The central exchange rate increased by 9 VND, the VN-Index decreased by 7.57 points (-0.60%) compared to the previous weekend, or the Government requested ministries, branches and localities to accelerate and make breakthroughs to achieve and surpass all 15/15 targets and goals of 2024... are some notable economic information in the week from December 9-13.

| Prime Minister: One more step to complete the project on streamlining the Government apparatus. Prime Minister requests timely rectification of land use rights auction work. |

|

| Economic news review |

Overview

In Resolution No. 233/NQ-CP of the regular Government meeting in November 2024 issued on December 10, 2024, the Government requested ministries, branches and localities to both accelerate and make breakthroughs to achieve and surpass all 15/15 targets and goals of 2024, and urgently deploy new, important and urgent tasks, creating momentum, creating force, creating position, and maintaining a higher pace to successfully implement the socio-economic development plan for 2025.

The socio-economic situation in November and 11 months of 2024 continues to affirm a clear recovery, with each month being better than the previous month, growth in the following quarter being higher than the previous quarter and better than the same period in most areas; it is expected to achieve and exceed 15/15 main socio-economic development targets for the whole year of 2024.

The macro economy is basically stable, inflation is under control, major balances are guaranteed and there is a high surplus. The average consumer price index (CPI) is on a downward trend, increasing by 3.69% in 11 months compared to the same period. The monetary market and exchange rate are basically stable, managed in line with market developments; interest rates continue to decrease; the safety of the banking system is guaranteed. The state budget revenue in 11 months is estimated at 106.3% of the estimate, up 16.1% over the same period in the context of implementing the exemption and extension of about 189 trillion VND in taxes, fees and land use fees. Import-export turnover, export and import in 11 months increased by 15.4%, 14.4% and 16.4% respectively over the same period; trade surplus is estimated at 24.31 billion USD. Public debt, government debt, foreign debt, and state budget deficit are well controlled, below the allowable limit.

Regarding the tasks and duties in the coming time, the Government agreed to: (i) resolutely and urgently arrange and streamline the Government's organizational apparatus, improve the effectiveness and efficiency of operations according to Resolution No. 18-NQ/TT;

(ii) focus on reviewing and removing bottlenecks and bottlenecks in institutions, mechanisms, and policies, and maximally mobilizing social resources;

(iii) continue to prioritize promoting growth associated with maintaining macroeconomic stability, controlling inflation, ensuring major balances of the economy, determined to achieve the highest level of the 2024 Socio-Economic Development Plan, creating momentum for acceleration, breakthrough, striving to achieve the growth target of 8% in 2025;

(iv) resolutely accelerate the disbursement of public investment capital, implement 03 National Target Programs, speed up the construction progress of key and important national works and projects; urgently complete, promulgate and deploy plans in 2024;

(v) Highly focus on implementing solutions to develop industrial and agricultural production and key sectors; ensure national energy and food security; accelerate national digital transformation, develop digital economy, green economy, circular economy, creative economy, new industries and fields, and high technology;

(vi) strongly develop the market and stimulate domestic consumption, expand export markets; synchronously implement tasks and solutions to serve the year-end and Lunar New Year 2025; promote administrative procedure reform, create a favorable business environment; resolutely remove backlogged and weak projects.

In particular, the State Bank is assigned the following specific main tasks:

Together with ministries, ministerial-level agencies, and agencies under the Government according to their assigned functions, tasks, and authority, urgently complete within a specific deadline in December 2024 the tasks related to the reorganization of the apparatus, including: (1) developing a weekly summary report on the implementation of Resolution No. 18-NQ/T; (2) developing a project and plan to reorganize and consolidate the apparatus according to the requirements and directions of the Central Steering Committee and the Government Steering Committee; (3) developing a draft Decree stipulating the functions, tasks, powers and organizational structure of ministries and agencies after the reorganization; (4) reviewing the system of legal documents directly related to the reorganization of the apparatus; (5) developing a Project to establish Party Committees of ministries, ministerial-level agencies, and agencies under the Government directly under the Government Party Committee, and drafting the Working Regulations of Party Committees of ministries and agencies.

