Net income in the quarter ended in September fell 80% from a year ago, larger than the record 64% drop in the second quarter of 2019, according to company data.

Specifically, SMIC achieved revenue of 1.62 billion USD in the last three months, down 15% compared to the same period last year. The company's net income was only 93.98 million USD, much lower than analysts' expectations of 165.1 million USD.

SMIC is China’s largest foundry, specializing in manufacturing contract semiconductor chips designed by other companies. The company is also the main hope for China’s ambition to boost its domestic semiconductor industry and catch up with global giants such as TSMC and Samsung.

“Inventories of our US and European customers remain at record highs,” said a SMIC representative, adding that this was one of the factors negatively impacting their business results.

Global semiconductor sales rose 1.9% in September from a month earlier, showing signs of chip recovery, according to data from the Semiconductor Industry Association. Globally, September sales fell 4.5% from a year earlier.

“Global semiconductor sales increased for the seventh consecutive month, reinforcing the positive momentum for the overall market,” said John Neuffer, president and CEO of the Semiconductor Association. “The long-term outlook for semiconductor demand remains strong, with chips being an integral part of countless products around the world and the future of innovation.”

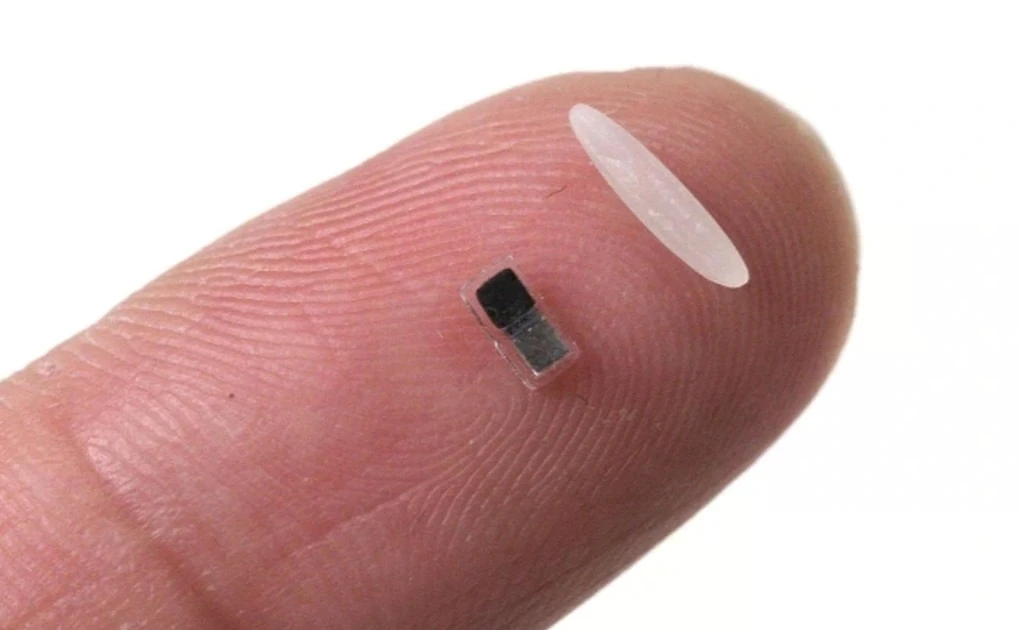

Also in September, SMIC suddenly attracted attention with its "breakthrough" 5G chip on the latest smartphone model from Chinese technology giant Huawei.

Huawei has been blacklisted by the US Department of Commerce since 2019. Meanwhile, SMIC was also blacklisted a year later.

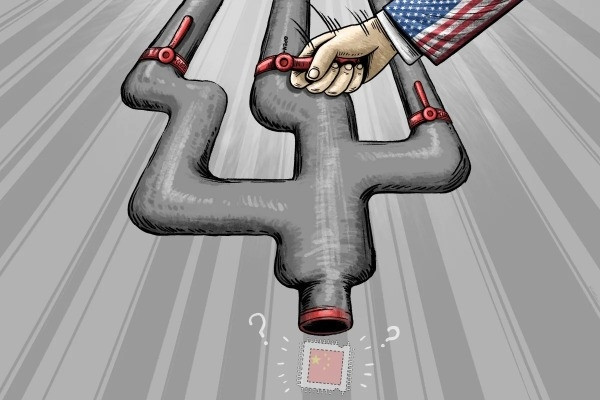

As the US tightens restrictions on semiconductor exports to China, the Kirin 9000 chip inside Huawei’s Mate 60 Pro phone is seen as a major blow to Washington. The processor, manufactured by SMIC on a 7nm process, signals that Beijing may soon make progress in building its technological self-sufficiency, although it is still several generations behind the advanced chips made by TSMC or Samsung.

(According to CNBC)

The latest 'blow' from the US exposes China's semiconductor weaknesses

The US has stepped up scrutiny of less advanced lithography systems, exposing China’s shortage of chipmaking equipment, despite recent progress toward Beijing’s overall goal of semiconductor self-sufficiency.

US needs 5 years to 'disengage' China from semiconductor supply chain

Concerns that the export restrictions could significantly disrupt the semiconductor industry have prompted Washington to come up with a longer-term roadmap for cutting China off from the semiconductor supply chain.

China's semiconductor future is more uncertain before the upcoming 'storm' of sanctions

Chinese semiconductor makers are rushing to buy ASML's chip foundry equipment ahead of new export restrictions that could come into effect later this month, but an uncertain future still lies ahead for the mainland's industry.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

Comment (0)