Sharing the main points of the revised Law on Social Insurance in 2024, Mr. Pham Truong Giang, Director of the Social Insurance Department (Ministry of Labor, War Invalids and Social Affairs), affirmed that reducing the condition on the minimum number of years of social insurance contributions to receive monthly pension from 20 years to 15 years is to increase the opportunity for employees to enjoy retirement benefits.

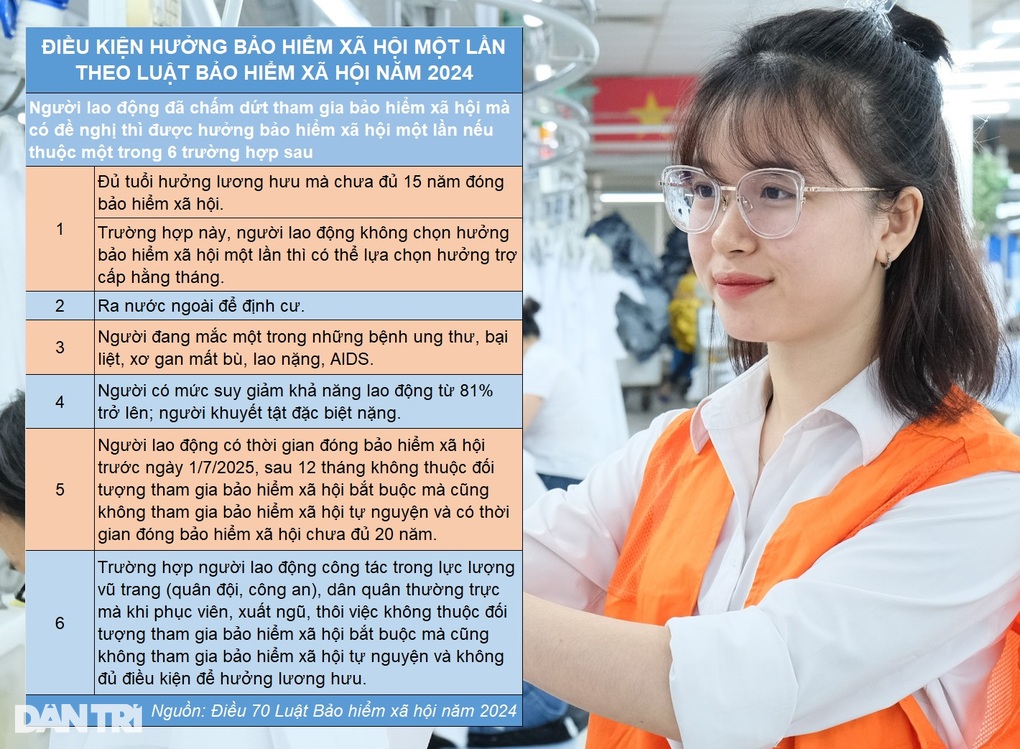

According to Mr. Giang, when the Social Insurance Law 2024 takes effect (from July 1, 2025), those who participated in social insurance before July 1, 2025 will still be entitled to receive one-time social insurance upon request in 6 cases. For those who participated in social insurance from July 1, 2025 onwards, they will still be entitled to receive one-time social insurance upon request in 5 cases.

In addition, Mr. Pham Truong Giang said that the 2024 Social Insurance Law also adds regulations in the direction of increasing benefits, encouraging employees to reserve social insurance payment time to receive pension instead of receiving social insurance at a time.

Accordingly, if employees reserve their social insurance participation time to receive pension instead of receiving social insurance at one time, they have the opportunity to enjoy 3 benefits.

The first is a credit support policy for workers who have paid social insurance but lose their jobs.

The second is the opportunity to receive monthly benefits from your own contributions as soon as you reach retirement age.

Third, during the period of receiving monthly allowance, you will receive health insurance paid for by the state budget.

According to statistics, in the 7 years of implementing the Social Insurance Law in 2014, there were over 53,000 people who were past retirement age and had to receive one-time social insurance payments because they had not paid 20 years of compulsory social insurance; there were over 20,000 people who, upon reaching retirement age, had not paid enough social insurance and had to pay one-time payments for the remaining time to receive pension.

With the regulation reducing the minimum social insurance payment period to receive pension to 15 years, the above cases will be greatly reduced, increasing the rate of people past working age receiving pension benefits, ensuring social security.

Source: https://dantri.com.vn/an-sinh/dieu-kien-huong-bao-hiem-xa-hoi-mot-lan-tu-ngay-172025-20241001121739304.htm

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)