| Commodity market today, July 8, 2024: World raw material prices fluctuate stronglyCommodity market today, July 9, 2024: Corn prices fall to 4-year low |

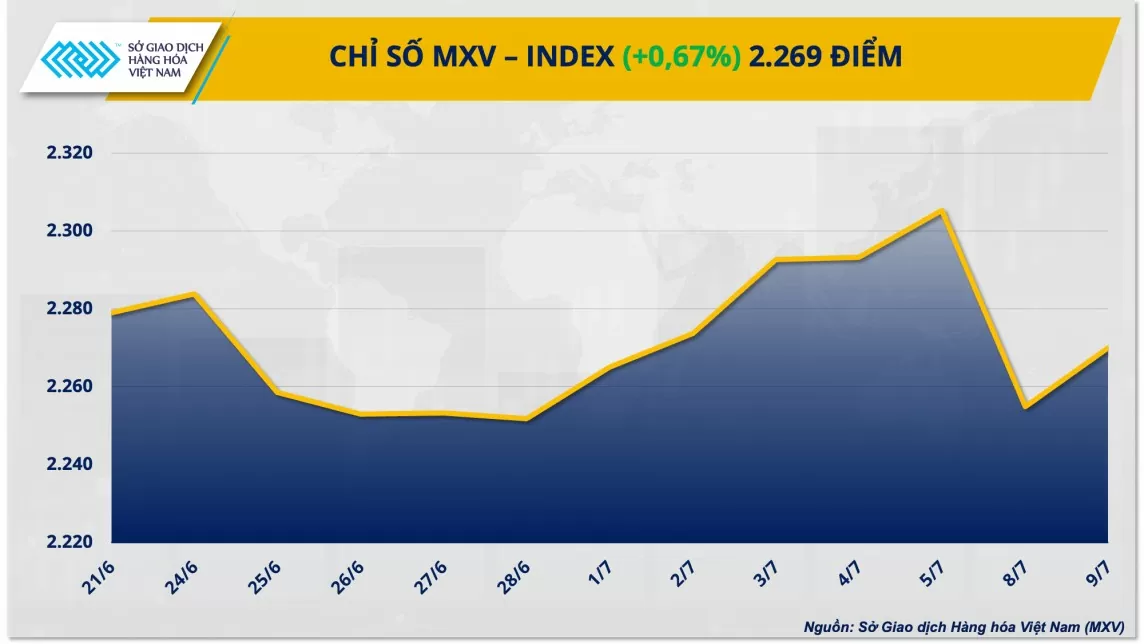

The strong increase of industrial raw materials led the general trend of the whole market. The MXV-Index recovered 0.67% to 2,269 points.

|

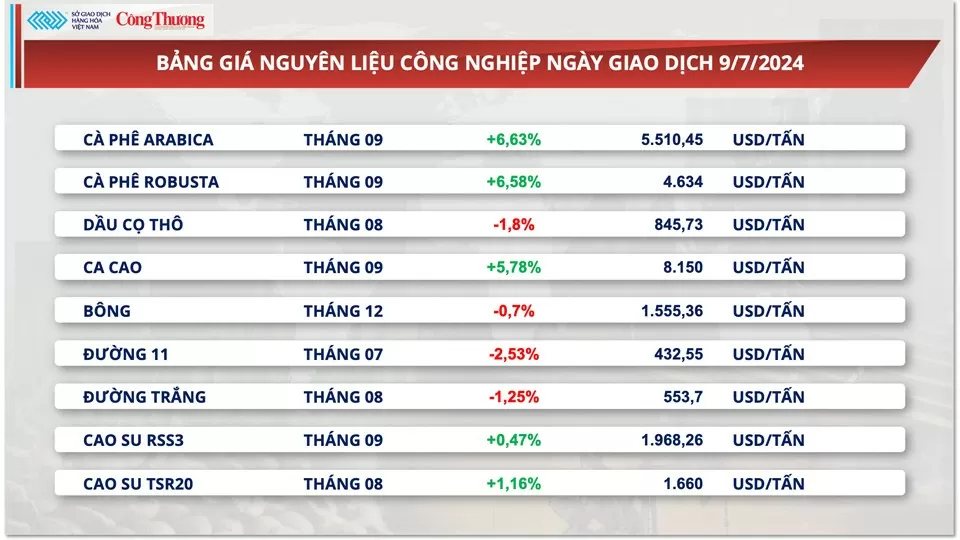

Cocoa prices rise sharply

Cocoa prices surged 5.78% as current market supplies remain tight. As of July 7, the amount of cocoa shipped to Ivory Coast ports was only 1.61 million tons from the start of the 2023-2024 crop year, down 29% from the same period last season. Consulting firm Trader Ecom Agroindustrial has lowered its forecast for the country's 2023-2024 cocoa production to an eight-year low of 1.75 million tons, down 21.5% from the same period last season.

