It is possible to identify many different ways and conditions to establish an international financial center in different countries, but for Vietnam, establishing an IFC is more difficult and different than other countries not only in terms of population size, geography... but also in terms of legal framework.

|

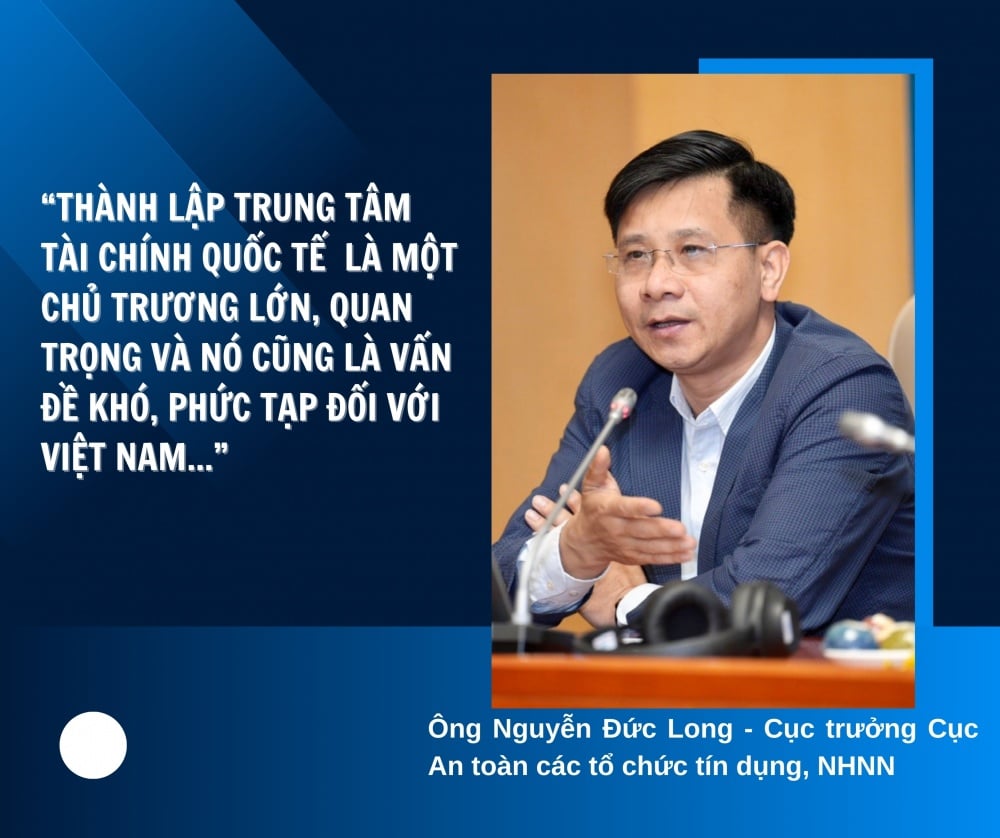

In fact, long-standing international financial centers in developed countries have open legal corridors. In Vietnam, there are currently strict regulations to ensure macroeconomic safety. For example, regarding capital transaction regulations, capital flow liberalization is a major condition for establishing IFC, but Vietnam currently has strict regulations on this issue. In addition, international commitments with Vietnam's trading partners still have requirements on market protection. In addition, if there are more incentives on conditions for opening financial institutions, it is also a problem. "How can we build a legal framework that both creates favorable conditions for international financial centers to operate effectively and ensures macroeconomic safety?", Mr. Nguyen Duc Long raised the question.

On the banking side, traditional banking activities in IFC will not be much but will be oriented towards new banking activities, following international practices. Along with that is the issue of operational safety management. In its role as a banking management agency, the State Bank will review and amend the circular on capital safety ratio, complying with advanced Basel II. At the same time, the State Bank will also coordinate with other parties to develop policies to ensure that financial centers operate effectively while maintaining macroeconomic stability.

Source: https://thoibaonganhang.vn/thanh-lap-trung-tam-tai-chinh-quoc-te-nhieu-co-hoi-nhung-cung-khong-it-kho-khan-162886.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)