The sentiment is somewhat more cautious because this is the derivatives expiry session. However, the VN-Index still increased thanks to the support of many large stocks.

VN-Index approaches 1,300 point mark, mineral stocks hit ceiling again

The sentiment is somewhat more cautious because this is the derivatives expiry session. However, the VN-Index still increased thanks to the support of many large stocks.

Continuing the previous session's upward momentum, in the session of February 20, with support from large-cap stocks, VN-Index increased from the beginning of the session. The upward trend also gradually expanded and at one point the index approached 1,296 points. However, investor sentiment was affected to a certain extent by the derivatives expiration session, causing the market to fluctuate and narrow the upward momentum towards the end of the morning session.

In the afternoon trading session, there were not many notable points. VN-Index fluctuated narrowly above the 1,290 point mark with cautious trading again. Market liquidity decreased somewhat towards the end of the session.

Overall, cash flow continues to be clearly differentiated, with buying power focused on certain industry groups, while other stocks are cautious. Leading stocks rotate, helping the market maintain a state of balance and avoid correction pressure.

At the end of the trading session, VN-Index increased by 4.42 points (0.34%) to 1,292.98 points. HNX-Index increased by 0.23 points (0.1%) to 238.02 points. UPCoM-Index increased by 0.74 points (0.74%) to 100.08 points.

The number of codes increasing in price in today's session was 437, while there were 341 codes decreasing and 781 codes remaining unchanged/not traded. The whole market recorded 41 codes increasing to the ceiling price but there were also 10 codes decreasing to the floor price.

|

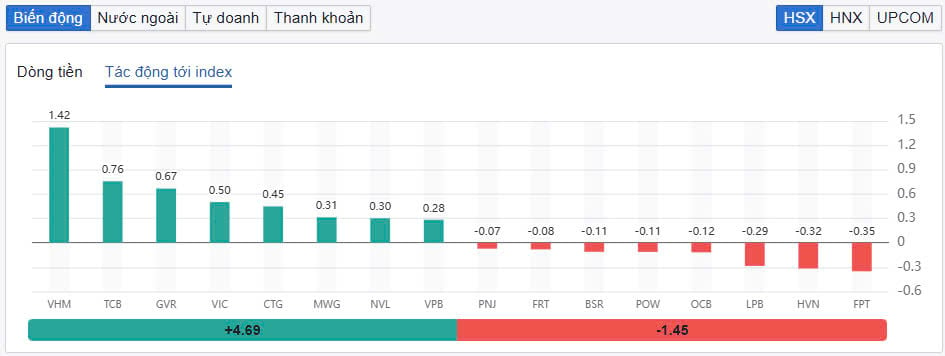

| Top stocks strongly impact VN-Index. |

Green still dominates the large-cap group and this helps maintain the slight increase of VN-Index. In the VN30 group today, 18 stocks increased while only 7 stocks decreased. The trio of "Vin family" stocks had positive fluctuations and contributed greatly to supporting VN-Index. However, the increase of this group cooled down at the end of the session. Closing the trading session, VHM increased by 3.71% and was the stock with the largest contribution to VN-Index with 1.42 points. Meanwhile, VIC and VRE increased by 1.36% and 0.87% respectively.

In addition, large stocks such as TCB, GVR, CTG, MWG... all increased in price quite well. TCB increased by 1.72%, CTG increased by 0.86%, MWG increased by 1.6%, GVR increased by 2.2%. NVL attracted attention when it was included in the list of stocks with the most positive impact on the VN-Index. At the end of the session, NVL was pulled up to the ceiling price of VND 10,100/share and contributed 0.3 points.

On the other hand, stocks such as LPB, FPT, VJC, VNM… were in red and somewhat put pressure on the general market. LPB decreased by 1.1%, FPT decreased by 0.69% and ranked first in the group negatively affecting the VN-Index with 0.35 points taken away.

