LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/14 AND EXCHANGE RATE TODAY 6/14

| 1. SJC - Updated: 06/13/2024 08:29 - Website time of supply source - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 74,980 | 76,980 |

| SJC 5c | 74,980 | 77,000 |

| SJC 2c, 1c, 5 phan | 74,980 | 77,010 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 72,900 | 74,500 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 72,900 | 74,600 |

| Jewelry 99.99% | 72,800 | 73,700 |

| Jewelry 99% | 70,970 | 72,970 |

| Jewelry 68% | 47,771 | 50,271 |

| Jewelry 41.7% | 28,386 | 30,886 |

Update gold price today June 14, 2024

Domestic gold prices have been moving sideways for many consecutive sessions, bringing a sense of stability to the market.

SJC gold bar price remained unchanged for the fifth consecutive session at VND76.98 million/tael for selling.

The difference between the price of SJC gold bars and the world price has gradually stabilized, no longer "jumping" like a few days ago, fluctuating around 5.78 million VND/tael.

The price of 9999 gold rings remained unchanged compared to the close of the session on June 12, trading in the range of 72.8 - 74.4 million VND/tael (buy-sell). The difference between buying and selling is about 1.6 million VND/tael.

Summary of SJC gold prices at major domestic trading brands at the closing time of June 13:

Saigon Jewelry Company listed at 74.98 - 76.98 million VND/tael.

Doji Group is currently listed at: 74.98 - 76.98 million VND/tael.

PNJ system listed at: 74.98 - 76.98 million VND/tael.

Phu Quy Gold and Silver Group listed at 75.50 - 76.98 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 75.50 - 76.98 million VND/tael.

|

| Gold price today June 14, 2024: Gold price maintains 'safe level', Fed is about to make a new move, will world gold increase? (Source: Kitco) |

World gold prices are struggling to hold the $2,350 level as the US Federal Reserve (Fed) kept interest rates unchanged, signaling only one rate cut this year.

According to TG&VN, at 6:00 p.m. on May 13 (Hanoi time), the world gold price traded on Kitco floor at 2,317.90 - 2,318.90 USD/ounce, down 6.9 USD compared to the previous trading session. The August gold futures price was last traded at 2,345.80 USD/ounce, up 0.79% on the day.

As expected, the Fed kept interest rates unchanged at 5.25%-5.50%. Updated economic projections show the central bank will cut rates once this year, down from the three it estimated in March. While maintaining positive gains, the gold market has dipped slightly below $2,350/ounce, which has proven to be a key resistance point as a “safe haven.”

Some economists say the US central bank will keep its options open as inflation continues to rise. However, the Fed has commented on inflation - US inflation has eased over the past year but remains high. In recent months, there has been modest progress toward the Fed's 2% target, the central bank said in its latest monetary policy statement.

Overall inflation is also expected to be higher this year and next before cooling in 2026. The Fed expects inflation to rise to 2.6% this year, up from its previous estimate of 2.4%. Inflation is expected to rise to 2.3% next year.

While the Fed has only signaled one rate cut this year, some economists note that it is only a “probable decision.” Ashworth, chief North American economist at Capital Economics, said everything depends on the health of the U.S. economy.

When will gold prices increase again?

Expert Jeffrey Christian, managing partner of CPM Group, commented that the Fed's decision to neither lower nor raise interest rates will cause investors to switch to less risky assets, including gold.

Gold is facing fresh headwinds from a stronger dollar and weaker Chinese demand, but the yellow metal will continue to rally after the Fed starts cutting rates, so prices are expected to ease slightly in the short term for the rest of the second quarter, said Ewa Manthey, commodity strategist at ING.

However, in the longer term, geopolitical uncertainty, which has fueled the trend of de-dollarization and fragmentation in the global economy, has been a major factor in gold’s surge to a record high above $2,450 this year. This trend is set to continue, according to industry and government experts at the 30th Annual Meeting of the International Economic Forum of the Americas in Montreal, which will continue to support the precious metal’s upward trend, according to the report.

Deglobalization was a major theme in many of the discussions held during the three-day conference. “It’s extraordinary to me how quickly we’ve gone from a situation where globalization seemed inevitable to one where it’s increasingly impossible,” said Perrin Beatty, a former Progressive Conservative cabinet minister and president and CEO of the Canadian Chamber of Commerce. Beatty cited the rise of economic nationalism, noting that broad international trade agreements are being replaced by narrower ones.

