Without breakthrough regulations paving the way for the development of offshore wind power, it will be difficult to achieve the goals set in the Power Plan VIII as well as the Government's commitment to net zero emissions by 2050.

Offshore wind power: Waiting for breakthrough from pioneering state-owned enterprise

When assessing the subjects of offshore wind power projects, the Ministry of Industry and Trade stated that the selection of international investors to implement pilot projects may still have many unforeseen difficulties and complications.

For domestic private enterprises, the Ministry of Industry and Trade's view is that they should not be assigned to pilot projects because they have not yet fully assessed issues related to national security and defense and legal issues.

The option that the Ministry of Industry and Trade is leaning towards is to assign investment to state-owned economic groups. Specifically, the Vietnam Oil and Gas Group (Petrovietnam), the Vietnam Electricity Group (EVN) or enterprises under the Ministry of National Defense.

However, in order for state-owned enterprises to confidently take on the leading role in implementing offshore wind power projects, the amendment of the current Electricity Law needs to be clearer.

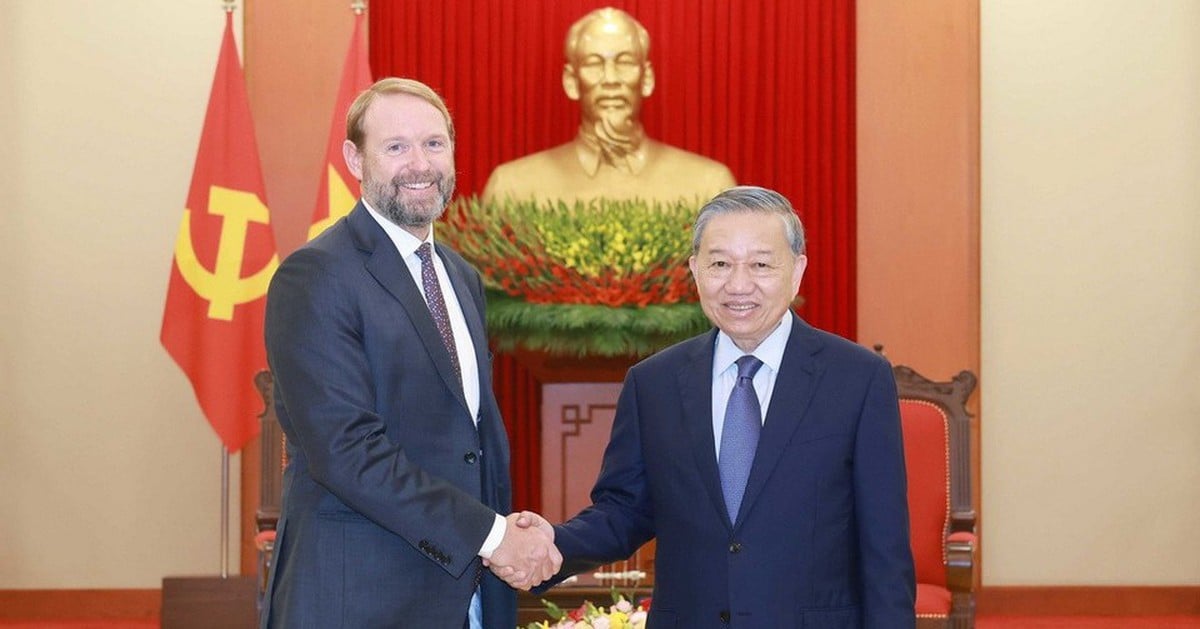

|

| Offshore wind power base construction site at PTSC port of Vietnam Oil and Gas Group. |

Highly agreeing and fully supporting the policy of building regulations and mechanisms to promote power projects in general, especially offshore wind power projects, Vietnam Oil and Gas Group (Petrovietnam) - an enterprise with a lot of experience in investing in large power projects, also proposed specific solutions.

According to Petrovietnam's analysis, the current revised Draft Law on Electricity has not resolved issues such as the Prime Minister assigning enterprises with 100% charter capital held by the State to cooperate with domestic and foreign partners to implement the first offshore wind power projects or assigning subsidiaries of enterprises with 100% charter capital held by the State to implement offshore wind power projects and conduct surveys.

Currently, offshore wind power projects are completely new in Vietnam and often have large investment scale and are complicated in the process of implementation, construction and installation. However, this is a field related to national security and sovereignty. Therefore, offshore wind power is also classified by the Investment Law as a "conditional investment in attracting foreign capital".

With the limited capacity and experience of domestic enterprises, the independent development of offshore wind power projects in Vietnam in the early stages will certainly face many challenges.

Therefore, to ensure security and defense, and at the same time initiate the first offshore wind power projects in Vietnam to ensure investment efficiency, there needs to be regulations for the Prime Minister to assign domestic enterprises to cooperate with capable and experienced international partners.

From the perspective of the oil and gas industry, there are many similarities with offshore wind power . Based on existing capacity and experience, Petrovietnam and its member units have proactively participated in the offshore wind power sector.

However, to promote the strengths of capacity and experience, and effectively use resources, in addition to enterprises with 100% charter capital held by the State, there should also be regulations allowing the Prime Minister to assign subsidiaries of enterprises with 100% charter capital held by the State to conduct surveys and develop offshore wind power projects.

In this direction, experts propose to amend Point a, Clause 2, Article 26 on Offshore Wind Power Project Survey in the direction that "The Prime Minister assigns enterprises in which the State holds 100% of charter capital to organize the preparation and proposal of plans and schemes to mobilize member units to conduct surveys".

