concerned that these measures will increase inflation and slow growth, making gold even more attractive.

Aakash Doshi, global head of gold at SPDR ETF Strategy, forecasts gold prices to surpass $3,100 an ounce in the second quarter of this year. If macro factors and market demand continue to support, gold prices could rise another 8%-10% by the end of 2025.

Goldman Sachs also recently raised its forecast for gold prices by the end of 2025 from $3,100 to $3,300 an ounce, citing stronger-than-expected inflows into ETFs and sustained demand from central banks.

Markets are now looking ahead to the Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) report, due on Friday. The results could influence expectations for the Fed’s interest rate path in the coming months.

According to Ilya Spivak, global macro director at Tastylive, the immediate resistance level for gold is $3,057/ounce – the high in March. If this level is broken, gold prices could move to $3,100/ounce.

Last week, the Fed kept its benchmark interest rate unchanged but signaled it could start cutting later this year. Minneapolis Fed President Neel Kashkari said that despite progress in controlling inflation, the Fed still needs more time to get inflation back to its 2% target.

Gold prices have surged since the beginning of the year and even surpassed Bitcoin in growth. In the context of many difficulties in cryptocurrency, gold is emerging as a priority choice in safe investment portfolios.

As inflation continues to erode the purchasing power of currencies, both gold and Bitcoin have become important alternative assets, helping to better allocate risk in a portfolio, according to Jigna Gibb, a representative of Bloomberg.

In its latest report, Bank of America forecasts that gold prices will average around $3,063 an ounce this year, rising to $3,350 an ounce by 2026. This is a much higher forecast than previous estimates. The bank also believes that if investment demand increases by 10%, gold prices could reach $3,500 within the next two years.

Source: https://baoquangnam.vn/gia-vang-hom-nay-28-3-2025-gia-vang-tang-tien-sat-dinh-ky-luc-3151606.html

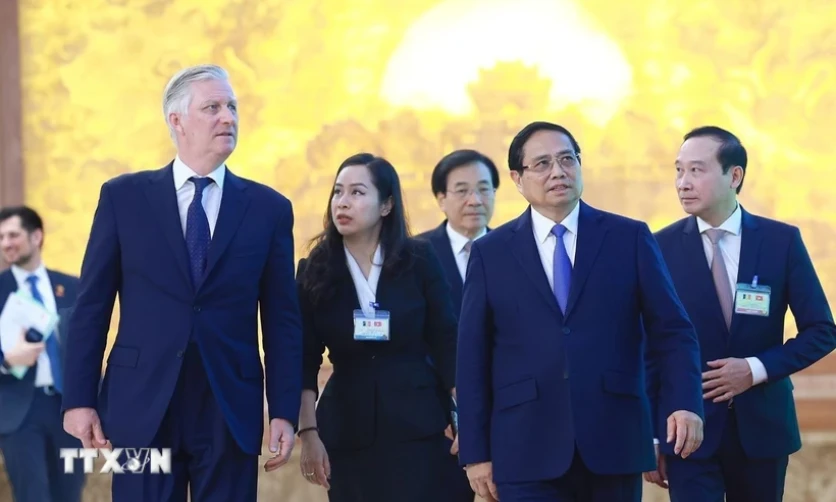

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

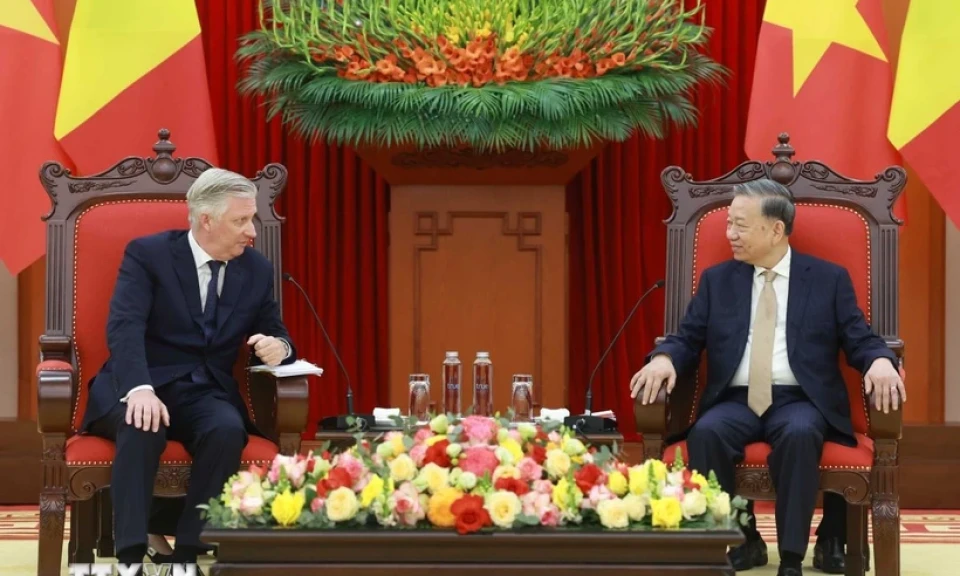

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)