Many individual taxpayers are surprised because of their tax debt on eTax Mobile with huge arrears and fines - Photo: NAM TRAN

Speaking with Tuoi Tre, lawyer Tran Xoa, director of Minh Dang Quang Law Firm, said that in the past, people with multiple sources of income had to get tax deduction certificates and at the end of the year had to summarize their income to do their own tax settlement.

However, currently, if the income generated is less than 10 million VND/month and has been temporarily deducted 10%, taxpayers can choose the more beneficial way for themselves, which is to settle or not, and do not necessarily have to summarize the income to settle as before.

Mr. Xoa said that in reality, for small payments under 2 million VND/time, the paying agency does not deduct.

At the end of the year, the taxpayer also forgot to settle the tax. Then the tax authority discovered and collected and imposed a heavy fine.

There are cases where people receive income of only a few hundred thousand dong but are fined several million dong, even tens of millions of dong.

According to many tax experts, personal income tax is quite complicated with many sources of income such as wages, salaries, real estate, stocks, house rentals, business... At the same time, each source of income has a different tax rate.

Even personal income tax from wages and salaries applies a progressive tax rate of 5 - 35%. Therefore, in order for taxpayers to pay taxes correctly, fully and promptly, the tax industry's eTax Mobile application needs to strive to be like a banking application.

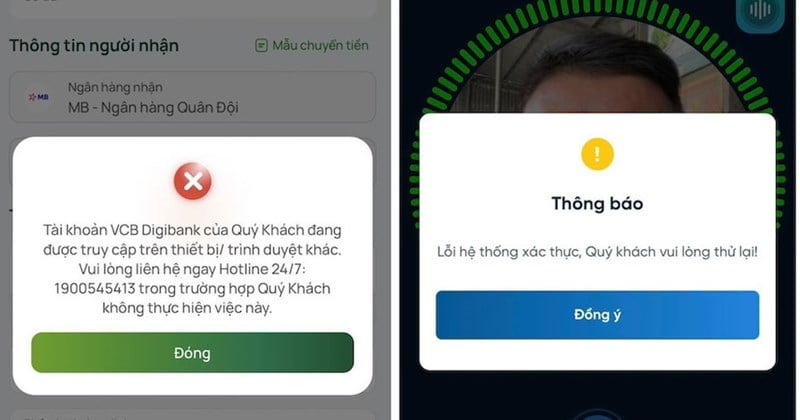

Accordingly, when there is a tax debt, etTax Mobile automatically notifies individual taxpayers and makes tax payment easy. Like a banking application, whenever there is a change in balance, the banking app notifies customers so they can know and manage their accounts.

Along with the notification of remaining tax payable or late payment penalty..., people only need to enter the file code or declaration on the eTax Mobile application to get the tax debt.

For a long time, paying electricity, water, phone bills... has been extremely easy, users just need to enter the customer code into the banking application and the amount to be paid will automatically appear. But to get to this step, the tax information and data must be accurate, down to the last penny.

As recently reported, the data on eTax Mobile is not really accurate, so taxpayers are very confused.

Unexpectedly owing tax on eTax Mobile

Unexpectedly owing tax on eTax MobileSource: https://tuoitre.vn/etax-mobile-nhu-app-ngan-hang-dan-se-do-bi-phat-20241013221526616.htm

Comment (0)