In the rubber stock group, besides GVR, stocks such as PHT, TRC, DPR... all increased sharply. PHR increased by 6.4%, TRC increased by 3.2%, DPR increased by 2.2%. The mineral stock group, after a few adjustment sessions, returned to the uptrend. Notably, MSR, MTA, HGM, BKC... all increased to the ceiling again.

The differentiation in today's session was relatively strong as many other small and medium-cap stocks went down. After a few sessions of strong growth, CEO also adjusted and decreased by 2.7%, NHA decreased by 1.9%, YEG decreased by 1.5%, GEX decreased by 0.9%...

|

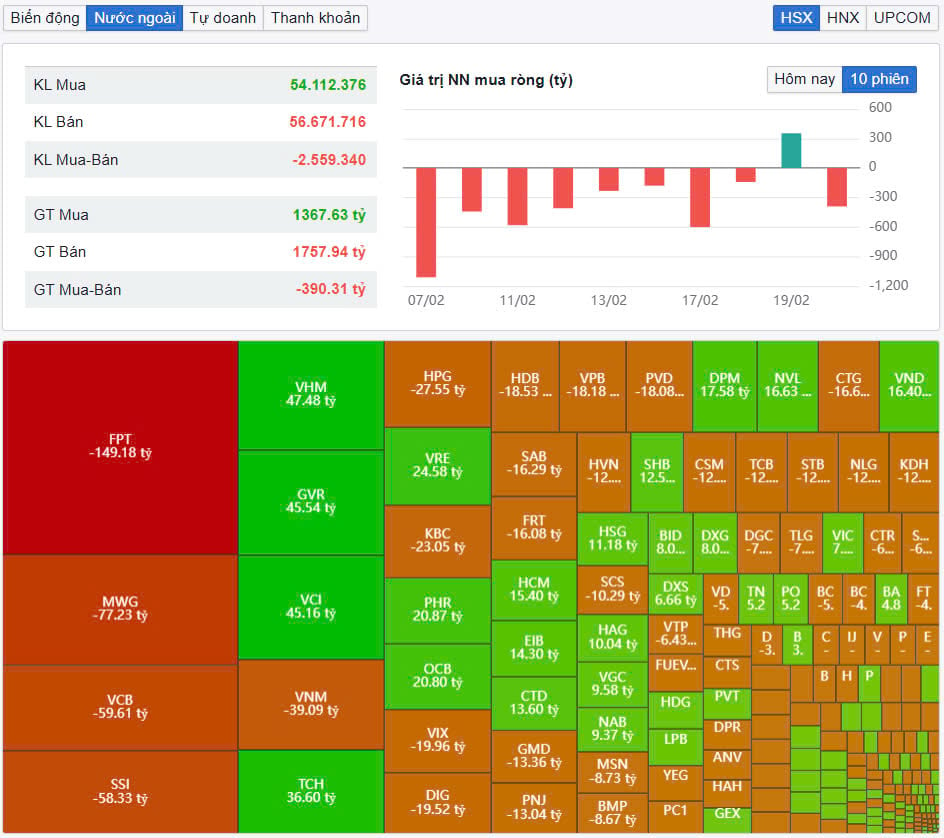

| FPT suffered heavy net selling pressure from foreign investors. |

Total trading volume on HoSE today reached nearly 771 million shares, equivalent to a trading value of VND16,293 billion, down 7% compared to the previous session, of which negotiated transactions accounted for VND1,302 billion. Trading values on HNX and UPCoM reached VND1,276 billion and VND938 billion, respectively.

TCB ranked first in total market transactions with a value of VND559 billion. VIX and FPT traded VND552 billion and VND485 billion respectively.

Foreign investors returned to net selling about 340 billion VND in the whole market. FPT was the most net sold by foreign investors with 149 billion VND. MWG and VCB were net sold with 77 billion VND and 60 billion VND respectively. In the opposite direction, VHM was the most net bought with 47 billion VND. GVR and VCI were net bought with 46 billion VND and 45 billion VND respectively.

Source: https://baodautu.vn/vn-index-tien-sat-moc-1300-diem-co-phieu-khoang-san-tang-tran-tro-lai-d248095.html

Comment (0)