The Government proposed extending the environmental tax reduction period on gasoline and oil until the end of 2024, and the budget is expected to reduce revenue by more than VND38,900 billion when applying this policy.

In a recent submission to the National Assembly Standing Committee, the Government proposed extending the environmental protection tax reduction policy on gasoline and oil until the end of 2024. Accordingly, the tax on gasoline (except ethanol) is VND2,000 per liter. Jet fuel, diesel, fuel oil, and lubricants is VND1,000 per liter. The tax rate on kerosene is VND600 per liter. This rate is equivalent to 50% of the tax bracket and is applied from April 2022 to the end of this year.

When this tax is reduced, the price of gasoline and oil to consumers will decrease by 1,100 - 2,200 VND per liter (including VAT), and kerosene will decrease by 660 VND per liter.

From January 1, 2025, the environmental protection tax on gasoline, oil, and grease will return to the ceiling level in the tax bracket, which is VND 4,000 per liter for gasoline (except ethanol); and VND 3,000 per liter for aviation fuel.

| Environmental protection tax | Proposed to apply in 2024 | Applicable level in 2023 | Tax bracket |

| Gasoline (per liter) | 2,000 VND | 2,000 VND | 4,000 VND |

| Jet fuel (per liter) | 1,000 VND | 1,000 VND | 3,000 VND |

| Diesel (per liter) | 1,000 VND | 1,000 VND | 2,000 VND |

| Fuel oil, lubricant | 1,000 VND | 1,000 VND | 2,000 VND |

| Grease (per kg) | 1,000 VND | 1,000 VND | 2,000 VND |

| Kerosene | 600 dong | 600 dong | 1,000 VND |

Assessing the impact of the tax reduction , the Government said that the state budget is estimated to reduce its average monthly revenue (including VAT) by about VND38,924 billion. However, extending the reduction of environmental protection tax on gasoline and oil until the end of next year will help reduce domestic retail prices, thereby directly contributing to reducing people's costs, production costs, and product prices.

On the other hand, according to the General Statistics Office, if the environmental protection tax on gasoline, oil, and lubricants increases to the upper level of the tax bracket from the beginning of 2024, the average CPI will increase by 0.36-0.54 percentage points. On the contrary, if this tax is continued to be reduced until the end of next year, fluctuations in retail prices of gasoline and oil will be avoided and the CPI will not increase.

This tax reduction also helps businesses increase their resilience, especially businesses that benefit from tax reduction on gasoline and oil such as transportation, gas services, and fishing.

Previously, when evaluating this proposal, the Ministry of Justice requested the Ministry of Finance - the drafting agency - to coordinate with the Ministry of Industry and Trade to supplement the assessment of supply and demand, domestic and world gasoline prices to come up with a suitable application time.

However, the Ministry of Finance said that gasoline prices often fluctuate rapidly in a short period of time and domestic prices depend on the world. Meanwhile, reducing environmental protection tax is a temporary solution, applied in the context of fluctuating gasoline prices, negatively affecting the economy.

"This policy only applies for a certain period of time, so the proposal to extend this tax reduction on gasoline, oil, and grease until the end of next year is appropriate," the Ministry of Finance argued.

The Ministry affirmed that it will continue to closely monitor the developments in world oil prices and in case prices decrease, it will work with other agencies to propose and submit to the Government a report to the National Assembly Standing Committee on appropriate tax imposition plans.

Source link

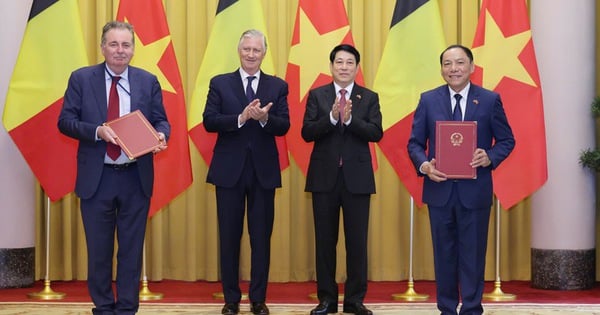

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

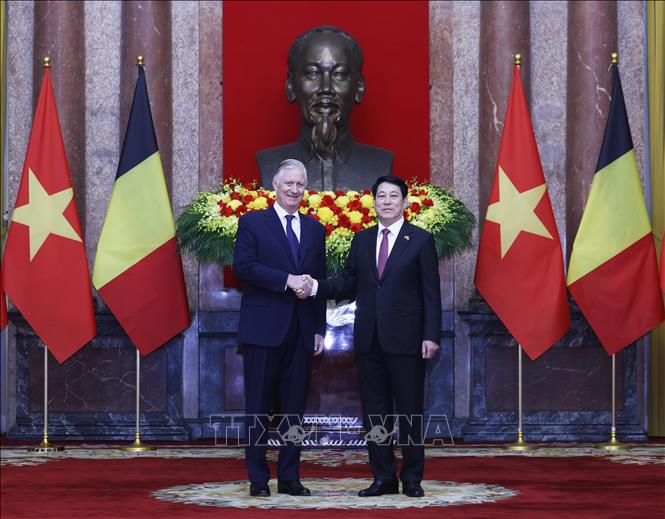

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

Comment (0)