Insurance stocks break out, VN-Index continues to increase in session on May 20

All indices maintained green in today's session thanks to the support of some large-cap stocks.

After approaching the strong contested zone of 1,276-1,281 points last week, the general index performance was quite positive in the first trading session of the week (May 20) as investor sentiment was relatively good. A series of stock groups increased in price and helped pull the indexes above the reference level.

However, similar to previous sessions, demand was still quite cautious at high prices, so the growth momentum of the indices was immediately narrowed. Selling pressure sometimes increased and caused the market to have some dips. However, every time the market dropped, some stocks received strong cash flow and created a spillover effect to help the recovery return. In general, the indices fluctuated in green throughout today's session, although the increase was not too strong.

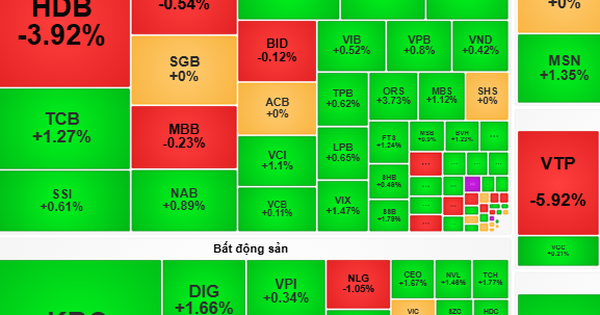

The market focus was on insurance stocks when codes such as BVH, BMI, MIG... all broke out. Of which, MIG was pulled up to the ceiling price and matched orders of 1.2 million units.

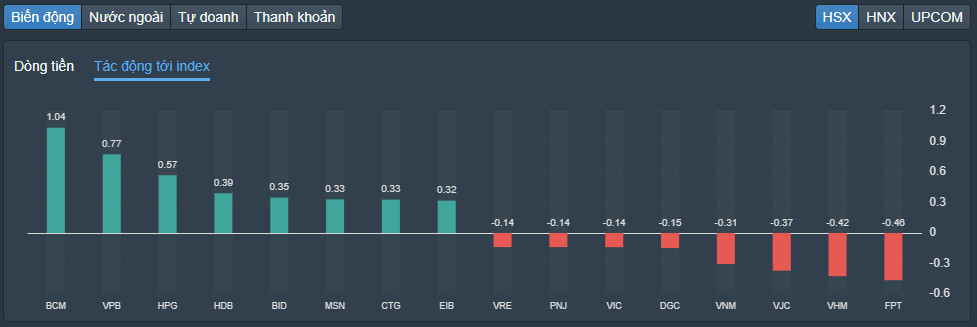

The recent announcement that the State will divest from many listed companies has also helped some stocks benefit, including NTP, which was pulled up to the ceiling price of VND47,000/share, VGV, which increased by 8%, and HGM, which increased by a dramatic 10%. However, although also on the divestment list, FPT faced profit-taking pressure and adjusted down 1.12%, after a period of impressive growth. FPT was also the stock that put the most pressure on the VN-Index in today's session, taking away 0.46 points from the index.

In the VN30 group, green is still more dominant, but the pressure from names like FPT, VHM, VJC or VNM is relatively large, which somewhat significantly restrains the upward momentum of the general market. VHM decreased by 0.1%, VJC decreased by 2.4%, VNM decreased by 0.9%...

|

| BCM contributed the most points to increase VN-Index |

On the other hand, BCM increased to the ceiling price of VND62,900/share and contributed 1.04 points to the VN-Index. BCM's increase came from Deputy Prime Minister Le Minh Khai's recent signing of Decision 426 approving the State capital holding ratio at the Industrial Development and Investment Corporation (Becamex IDC - Stock code: BCM) until 2025. According to the decision, the State capital holding ratio at Becamex IDC will decrease from 95.44% of charter capital to over 65% of charter capital by the end of 2025, meaning that more than 30% of the shares of this industrial park giant will be divested.

Many stocks such as VPB, HPG, HDB, BID and MSN also increased in price and contributed to maintaining the green color of VN-Index. VPB increased by 2.1% and contributed 0.77 points to VN-Index. VPB's stock price has fluctuated well recently because the deadline for paying cash dividends at a rate of 10% is approaching.

Some notable stocks in today's session include LPB and TCH. These two codes increased strongly at the beginning of the session but then faced quite heavy profit-taking pressure and both erased all the achievements they had made. Specifically, LPB closed the session down 0.9% while TCH retreated to the reference price of VND19,000/share, although it jumped to VND20,150/share at times.

