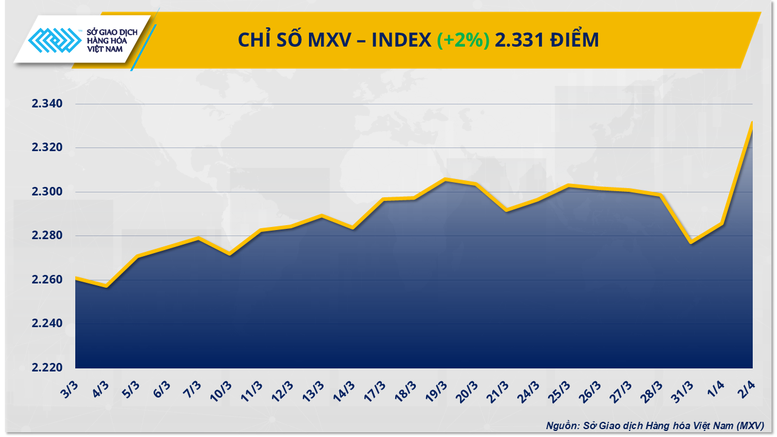

The Vietnam Commodity Exchange (MXV) said that the world raw material market recorded many remarkable developments in the trading session on April 2. At the close, overwhelming buying pressure supported the MXV-Index to increase sharply by 2%, surpassing the 2,330 point mark - the highest level since the last week of February.

Notably, in the industrial raw materials market, cocoa prices suddenly jumped to a one-month high amid concerns about declining supply. On the other hand, oil prices also unexpectedly turned sharply higher due to the impact of short-term shortages. This morning (April 3), Vietnam time, US President Donald Trump announced the imposition of reciprocal tariffs on 185 countries and territories. It is expected that in today's trading session, world commodity prices will fluctuate strongly.

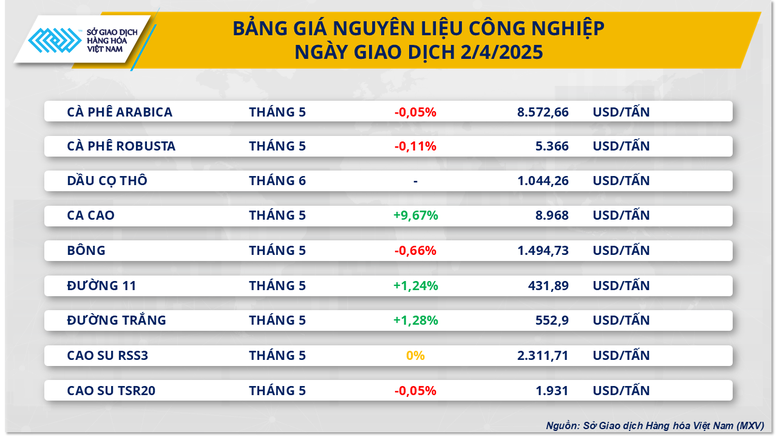

At the end of the trading session on April 2, the price of industrial raw materials was mixed with green and red. Cocoa attracted the attention of investors when leading the upward trend of the whole market.

Closing, the price of cocoa contract for May increased sharply to over 9,168 USD/ton, up 9.67% and reaching a one-month high. This is the second consecutive increase with a total increase of nearly 13.5% compared to the closing price on March 31, reflecting the positive sentiment of the market in response to fundamental information.

The outlook for global cocoa supplies is dimming as the mid-season harvest in West Africa, the world’s largest cocoa-producing region, shows signs of slowing. Late rains have hampered crop development in Ivory Coast and Ghana, according to a Rabobank report.

Recent surveys of farmers in the region have also shown disappointing results. The average production estimate for this year’s mid-season crop in Ivory Coast, the world’s largest cocoa producer, is just 400,000 tons, down 9% from 440,000 tons last year. While Ivorian government data released Tuesday showed farmers shipped 1.44 million tons of cocoa to ports between Oct. 1 and March 30, up 11% from the same period last year, the increase was significantly lower than the 35% increase recorded in December.

