Today's liquidity decreased by more than VND6,000 billion compared to the previous session as investors continued to choose to stand outside and observe, causing the index to decrease by more than 3 points compared to the reference, down to 1,258 points.

Today's liquidity decreased by more than VND6,000 billion compared to the previous session as investors continued to choose to stand outside and observe, causing the index to decrease by more than 3 points compared to the reference, down to 1,258 points.

Before entering the trading session on October 30, some experts said that the market could witness short-term recoveries in the coming sessions. However, according to the expert group's opinion, investors should still be cautious and avoid the psychology of chasing or dumping for short-term transactions.

Reality proved the opposite when VN-Index opened today's session in green. However, this development did not last long when selling pressure gradually increased from mid-morning. The index representing the Ho Chi Minh City Stock Exchange gradually fell below the reference and remained in this state until closing. VN-Index closed at 1,258.63 points, down 3.15 points compared to the previous session.

The selling side dominated as 210 stocks declined, while only 163 stocks closed in the green. The large-cap basket also recorded a similar situation with 17 stocks declining, while only 8 stocks closed above the reference.

Two Vingroup stocks topped the list of 10 stocks with the most negative impact on the VN-Index. Specifically, VHM fell 3.74% to VND41,150, while VIC fell 0.85% to VND41,000.

The remaining codes appearing in the above list come from many different industries such as food, retail, oil and gas... Specifically, VNM lost 1.04% to 66,300 VND, GVR lost 0.76% to 32,700 VND, MWG lost 0.75% to 66,000 VND and PLX lost 1.19% to 41,400 VND.

Most steel stocks also fell into negative territory. HSG fell 1.7% to VND20,350, TLH fell 0.6% to VND5,140, NKG fell 0.5% to VND20,650 and HPG fell 0.2% to VND27,000.

Similarly, the fertilizer group also put pressure on the market. Specifically, BFC decreased by 3.4% to VND39,700, DCM decreased by 1.3% to VND37,600 and DPM decreased by 1% to VND34,600.

On the other hand, banking stocks played a supporting role for the market in today's session. Specifically, TCB led the ranking of stocks with the most positive impact on the VN-Index when it increased by 1.05% to VND24,000. Next were STB increasing by 2.2% to VND34,800, BID increasing by 0.32% to VND47,700, VIB increasing by 1.33% to VND19,000, LBP increasing by 0.77% to VND32,550 and TPB increasing by 0.88% to VND17,250.

Market liquidity today reached VND12,700 billion, down VND6,120 billion compared to the previous session. This value came from about 537 million shares changed hands, down 338 million units compared to yesterday's session. The VN30 basket contributed to the trading value of nearly VND7,218 billion, equivalent to 228 million shares successfully matched.

VHM ranked first in terms of liquidity value, reaching approximately VND1,333 billion (equivalent to 31.8 million shares). The following codes were far from the leading position. Specifically, STB reached a value of more than VND591 billion (equivalent to 17.1 million shares), MWG about VND589 billion (equivalent to 8.9 million shares), MSN more than VND437 billion (5.6 million shares) and VIB nearly VND413 billion (equivalent to 21.7 million shares).

Foreign investors have been net sellers for five consecutive sessions. Specifically, this group sold more than 51 million shares, equivalent to a transaction value of VND1,666 billion, while only disbursing about VND1,524 billion to buy nearly 51.4 million shares. The net selling value accordingly reached VND142 billion.

On the Ho Chi Minh City Stock Exchange, foreign investors focused on selling MSN shares with a net value of more than VND90 billion, followed by STB with approximately VND84 billion. In contrast, foreign investors' cash flow focused on VPB with a net value of about VND141 billion, TCB with a net absorption of nearly VND125 billion and FPT with about VND109 billion.

Source: https://baodautu.vn/dong-tien-suy-yeu-vn-index-giam-hon-3-diem-d228762.html

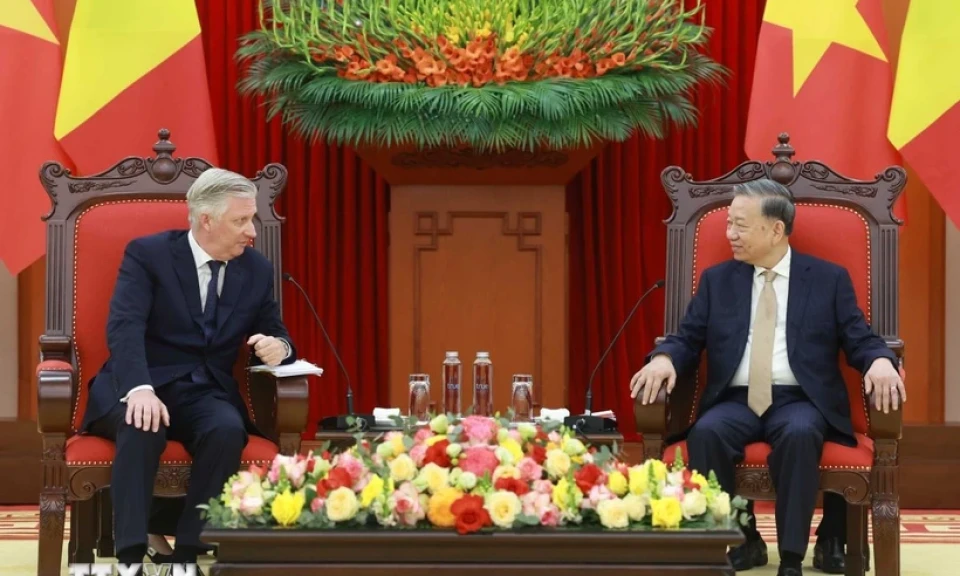

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)