A rising bank stock helps the market limit its decline

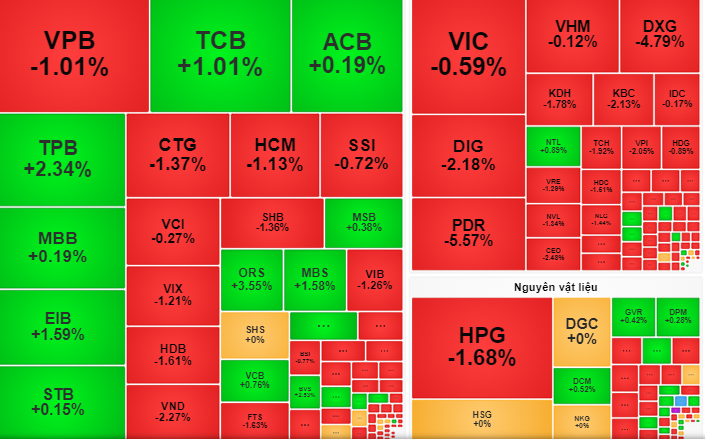

At the end of the trading session on October 2, the VN-Index decreased by 4.3 points (-0.34%), closing at 1,287.8 points. Market liquidity decreased compared to the previous session when the trading volume reached more than 771 million shares, equivalent to a value of VND 17,747 billion.

The developments throughout the trading session showed that demand was concentrated on a number of banking stocks, helping to limit the decline of the VN-Index. For example, the codes in the banking stock group that increased in points included: VCB (+0.76%), TCB (+1.01%), TPB (+2.34%)... Therefore, many investors expect this group to lead the market in the next session.

In this session, foreign investors net bought 252.48 billion VND worth of stocks on the HoSE. Foreign investors focused on buying TCB, PNJ, FPT... and selling VPB, HDB, CTG...

According to ACBS Securities Company, the liquidity of the October 2 session decreased compared to the previous session, showing that the selling pressure to take profits has weakened somewhat. Therefore, in the coming time, the market will likely continue to fluctuate in the range of 1,280 - 1,300 points. After that, the VN-Index will return to the uptrend, aiming to surpass the resistance level of 1,300 points.

Meanwhile, Dragon Capital Securities Company (VDSC) said the market will continue to probe supply and demand at the 1,290-point area before there are more specific signals. Therefore, investors need to slow down their trading.

Given the above developments and comments, VCBS Securities Company recommends that investors gradually take profits from stocks with strong selling pressure, and consider disbursing stocks with flat prices or upward trends in the banking, steel, transportation, seaport, and public investment sectors.

Source: https://nld.com.vn/chung-khoan-ngay-mai-3-10-co-phieu-ngan-hang-co-the-dan-song-196241002180642948.htm

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Infographic] Diverse activities of the 4th Dong Thap Province Book and Reading Culture Day in 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/a5f00b7d966a475d891f3c3e528c9a66)

Comment (0)