Credit cards offer many conveniences in shopping and making payments, but sometimes you may want to cancel your credit card for various reasons such as wanting to better control your spending, avoiding unnecessary annual fees, or no longer needing to use the card. Below is a detailed guide on how to cancel your credit card in a simple and effective way.

Step 1: Pay off the entire outstanding balance

Before canceling a credit card, it is important to pay off the entire outstanding balance on the card. This will help avoid interest and penalties that may arise after you cancel the card. Check your credit card statement for the exact balance and pay it in full.

Illustration: 3gang.

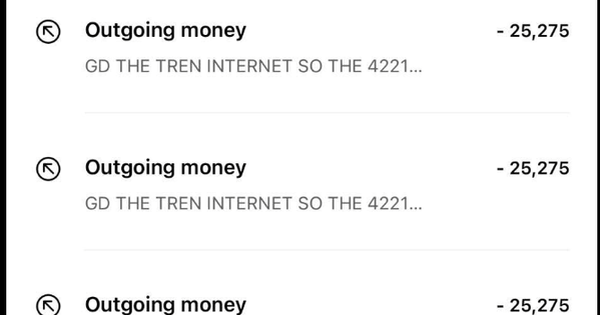

Step 2: Cancel auto-linked transactions

If you have any automatic transactions (such as bill payments, online services, or monthly subscriptions) associated with the credit card you want to cancel, cancel them or switch to another payment method. This helps ensure that you don't experience any service interruptions and avoid unexpected charges when the card is canceled.

Step 3: Contact the bank

After paying off the entire balance and canceling the automatic transactions, contact the card issuing bank to request the cancellation of the credit card. You can contact the customer service hotline, send an email, or visit the bank branch directly. When contacting, provide the necessary information such as the credit card number, cardholder name, and reason for canceling the card.

Note: Some banks have specific requirements for the information provided to confirm card cancellation, and each bank has detailed instructions for card cancellation published on the bank's website. To be sure, which bank you use your credit card from, read the instructions on how to cancel that bank's card on that bank's official website.

Step 4: Confirm card cancellation request

After requesting card cancellation, ask your bank for written or email confirmation of the credit card cancellation. This will provide you with evidence in case of any future disputes or errors. Keep this confirmation safely.

Step 5: Cancel the physical card

Once you receive confirmation of cancellation from your bank, cut your credit card into several pieces to ensure that it cannot be reused. Take special care to cut through the magnetic strip and chip of the card to ensure that the information on the card cannot be stolen or used without permission.

Step 6: Track your statement after canceling your card

After canceling your credit card, check your statements over the next few months to make sure that no transactions have occurred since the card was canceled. If you find any unusual transactions, contact your bank immediately to resolve them.

Source: https://vtcnews.vn/cach-huy-the-tin-dung-vo-cung-don-gian-ar906919.html

![[Photo] The 9th Vietnam-China Border Defense Friendship Exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/10e73e2e0b344c0888ad6df3909b8cca)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] General Secretary To Lam gave a speech at the National Conference to disseminate the Resolution of the 11th Central Conference, 13th tenure.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/04e0587ea84b43588d2c96614d672a9c)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Deputy Prime Minister Neth Savoeun](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/e3dc78ec4b844a7385f6984f1df10e7b)

![[Photo] The capital of Binh Phuoc province enters the political season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c91c1540a5744f1a80970655929f4596)

Comment (0)