Meanwhile, in the coffee market, the price of Arabica coffee for May contract decreased slightly by 0.05%, while the price of Robusta coffee closed at 5,336 USD/ton, down 0.11%. This development reflects the market adjustment after previous volatile sessions.

According to ICE statistics, Arabica inventories as of April 2 reached 777,263 bags, remaining low but unchanged from the previous week. Meanwhile, Robusta inventories decreased slightly from a seven-week high of 4,414 lots (March 25) to 4,342 lots.

Oil prices rise sharply despite demand concerns

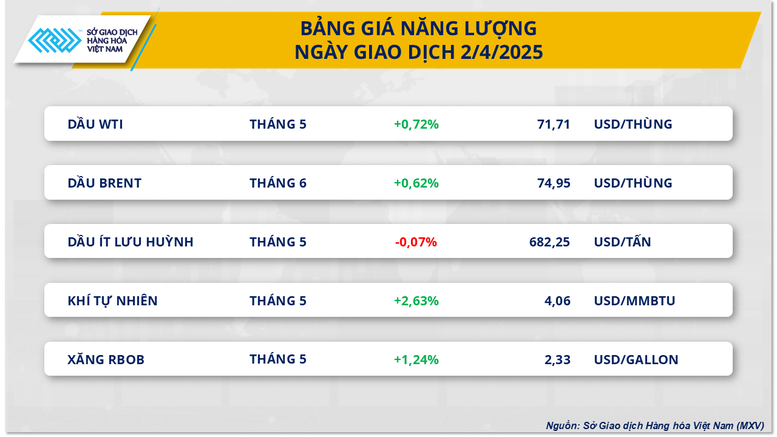

According to MXV, oil prices unexpectedly turned up in the trading session on April 2, despite concerns about future oil demand. The impact of short-term supply shortages is still dominant as the market can feel the "shakes" from the announcement of reciprocal taxes by the administration of US President Donald Trump.

At the end of the session, Brent crude oil price reached 74.95 USD/barrel, up 0.62%, while WTI crude oil price increased 0.72% to 71.71 USD/barrel. This is the highest price of both types of oil since the beginning of March.

Concerns about short-term supply shortages continue after US sanctions were announced targeting crude oil from Iran and Venezuela. Venezuela’s oil exports in March were estimated to have fallen 11.5% from the previous month.

Meanwhile, before implementing the plan to increase production in April and announcing a similar plan for May, OPEC+ has implemented measures to cut excess production in many member countries. Kazakhstan is one of the countries most pressured by this decision, and the issue of production cuts there is expected to be a focus of discussion at this week's OPEC+ Ministerial Meeting.

In addition, OPEC+ reduced crude oil production to about 27.43 million barrels per day in March, down 110,000 barrels per day from the previous month. Nigeria was the largest contributor to the decline, with production falling by about 50,000 barrels per day, mainly due to a fire on the Trans-Niger pipeline on March 19, which disrupted the system for six days.

Global oil supplies have also come under further pressure as the Russian government has ordered the closure of two of the three berths at the Caspian Pipeline Joint Venture’s (CPC) main oil export terminal in the Black Sea. This move could reduce CPC oil exports by up to 700,000 barrels per day, significantly affecting regional supplies.

On the afternoon of April 2, local time, President Trump announced a series of new reciprocal tariffs on imported goods from a series of major trading partners. As of 6:00 a.m. this morning, the market reacted strongly to this information in the trading session on April 3. WTI oil prices recorded a sharp drop of more than 2.5% and this downward trend is expected to continue until the end of today's session.

Source: https://baochinhphu.vn/gia-ca-cao-bat-ngo-len-muc-cao-nhat-trong-mot-thang-102250403085616606.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)