This leads to limitations in financial potential and competitiveness. This is also one of the reasons why businesses, especially small and medium-sized enterprises, still face many difficulties in accessing capital. In fact, the issue of capital for businesses has been mentioned for many years. However, according to experts, this issue needs to be viewed from two sides. The bank itself is also a business, "borrowing" from people to re-lend. Therefore, banks also need to have rules in their operations to ensure that people's deposits are safe and loans can be repaid.

Banks cannot ignore lending regulations at all costs because the bad debt ratio is always a constant concern for every bank. If this ratio is not controlled, it will not only affect the stability of the banking system, but also the entire economy.

Therefore, in recent times, banks have made great efforts to create favorable conditions for lending to businesses at reasonable costs by reducing lending interest rates, improving processes and procedures, diversifying mortgage forms, applying digitalization, and even being willing to cut profits to accompany businesses, especially in difficult circumstances.

For example, at Agribank, Mr. Pham Toan Vuong, General Director, said that sharing difficulties and supporting people and businesses to access capital, in February 2025, Agribank continued to adjust lending interest rates down by 0.2-0.5%/year, and at the same time continued to implement preferential credit programs with a scale of over 320,000 billion VND from the beginning of 2025. Agribank directs credit flows to production and business sectors, priority sectors and economic growth drivers under the direction of the Government, with attractive lending interest rates, 1-2%/year lower than normal interest rates. Accordingly, Agribank's current lending interest rates are only from 4.0%/year for short-term and from 6.0%/year for medium and long-term.

Not only Agribank, the wave of interest rate cuts has been implemented drastically by banks in the recent past. On March 19, the State Bank of Vietnam announced that from February 25 to March 18, a total of 23 commercial banks adjusted their deposit interest rates down by 0.1-1%/year. This is an important basis for the lending interest rate to decrease in the coming time, further supporting businesses in accessing cheap capital.

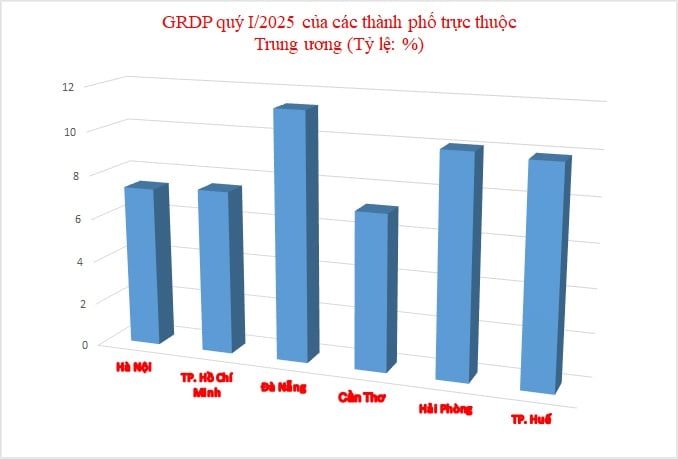

In the current context, Associate Professor, Dr. Nguyen Huu Huan, Ho Chi Minh City University of Economics, assessed that maintaining the current interest rate level is a success of the State Bank. However, to support growth to achieve the set target (8% or more), in addition to interest rate policy, it is necessary to implement other solutions and policies. Because the room for interest rate reduction is currently very limited, if interest rates are adjusted to reduce deeply, deposits will seek other investment channels with higher returns, and capital flows supporting growth will certainly be affected.

Regarding lending processes and procedures, the SBV leader said that a legal framework has been established to promote credit granting via electronic means, lending small loans, facilitating asset mechanisms in credit activities..., especially giving priority to credit institutions that seriously implement support policies. Thanks to that, the cash flow in the economy is better circulated.

At the same time, the SBV also promotes increasing access to credit, especially preferential loans for the agriculture, aquaculture, and social housing sectors. Not only that, the SBV also focuses on allocating capital to priority sectors to promote economic growth, while still strictly controlling credit to potentially risky sectors.

For businesses, cooperatives and individuals, the State Bank also encourages borrowers to have a better understanding of banking products and services in order to have an effective plan to access capital. More importantly, banks also need to proactively improve their products and services to suit actual needs, helping businesses and banks to "meet" more effectively.

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)