It is also proposed to add the clause a, Clause 1, Article 27 on approval of investment policy for offshore wind power projects to the sentence “The Government shall specify this content in detail” in the sentence “enterprises in which the State holds 100% of charter capital shall prepare a dossier requesting approval of investment policy and at the same time approve investors according to regulations, including proposing cooperation partners, assigning subsidiaries to organize the implementation of investment projects, or preparing a dossier requesting approval of investment policy to bid for selection of investors.

Besides, it is the story of clearly defining the authority of the Prime Minister in approving offshore wind power investment policies, including offshore wind power export projects.

That is because the Draft Electricity Law in Clause 4, Article 12 does not clearly stipulate which level has the authority to approve investment policies for projects exporting electricity from offshore wind power sources, leading to a legal gap because it is unclear which level has the authority.

Opportunity to increase domestic production

When implementing investment in large hydropower projects in the period of 2003-2014, domestic hydromechanics were facilitated by the State to participate in manufacturing, thereby significantly maturing in capacity.

However, the support for more domestic production participation in offshore wind power projects is currently unclear. Specifically, the Draft Electricity Law does not have regulations on support policy mechanisms for offshore wind power projects (Clause 4, Article 25 General Provisions), and both the Tax Law and the Investment Law do not have specific regulations for offshore wind power .

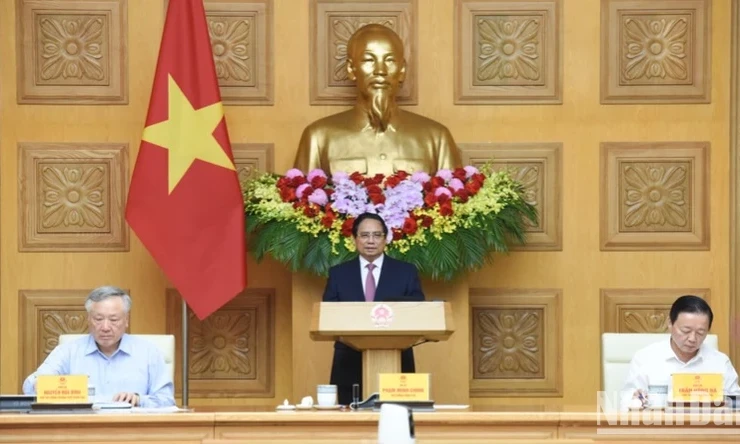

|

| PTSC performs underground cable installation for Tan Thuan wind power project. |

“It is necessary to clarify incentive mechanisms as well as specify regulations on giving priority to domestic enterprises participating in the offshore wind power industry, starting from the survey stage until project dismantling, especially in the first projects,” is the opinion that Mr. Nguyen Quoc Thap, Chairman of the Vietnam Petroleum Association, commented on the revised Electricity Law.

In order for offshore wind power projects to contribute more to the power system as well as the journey to Net Zero, the issue of electricity selling price and minimum contracted electricity output is also raised because the current draft Law does not exist, making the negotiation process of the Power Purchase Agreement time-consuming and not easy to reach results.

This is also because EVN - the only wholesale electricity buyer today - also has to calculate business efficiency so it cannot buy high and sell low.

According to this proposal, Clause 4, Article 25 needs to clearly state “The electricity selling price and the minimum long-term contract electricity output for projects selling electricity to the national power system on the principle of mobilizing maximum offshore wind power output on the basis of ensuring the safety of the power system to meet the investment efficiency of the project, while fully reflecting the investment and production costs for offshore wind power projects…”.

Experts also said that it is necessary to clearly stipulate in the revised Electricity Law the exemption and reduction of fees for using sea areas; land use/land rent fees or the enjoyment of corporate income tax incentives at the highest level according to the provisions of the law on rent; import tax incentives for materials, goods and equipment of offshore wind power projects as well as the localization rate for survey, construction, development, operation, exploitation and dismantling activities of offshore wind power projects.

Also because the revised Electricity Law is being drafted as a framework law, experts believe that it is necessary to add the assignment of the Government to specify in detail the rights of enterprises in which the State holds 100% of the charter capital and has participated in the survey assignment.

In addition, the new Draft Electricity Law only stipulates the rights of enterprises in which the State holds 100% of the charter capital and has participated in the assigned survey at Point a, Clause 3, Article 26, but does not clearly stipulate capital contribution. Therefore, it is also necessary to add a provision on "enterprises assigned to contribute capital to invest in projects in areas assigned by the Prime Minister to conduct surveys. The Government shall specify in detail the content and form of capital contribution".

“The draft Electricity Law needs to set out clear policies, remove obstacles and difficulties for businesses when participating in investment, create a system of legal documents on the energy sector that is synchronous, unified, and effective to meet the demand for electricity for socio-economic development and export, and at the same time must aim to exploit wind resources so that Vietnam can participate in supplying electricity to the international market, creating foreign currency revenue from exporting electricity,” said a representative of Petrovietnam.

Then in April 2024, the Norwegian state-owned energy group Equinor confirmed that it had canceled its investment plan in Vietnam's offshore wind power.

Although Vietnam is considered to have “one of the best wind resources in Asia,” according to the World Bank’s analysis team, Vietnam has attracted international attention with its renewable energy plans, but its slow policies have caused some potential investors to reconsider their plans.

Mr. Andrew Ho, Director of Government Relations and Policy for Asia-Pacific at Orsted Group (Denmark) also commented that when interested in a market, international investors need to see a stable policy framework for long-term investment in that market. The government needs to provide important and transparent legal frameworks because offshore wind power cannot be deployed quickly.

Source: https://baodautu.vn/dien-gio-ngoai-khoi-cho-cu-hich-tu-luat-dien-luc-sua-doi-d231258.html

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)