Accordingly, the growing trend of economic nationalism is increasing costs for businesses around the world, contributing to rising inflationary pressures. He also pointed out that the expansion of BRICS (Brazil, Russia, India, China and South Africa) is a sign that a new multipolar world has been established.

Source

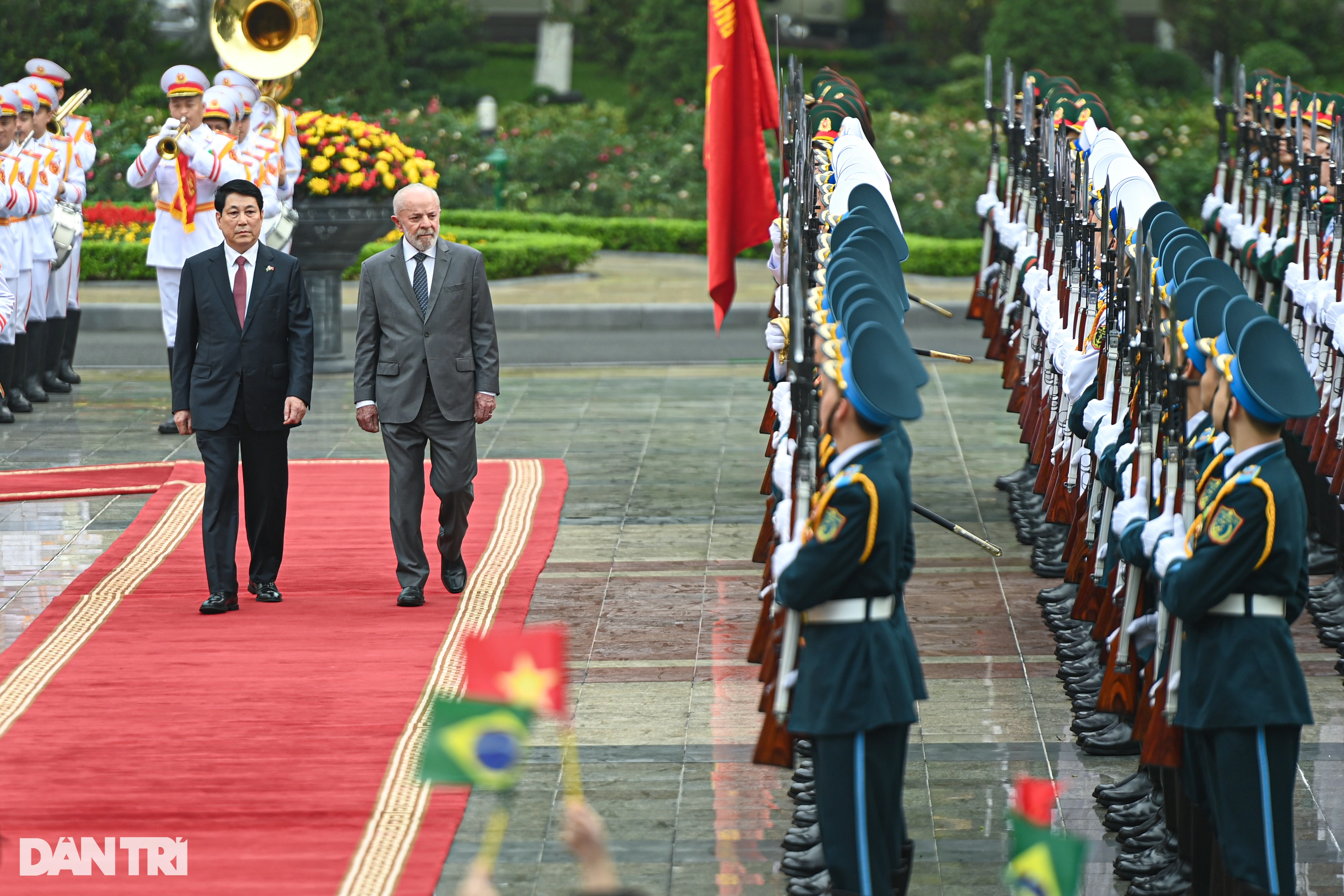

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)