SGGP

The market capitalization of this electric car company after its first trading session in the US reached 85.5 billion USD, 3.7 times higher than its initial valuation of 23 billion USD and more than 3 times higher than its re-valuation after the successful merger with Black Spade.

|

At the end of the trading session on August 15 in the US, VinFast's VFS shares closed at $37.06, up 68.4% from the initial price ($22). The matched volume in the first session reached nearly 6.8 million shares.

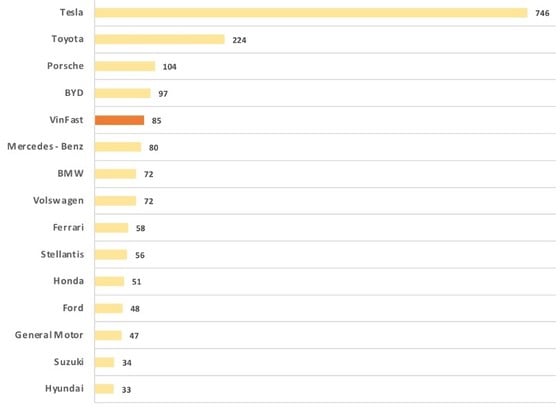

With the above figure, the capitalization value of this electric car company after the first trading session in the US reached 85.5 billion USD, 3.7 times higher than the initial valuation of 23 billion USD and more than 3 times higher than the re-valuation after the successful merger with Black Spade. In fact, the level of 85.5 billion USD has made VinFast into the top 5 largest capitalized car manufacturers in the world. The above figure also helps the capitalization of the electric car company from Vietnam surpass many giants such as Mercedes - Benz, BMW, Volswagen, Honda, Ford...

The listing of VinFast will certainly create a big boost for Vingroup. The revaluation of investors can have a positive impact on Vingroup because the capital in VinFast alone (51%) is worth more than 43 billion USD, far exceeding the current capitalization of this group, not to mention other assets and subsidiaries that are all very valuable. According to the sum-of-parts method (SOTP), Vingroup can be considered to be undervalued.

Source

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)