A series of mineral stocks increased sharply and then collapsed, even falling dramatically. Meanwhile, some large stocks increased well and this helped VN-Index maintain green throughout the trading session on February 18.

VN-Index hovers around 1,280 points, Bao Viet shares hit ceiling

A series of mineral stocks increased sharply and then collapsed, even falling dramatically. Meanwhile, some large stocks increased well and this helped VN-Index maintain green throughout the trading session on February 18.

VN-Index closed at 1,272.72 points, down 0.26%, trading volume increased 21% compared to the previous session.

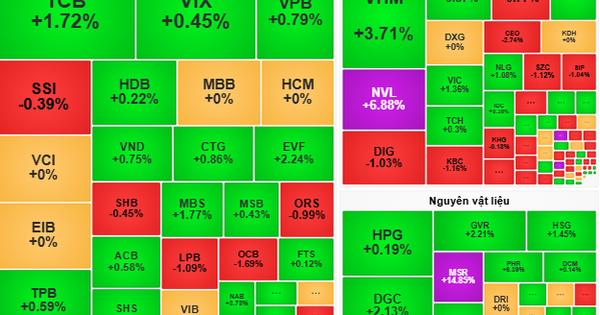

Entering the trading session on February 18, all indices were pulled above the reference level. The recovery then took place when the green color spread widely, helping the general index increase more strongly. The consensus from many important industry groups created momentum to help the market overcome the resistance level of 1,280 points. However, after a period of positive increases, profit-taking pressure gradually appeared, causing the increase to narrow towards the end of the morning session. The VN-Index peaked at 1,283.05 points and then corrected again.

Cash flow showed significant improvement, especially focusing on large-cap stocks, contributing to pushing market liquidity to a higher level than in previous sessions. Although some industry groups played a leading role in the morning's increase, at the end of the session, there was a correction as demand weakened and selling pressure increased. Caution returned, causing market liquidity at the end of the session to be somewhat worse than in the previous session.

At the end of the trading session, VN-Index increased by 5.42 points (0.43%) to 1,278.14 points. HNX-Index increased by 2.65 points (1.14%) to 235.84 points. UPCoM-Index increased by 0.12 points (0.12%) to 99.51 points.

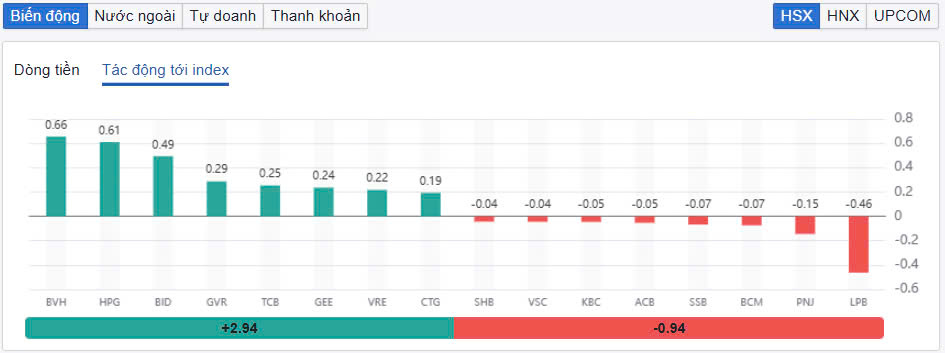

The entire market had 453 stocks increasing, while 310 stocks decreasing and 796 stocks remaining unchanged/not traded. The entire market recorded 45 stocks increasing while 7 stocks hitting the floor. Although selling pressure occurred relatively in the afternoon session, VN-Index still maintained green thanks to the push from large stocks. In particular, BVH surprised when it was pulled up to the ceiling price of 57,300 VND/share. BVH was the stock with the most important contribution to VN-Index with 0.66 points. Next, HPG also surprised when it increased by 1.5% and contributed 0.61 points to VN-Index. Other large stocks such as BID, GVR, TCB... all increased in price today.

|

| BVH unexpectedly became the locomotive pulling the VN-Index up . |

On the other hand, LPB, PNJ, BCM, SSB and ACB closed the session in red and were the stocks that had the worst impact on the VN-Index. At the end of the session, LPB decreased by 1.7% to VND36,600/share and took away 0.46 points from the VN-Index.

