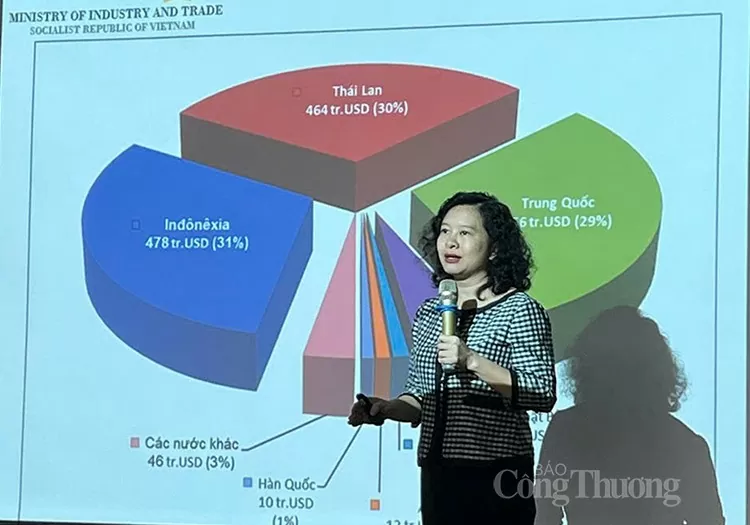

This is the sharing of Ms. Trinh Thi Thu Hien - Head of Industrial Goods Import and Export Department - Import and Export Department (Ministry of Industry and Trade) at the training session "Support and guidance on regulations on import and export of industrial goods to markets where Vietnam has signed FTAs" organized by Hanoi Department of Industry and Trade in coordination with the Import and Export Department (Ministry of Industry and Trade), Vietnam TBT Office (National Committee for Standards, Metrology and Quality) on September 10, in Hanoi.

Notes for export businesses

Sharing about the situation of applying regulations on import and export of industrial goods in the context of FTA implementation, Ms. Trinh Thi Thu Hien cited that, related to fabric products (HS 5603), according to the regulations on rules of origin of the EVFTA Agreement, there are requirements on the needle piercing stage. However, recently, we have non-woven fabric products, without the needle piercing stage but still forming fabric products. If compared with the actual production and the regulations of the Agreement, it is clear that we do not meet the requirements.

|

| Ms. Trinh Thi Thu Hien - Head of Industrial Goods Import and Export Department - Import and Export Department (Ministry of Industry and Trade) |

Or with carpet products made from scraps. Scraps here are collected from many places, then brought back and produced. It will be difficult to determine the origin. How can businesses that produce carpets and export to the EU prove that these products originate from Vietnam and enjoy tariff incentives under the EVFTA?

This is a technical and somewhat complicated story, but according to Ms. Hien, businesses making carpets or non-woven fabrics still enjoy tariff incentives from the EVFTA when exporting to the EU market.

Applying flexible rates is also an issue that businesses are interested in in the early stages of implementing the EVFTA. Up to now, although this story has become quite routine, there are still some cases of incorrect and non-standard application, and there may be issues related to understanding and application that affect the issue of enjoying preferential tariffs for goods exported to the EU.

Specifically, there are items related to the annotation: “Applicable percentage of non-originating materials”. When there are accompanying annotations, these annotations will apply to both the above and below criteria, not the flexible percentage that only applies to the below annotation.

Some businesses have encountered difficulties when applying the lower criteria and ignored the upper criteria, thus missing out on some calculation methods to support goods meeting origin regulations to enjoy tariff preferences.

Regarding threshold protection for goods exported to markets of countries related to the Eurasian Economic Union. Recently, this market has a document related to the regulation that some product codes when exported to this market (mainly the Russian market), when exceeding a certain threshold in output and can affect or compete with domestic products, as well as causing risks and affecting domestic protection, they will issue a threshold protection. The current goods that have fallen into the threshold protection do not exclude the possibility that the Eurasian Economic Commission (EEC) as well as Russia will issue regulations and requirements to impose MFN tariffs in the WTO instead of preferential tariffs, this is a threshold protection measure that is already included in the provisions of the Agreement.

Therefore, businesses also need to pay attention to this issue when exporting goods, because if they enjoy preferential tariffs from the Agreement, they will have to pay 0% or 5%, but if they have to pay threshold defense tariffs, they will have to pay tariffs of up to 20 - 30%.

With the revised Protocol within the framework of the EU - EVFTA, Ms. Hien said, there will be a change in the HS code version, accordingly, using the 2022 version; adding a line on criteria related to Chapter 41, here businesses that make leather and footwear related to leather and rawhide products need to pay attention; related products have HS code 6212; the language of expression of Chapter 19. These are the contents that Vietnam and the EU have agreed on and have instructions at different levels of documents, but in the revised part of the Protocol, it will be specified and legally binding between the two sides as well as the instructions and implementation later will be more convenient.

Not all FTAs have low tax rates.

In the context that Vietnam is participating in many FTAs, we have many advantages compared to countries without FTAs, Vietnamese goods enjoy tariff incentives.

|

| Overview of the training session |

However, this is also a tool to neutralize tariff preferences and some measures may be applied to suspend preferences, not only to an exporting company, to an exporting company, but to the entire product line of all companies that produce up to the HS code related to that product line when exporting to the partner country. These are quite strict regulations in some new generation FTAs. Enterprises also need to pay attention to this issue.

“When they discover fraud and the business cannot prove it, and the Vietnamese organization cannot prove it, they will take measures to temporarily suspend incentives for a series of products with the same HS code or with a series of businesses exporting the same product to the partner market,” Ms. Hien emphasized.

On the other hand, there are cases where some businesses exporting goods to Japan, Australia, and New Zealand are still familiar with using the CO AANZ form within the framework of the ASEAN, Australia, and New Zealand Free Trade Agreement; or using the CO AJ or CO VJ form within the framework of the Vietnam-Japan Economic Partnership Agreement (VJEPA) and the ASEAN-Japan Comprehensive Economic Partnership Agreement (AJCEP). However, when notified of the emergence of new Agreements such as CPTPP, RCEP, businesses immediately changed direction and applied the new Agreements.

However, the tariffs in the new Agreement are not necessarily as preferential as those in the old Agreement, because the tariffs in the new Agreement are at the top of the slope in the tax reduction roadmap. Meanwhile, in the old Agreements, they are at the bottom of the slope. Which goods, which markets, and tariffs at the time of export to have appropriate application.

“For agricultural products exported to Japan, in CPTPP it may be 0% but in AJCEP, VJEPA it may be 8% or 5%. While CPTPP is a newly signed agreement, in AJCEP, VJEPA have been signed for a long time,” Ms. Hien cited. These are points that businesses need to pay attention to, related to HS codes of export products, export markets, as well as Agreements of which the markets of those countries are members.

“In the CPTPP Agreement , there are up to 7 countries that are already trade partners in other FTAs, only Canada, Mexico, and Peru are 3 countries that do not have any FTAs or tariff preferences with Vietnam. Therefore, businesses operating in import and export with these markets can take advantage of tariff preferences from the CPTPP, and with other markets, businesses can choose FTAs that are suitable for their production processes or take advantage of more tariff preferences,” Ms. Hien recommended.

Source: https://congthuong.vn/xuat-khau-hang-cong-nghiep-cach-nao-tan-dung-hieu-qua-nhat-loi-the-tu-cac-fta-345029.html

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

Comment (0)