Livestock stocks related to pig prices still had positive developments such as MML hitting the ceiling, DBC up 3.44%, BAF up 1.8%...

At the end of the trading session, VN-Index increased by 4.47 points (0.35%) to 1,277.58 points. The entire floor had 264 stocks increasing, 174 stocks decreasing and 69 stocks remaining unchanged. HNX-Index increased by 1.03 points (0.43%) to 242.57 points. The entire floor had 103 stocks increasing, 91 stocks decreasing and 58 stocks remaining unchanged. UPCoM-Index increased by 0.46 points (0.49%) to 93.53 points.

The total trading volume on HoSE alone was 1.16 billion shares, worth VND27,679 billion, up 20% compared to the previous weekend session, of which negotiated transactions contributed VND4,304 billion. The trading value on HNX and UPCoM reached VND2,114 billion and VND1,058 billion, respectively.

The most strongly matched stock today belonged to HPG with 46.5 million shares. Next, SHB and EVF matched orders with 36.3 million units and 36 million units, respectively.

|

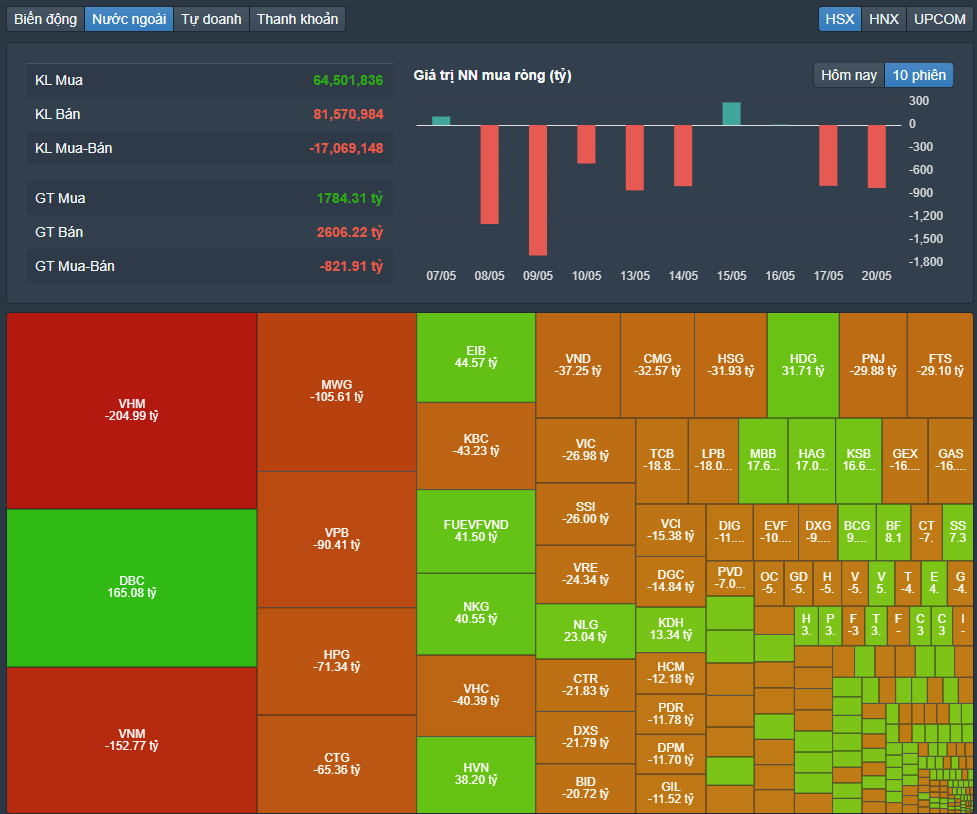

| Foreign investors continue to sell strongly |

Foreign investors continued to net sell VND820 billion on HoSE. Similarly, this capital flow also net sold VND55 billion on HNX and VND140 billion on UPCoM.

VHM topped the list of foreign net sellers with VND205 billion. VNM and MWG were net sold VND152 billion and VND106 billion respectively. Meanwhile, DBC was the most net bought with VND165 billion. EIB was behind with a net buying value of VND45 billion.

Source: https://baodautu.vn/co-phieu-bao-hiem-but-pha-vn-index-tiep-tuc-tang-diem-trong-phien-205-d215625.html

Comment (0)