The mining group continued to be the focus of investors’ attention, but due to the reversal. Unlike previous sessions, many stocks in this industry group had strong adjustments. Both of the two highest-priced stocks in the Vietnamese stock market, HGM and KSV, were pulled down to the floor price. In addition, stocks that had increased strongly in recent sessions, such as MSR, AMC, etc., also plummeted.

Meanwhile, the steel group was quite positive. After more than a week since the deep fall due to the panic buying sentiment following the news of aluminum and steel tariffs, HPG has regained what it had lost. At the same time, NKG increased by 1.46%, HSG increased by 1.47%, VGS increased by 2.2%. Some real estate stocks also had quite positive developments. CEO continued to increase by more than 3%, DXS increased by 2.8%, QCG increased by 2.45%, DIG increased by 2.4%.

|

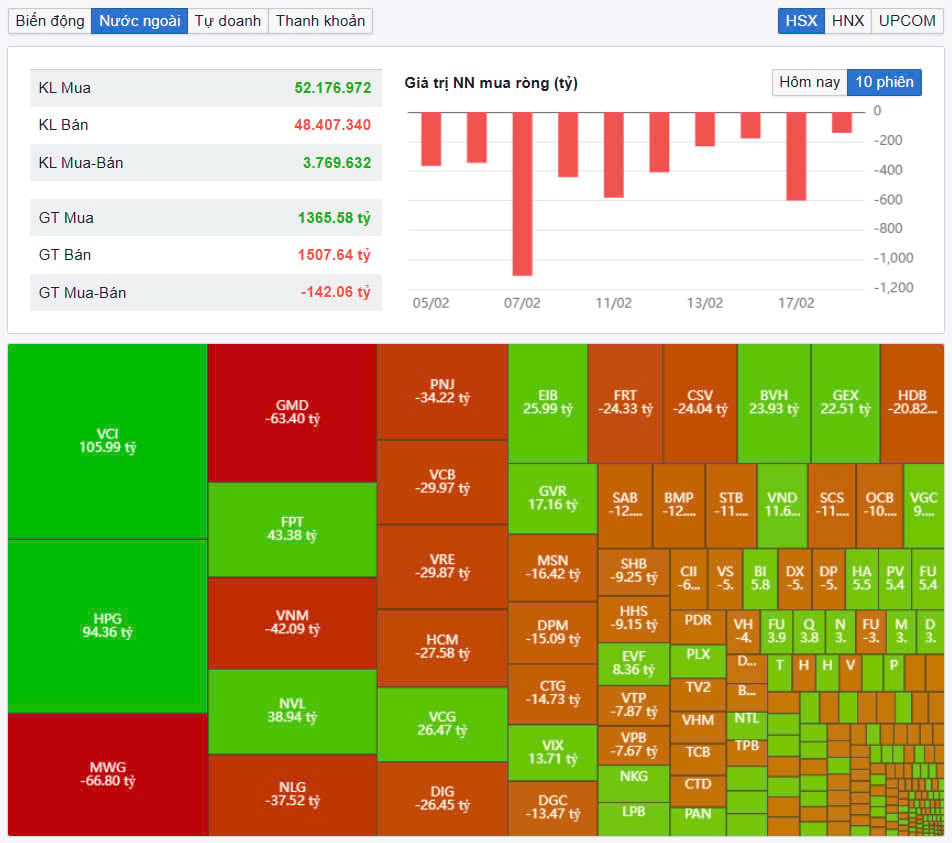

| Foreign investors have not yet ended their net selling streak. |

Total trading volume on the HoSE today reached 707 million shares, equivalent to a trading value of VND14,265 billion, down 19% compared to the previous session, of which negotiated transactions contributed VND1,454 billion. Trading values on the HNX and UPCoM reached VND1,108 billion and VND982 billion, respectively.

Foreign investors still maintained their net selling status but the value decreased significantly to 140 billion VND in the whole market. Foreign investors sold the most MWG code with 67 billion VND. GMD and VNM were sold net 63 billion VND and 42 billion VND respectively. In the opposite direction, VCI was bought the most with 106 billion VND. HPG and FPT were bought net 94 billion VND and 43 billion VND respectively.

Source: https://baodautu.vn/vn-index-giang-co-quanh-moc-1280-diem-co-phieu-bao-viet-tang-kich-tran-d247622.html

Comment (0)