Manage exchange rates and interest rates in line with macroeconomic developments and set targets, maintain stability in the monetary, foreign exchange, and gold markets, and ensure the safety of the credit institution system. Manage credit growth in a timely manner, support production and business development, and achieve the credit growth target of 15% in 2024. Direct credit institutions to continue to strive to reduce lending interest rates; focus credit on production and business sectors, priority sectors, and economic growth drivers; strictly control credit in potentially risky sectors. Strengthen inspection, examination, and supervision of credit granting and interest rate announcement by credit institutions; promptly and strictly handle violations.

Direct credit institutions to promote lending to serve production, business, and consumer needs at the end of the year and the Lunar New Year 2025; research and develop credit products and banking services specifically for the consumer sector, creating favorable conditions for people and businesses to access loans to promote consumption and economic development. Urgently submit before December 20, 2024 the plan for compulsory transfer of the remaining 02 specially controlled banks (Global Petroleum Joint Stock Commercial Bank, Dong A Commercial Joint Stock Bank); promptly implement according to authority or submit to competent authorities the handling plan for Saigon Commercial Joint Stock Bank, without further delay.

Domestic market summary week from December 9-13

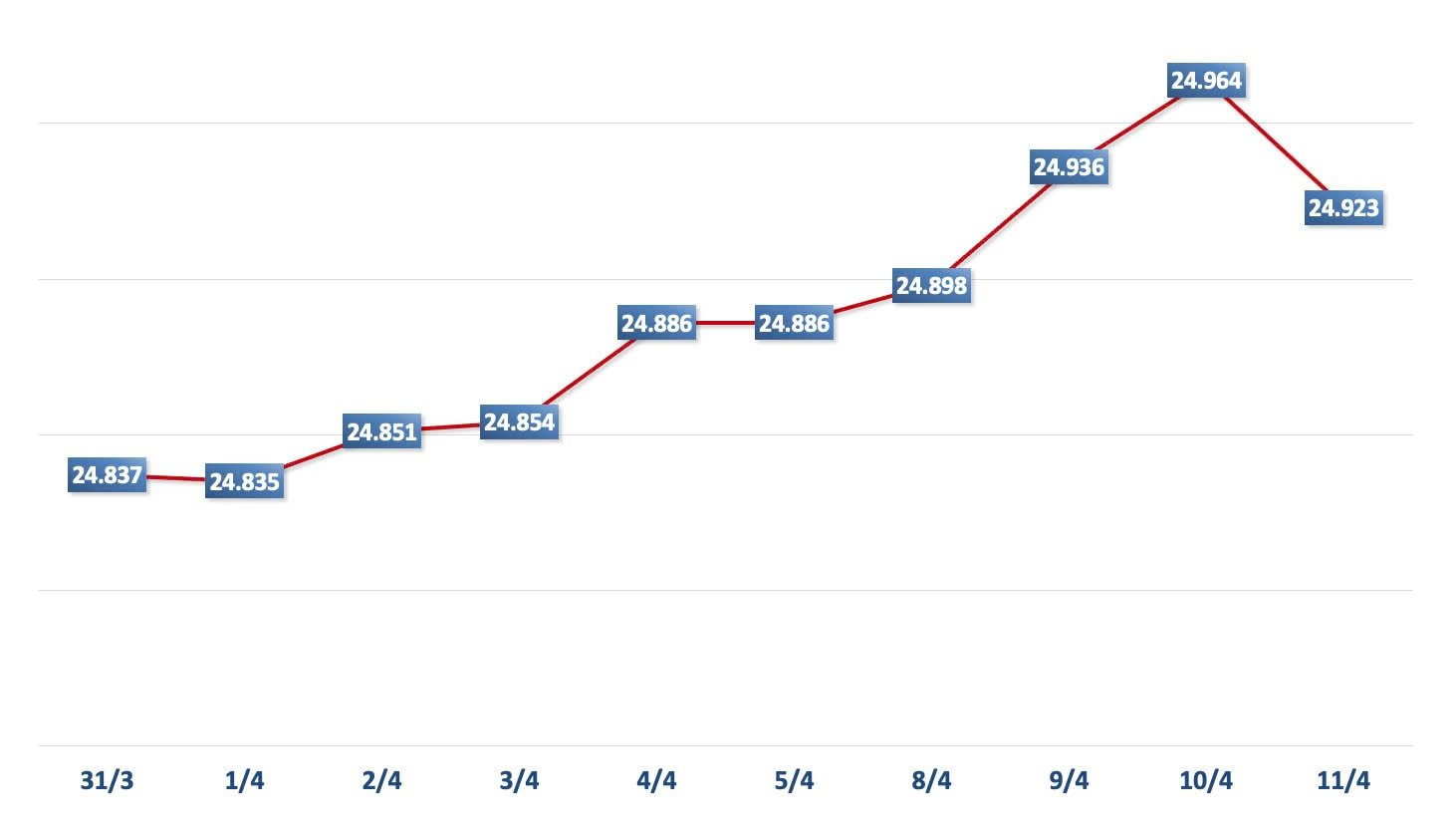

In the foreign exchange market, during the week of December 9-13, the central exchange rate was adjusted up and down alternately by the State Bank. At the end of December 13, the central exchange rate was listed at 24,264 VND/USD, up 09 VND compared to the previous weekend session.

The State Bank of Vietnam continues to list the spot buying rate at 23,400 VND/USD and the spot selling rate at 25,450 VND/USD.

The interbank USD-VND exchange rate in the week from December 9-13 decreased in the first session of the week and then increased again. At the end of the session on December 13, the interbank exchange rate closed at 25,403, up 14 VND compared to the previous weekend session.

The dollar-dong exchange rate on the free market has been on a downward trend. At the end of the session on December 13, the free exchange rate decreased by 140 VND in both buying and selling directions compared to the previous weekend session, trading at 25,550 VND/USD and 25,650 VND/USD.