|

| Industrial raw material price list |

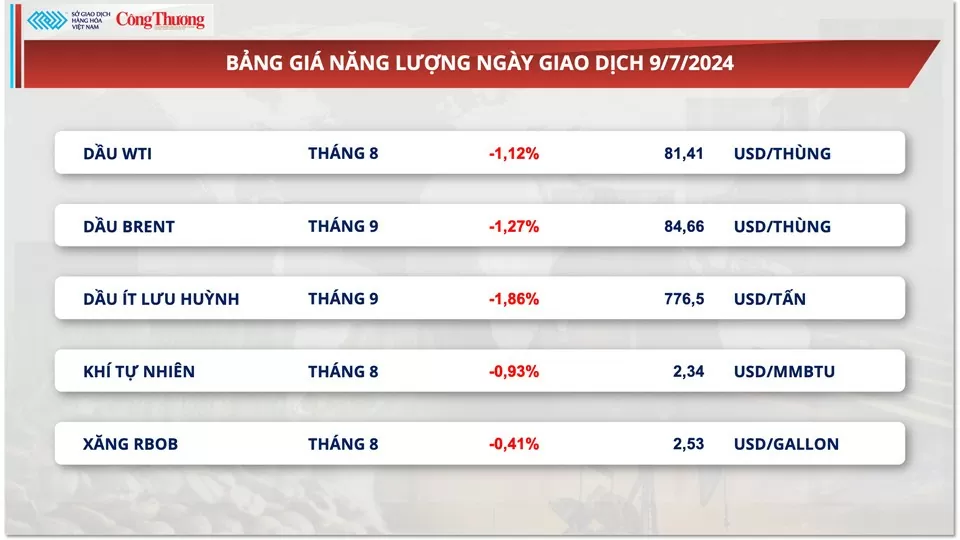

Oil prices continue to decline for the third consecutive session

At the end of yesterday's session, world oil prices weakened for the third consecutive session, due to the risk of reduced supply from the US. At the end of the day, WTI oil prices decreased by 1.12% to 81.41 USD/barrel, Brent oil prices decreased by 1.27% to 84.66 USD/barrel.

|

| Energy price list |

Traders said supply disruptions from Hurricane Beryl were limited. While some offshore U.S. production sites were evacuated, ports were closed and refining activity slowed, major refineries along the U.S. Gulf Coast appeared to be largely unaffected after Beryl weakened to a tropical depression. Major Texas oil ports were set to reopen on Tuesday after being forced to close earlier. Some operators such as Marathon Petroleum said they were also preparing to restart their refineries.

Investors also had mixed reactions to comments from Federal Reserve Chairman Jerome Powell after congressional testimony on Tuesday. Powell said the economy was no longer overheating and the job market was cooling. Despite suggesting a possible rate cut was coming, oil prices fell further after the comments as the weakening economy could hamper demand for crude.

Sharing the same view, in its July Short-Term Energy Outlook Report, the US Energy Information Administration (EIA) also lowered its forecast for US gross domestic product growth this year to 2.4%, 0.1 percentage point lower than its previous estimate.

However, the market's decline was narrowed by the end of the trading session when, despite lowering the US growth forecast, the EIA said the market would remain in a significant deficit in 2024, with the full-year deficit averaging 500,000 barrels per day, 100,000 barrels per day higher than the previous estimate. Specifically, global oil production in 2024 was revised down by the EIA to 102.4 million barrels per day, from 102.6 million barrels per day, while supply growth was kept at 1.1 million barrels per day.

Meanwhile, early this morning, the American Petroleum Institute (API) said that the country's commercial crude oil inventories fell by nearly 2 million barrels in the week ending July 5, compared to the market's forecast of a decrease of 0.7 million barrels. The inventory pressure has thereby pulled oil prices back up.

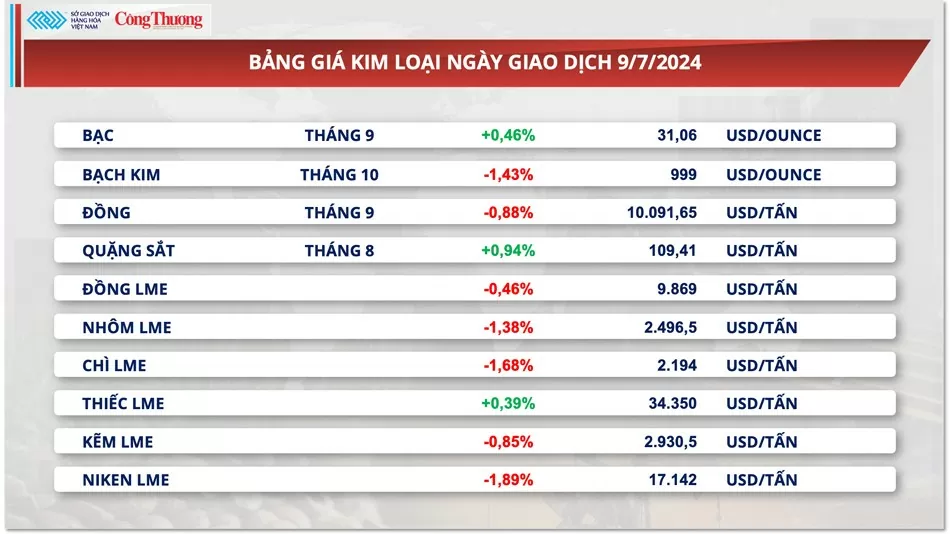

Prices of some other goods

|

| Metal price list |

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1072024-gia-dau-noi-dai-da-giam-sang-phien-thu-3-lien-tiep-331203.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)