(PLVN) - The Ministry of Finance has just completed the proposal to develop a draft Law on Personal Income Tax (PIT) (replacement). The project is expected to be approved by the National Assembly in May 2026.

|

| Many contents of the current Personal Income Tax Law are no longer suitable and need to be amended and supplemented. (Illustration photo: VGP). |

(PLVN) - The Ministry of Finance has just completed the proposal to develop a draft Law on Personal Income Tax (PIT) (replacement). The project is expected to be approved by the National Assembly in May 2026.

The Ministry of Finance assessed that, in more than 10 years of implementation, the personal income tax policy has demonstrated and promoted its role as an important tool in implementing the policy of regulating and redistributing income, gradually narrowing the income gap between individuals in society, towards social justice according to the policies and guidelines of the Party and State.

Accordingly, the proportion of personal income tax revenue in total state budget revenue has increased from 5.33% in 2011 to more than 9% in 2023, in line with the development trend of the economy, contributing significantly to consolidating the scale of state budget revenue in a sustainable direction.

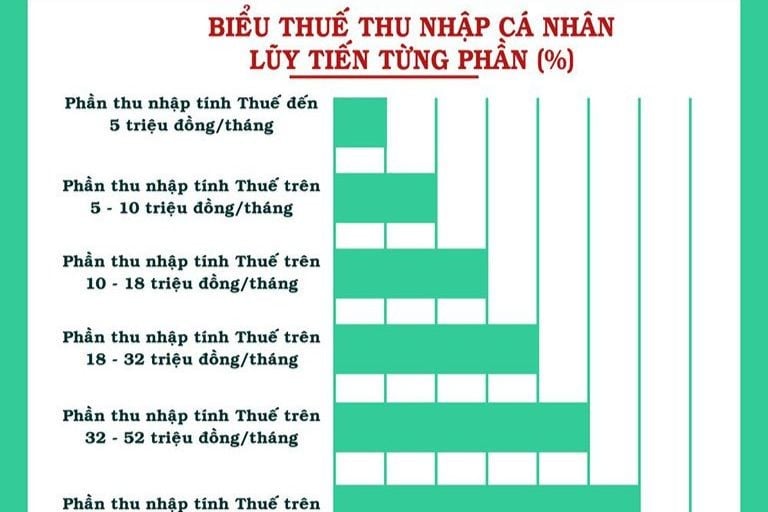

However, in addition to the achieved results, in the process of economic development and integration, some limitations and shortcomings have arisen that need to be studied and revised to suit the reality, such as taxable income, tax-exempt income, tax base and method of determining the amount of tax payable; progressive tax schedule; Some contents on the scope and taxable subjects in the Personal Income Tax Law have not fully covered taxable income and the emergence of new business models...

Therefore, the Ministry of Finance believes that the current Personal Income Tax Law needs to be reviewed to be amended and supplemented to suit the domestic socio-economic context, as well as the trend of reforming personal income tax policies in the world. Thereby, contributing to promoting the effective role of this tax in the overall tax policy system of Vietnam.

The Ministry of Finance said that the draft Law on Personal Income Tax is expected to amend and supplement 31/35 articles of the current Law on Personal Income Tax (accounting for 88.5%). It includes provisions on: Scope of regulation; Taxpayers; Taxable income; Tax-exempt income; Tax reduction; Tax period; Tax on resident business individuals; Progressive tax rates, in part and in full; Business income of non-resident individuals; Tax on income from capital transfer of non-resident individuals...

With the expected comprehensive and fundamental amendments and supplements as above, based on the provisions of the Law on Promulgation of Legal Documents, the Ministry of Finance submits to the Government for permission to propose the development of a draft Law on Personal Income Tax to replace the current laws on personal income tax.

The draft Law outline is built on 3 groups of issues, focusing on 7 policy groups: Completing regulations related to personal income tax payers; Completing regulations related to personal income tax and tax calculation for each type of taxable income; Amending and supplementing regulations related to tax-exempt and tax-reduced income; Completing regulations on personal income tax for business individuals; Completing regulations on family deductions, deductions for charitable and humanitarian contributions and other specific deductions...

Regarding the progress of the project, the Ministry of Finance submitted to the Government a plan to submit to the National Assembly Standing Committee for the National Assembly Standing Committee to report to the National Assembly for approval of the proposal to add the Personal Income Tax Law (replacement) to the Law and Ordinance Development Program for 2025 at the 9th Session of the 15th National Assembly (May 2025). The Government submitted to the National Assembly for comments on the Personal Income Tax Law (replacement) at the 10th Session of the 15th National Assembly (October 2025) and is expected to approve the Personal Income Tax Law (replacement) at the 11th Session of the 15th National Assembly (May 2026).

Source: https://baophapluat.vn/bo-tai-chinh-de-nghi-sua-doi-toan-dien-luat-thue-thu-nhap-ca-nhan-post533185.html

Comment (0)