Interbank money market, week from December 9-13, interbank VND interest rates increased at the beginning of the week and only decreased at the end of the week. Closing on December 13, interbank VND interest rates were traded at: overnight 4.08% (+0.08 percentage points); 1 week 4.43% (+0.16 percentage points); 2 weeks 4.58% (+0.11 percentage points); 1 month 5.12% (+0.35 percentage points).

Interbank USD interest rates fluctuated slightly last week. On December 13, interbank USD interest rates were: overnight 4.61% (+0.01 percentage point); 1 week 4.66% (unchanged); 2 weeks 4.71% (unchanged) and 1 month 4.75% (-0.01 percentage point).

In the open market last week from December 9 to December 13, in the mortgage channel, the State Bank of Vietnam offered 7-day term with a volume of VND51,000 billion, interest rate kept at 4.0%. There were VND50,999.89 billion in winning bids, and VND30,000 billion maturing last week in the mortgage channel.

The State Bank of Vietnam bids for treasury bills The State Bank of Vietnam bids for interest rates at two terms: 14 days and 28 days. VND14,750 billion was won at the 14-day term, with an interest rate of 4.0%, VND2,200 billion was won at the 28-day term, with an interest rate of 4.0%. VND2,550 billion of treasury bills matured last week.

Thus, the State Bank of Vietnam pumped a net VND6,599.89 billion into the market last week through the open market channel. There were VND50,999.89 billion circulating on the mortgage channel, and VND51,005 billion in State Bank bills circulating on the market.

Bond market, on December 11, the State Treasury successfully bid 1,740 billion VND/9,000 billion VND of government bonds called for bid, with a winning rate of 19%. Of which, the 5-year term won 500 billion VND/2,000 billion VND called for bid, the 10-year term raised 1,200 billion VND/4,500 billion VND called for bid and the 30-year term raised 40 billion VND/1,500 billion VND called for bid. The 15-year term alone called for bid of 1,000 billion VND but there was no winning volume. The winning interest rate for the 5-year term was 2.0% (+0.09 percentage points compared to the previous auction), the 10-year term was 2.73% (+0.07 percentage points) and the 30-year term was 3.18% (+0.08 percentage points).

This week, on December 18, the State Treasury plans to bid for VND9,000 billion in government bonds, of which VND2,000 billion will be offered for the 5-year term, VND4,500 billion for the 10-year term, VND1,000 billion for the 15-year term, and VND1,500 billion for the 30-year term.

The average value of Outright and Repos transactions in the secondary market last week reached VND29,255 billion/session, a sharp increase compared to VND9,030 billion/session of the previous week. Government bond yields last week tended to increase across all maturities. At the close of the session on December 13, government bond yields were trading around 1-year 1.86% (+0.02 percentage points compared to the session at the end of last week); 2-year 1.88% (+0.03 percentage points); 3-year 1.90% (+0.03 percentage points); 5-year 2.14% (+0.14 percentage points); 7-year 2.37% (+0.04 percentage points); 10-year 2.84% (+0.05 percentage points); 15-year 3.02% (+0.04 percentage points); 30 years 3.18% (+0.01 percentage point).

Stock market, week from December 9 to December 13, the indexes on the stock market decreased slightly in most sessions. At the end of the session on December 13, VN-Index stood at 1,262.57 points, down 7.57 points (-0.60%) compared to the previous weekend; HNX-Index lost 1.92 points (-0.84%) to 227.0 points; UPCoM-Index fell 0.27 points (-0.29%) to 92.54 points.

Average market liquidity reached about VND15,100 billion/session, down from VND17,000 billion/session the previous week. Foreign investors net sold over VND1,544 billion on all three exchanges.

International News

The United States recorded some notable economic indicators. First, on inflation, the US Bureau of Labor Statistics (BLS) announced that the country's headline CPI and core CPI both increased 0.3% month-on-month in November after increasing 0.2% and 0.3% respectively in October, matching experts' forecasts. Compared to the same period in 2023, the headline CPI and core CPI increased 2.7% and 3.3% respectively compared to the same period in 2023, unchanged from the 2.6% and 3.3% levels in the previous month.

Next, the BLS said the country's headline PPI rose 0.4% month-over-month in November after rising 0.3% in October, stronger than the forecast 0.2% increase. In addition, the core PPI in the US rose 0.2% in November after rising 0.3% in October, matching the forecast. Compared to the same period in 2023, headline PPI and core PPI increased 3.0% and 3.5% year-over-year, respectively, expanding from the 2.6% and 3.5% increases in October.

In the labor market, the number of initial jobless claims in the US in the week ending December 6 was 242 thousand, up from 225 thousand the previous week and at the same time higher than the forecast of 221 thousand. The average number of claims in the most recent 4 weeks was 224.25 thousand, up 5.75 thousand compared to the average of the previous 4 weeks.

This week, the market awaits information about the US Federal Reserve's meeting on December 17-18. The results of the meeting were announced early on the morning of December 19, Vietnam time. According to CME's forecast, there is a 95% chance that the Fed will cut the policy interest rate by 25 basis points at this meeting, and only a 5% chance that the policy interest rate will remain unchanged at 4.5% - 4.75%. In addition, after the meeting, the Fed also announced its forecasts for GDP, inflation, unemployment rate and policy interest rate in 2025 and in the long term.

The European Central Bank (ECB) cut its policy interest rate at its year-end meeting, while the Eurozone received some important economic indicators. At its meeting on December 12, the ECB assessed that the process of reducing inflation is progressing smoothly. The agency forecasts average headline inflation of 2.4% in 2024, 2.1% in 2025 and 1.9% in 2026. Core inflation in these years is forecast at 2.9%, 2.3% and 1.9% respectively.

Next, the ECB forecasts Eurozone GDP to grow by 0.7% in 2024, 1.1% in 2025 and 1.4% in 2026. The ECB Governing Council has shown its determination to ensure that inflation will be stable and sustainable at the target of 2.0%. At this meeting, the ECB decided to lower its policy rates by 25 basis points. Accordingly, the refinancing rate, marginal lending rate and deposit rate at the ECB will be reduced to 3.0%; 3.15% and 3.4% respectively. The ECB will continue to rely on data at each subsequent meeting to determine the appropriate monetary policy stance. The ECB does not commit to any specific policy rate roadmap.

Regarding the Eurozone economy, industrial output in the region was flat (0.0% m/m) in October after a sharp decline of 1.5% in the previous month, in line with experts' forecasts. Compared to the same period in 2023, Eurozone industrial output fell by about 1.2% m/m.

Next, in Germany, the headline CPI officially fell 0.2% month-on-month in November, unchanged from the preliminary reading and in line with analysts' forecasts. Compared to the same period in 2023, the German CPI still increased by about 2.2% month-on-month last month, up from 2.0% in October. Finally, the German trade balance was in surplus at 13.4 billion euros in October, down from 16.9 billion in September and also below the forecast of 15.7 billion.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-tuan-tu-9-1312-158936-158936.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

Comment (0)