A joint proposal to increase the family deduction level

The Ministry of Finance has just published a summary, explanation, and comments on the draft Law on Personal Income Tax (PIT). In particular, a series of ministries, sectors, and localities have proposed to increase the family deduction level (GTGC). Specifically, the Ministries of National Defense, Transport, Health, Agriculture and Rural Development, Information and Communications... all said that the GTGC level applied to taxpayers of VND 11 million/month and VND 4.4 million/month for dependents is no longer suitable for the current economic conditions and living standards of the people.

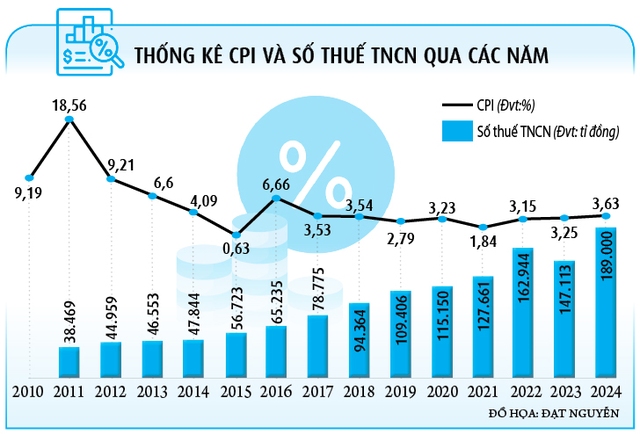

Prices of goods and services have increased over the years but the family deduction level remains unchanged.

PHOTO: NHAT THINH

Shorten personal income tax table

In the amendment of the Personal Income Tax Law, the simplification of the personal income tax schedule must also be implemented. It is necessary to reduce the tax schedule from the current 7 levels to 4 levels and the maximum tax rate is only 30%. Because the current corporate income tax is only applied at 20% and even lower in some preferential fields and industries. Moreover, enterprises only pay tax after deducting all reasonable and valid expenses. If they incur losses, they can also carry forward the losses for a period of 5 years. In addition, enterprises can also reduce income tax by up to 30% in special periods such as natural disasters, epidemics, etc.

Lawyer Tran Xoa, Director of Minh Dang Quang Law Firm

In particular, the Ministry of National Defense proposed to increase the personal income tax rate for taxpayers to 17.3 million VND/month and for dependents to 6.9 million VND/month. Because the basic salary at the time of promulgation of the personal income tax rate of 11 million VND/month at the end of 2019 was only 1.49 million VND, by the end of 2024 it had increased to 2.34 million VND, equivalent to an increase of 57.05%. The People's Committee of Ha Tinh province proposed to increase the personal income tax rate for taxpayers to 18 million VND/month, and for dependents to 8 million VND/month. The province cited that according to the 2012 Personal Income Tax Law, the deduction for taxpayers is 9 million VND/month, and for dependents is 3.6 million VND/month, applied from July 2013. At that time, the basic salary was 1.15 million VND. Up to now, the basic salary has increased 2.03 times, equivalent to 2.34 million VND, so it is necessary to raise the GTGC level in accordance with the increase rate of the basic salary.

In addition, the People's Committee of Bac Giang province proposed to increase the current GTGC level in a direction that is suitable for the practical living conditions of each region because the minimum wage is divided into 4 regions. Moreover, the price of goods is increasing, leading to an increase in daily living expenses, so the current level is no longer suitable. At the same time, Bac Giang province proposed that the Ministry of Finance promptly submit to the competent authority to amend the Personal Income Tax Law (replacement) because some regulations are no longer suitable for the current economic development and the Land Law 2024 has taken effect since August 2024. The Ministry of Information and Communications proposed to increase the GTGC level to match the increase in the consumer price index, economic growth rate and the increase in the basic salary from July 1, 2024. At the same time, build the GTGC level accordingly to match the salary policy of the Government currently prescribed (according to 4 regions).

It is necessary to immediately amend the VAT rate for taxpayers according to the recommendations of ministries, branches and provinces and cities.

PHOTO: NGOC DUONG

Consider fixing now, don't wait for the roadmap

The reason why many economic experts as well as National Assembly deputies proposed to adjust the personal income tax rate early without waiting for the CPI to increase by 20% is because the economy has had unusual fluctuations. From 2020 to 2023, the Covid-19 pandemic has had a strong impact on the socio-economic situation of both the world and Vietnam. A series of essential goods have increased in price. Thus, it is impossible to wait for the CPI to increase as prescribed because that is a development under normal conditions. The Government needs to consider changing the personal income tax rate immediately without waiting for the roadmap to comprehensively amend the Personal Income Tax Law. When the Personal Income Tax Law is amended, it will be revised more comprehensively. Considering and revising immediately, raising the personal income tax rate is in line with reality, accompanying the people, and nurturing revenue sources.

Lawyer Nguyen Duc Nghia , Deputy Director of the Center for Supporting Small and Medium Enterprises (Ho Chi Minh City Business Association)

Many localities and ministries have also proposed adding deductions to support costs for education, healthcare, housing, voluntary social insurance and investments in human development. At the same time, regulations are added to support special cases such as employees who are single parents, or have relatives with serious illnesses, etc.

Previously, a series of voters from provinces and cities and tax and economic experts also gave their opinions and proposed to raise the level of GTGC because the current regulations are too outdated, not ensuring an average living standard for many families. According to lawyer Nguyen Duc Nghia, Deputy Director of the Center for Supporting Small and Medium Enterprises (Ho Chi Minh City Business Association), when amending the Personal Income Tax Law, the most important thing is to change the basis for calculating the GTGC level for taxpayers. The GTGC level should be regulated to be 4 times the regional minimum wage (region 1 has a minimum wage of 4.969 million VND, so the GTGC level will be nearly 20 million VND/month; region 2 has a minimum wage of 4.41 million VND, so the GTGC level will be about 17.6 million VND/month...). The annual regional minimum wage is regulated by the Government after listening to opinions from representatives of employees and employers, so it is quite suitable for the general socio-economic situation, taking into account different regional factors.

CPI is the "bottleneck" of personal income tax

That is the comment of many experts on personal income tax in recent years. According to current regulations, the personal income tax rate can only be changed when the CPI increases by 20%. Lawyer Tran Xoa, Director of Minh Dang Quang Law Firm, commented that this regulation has caused frustration for taxpayers because the personal income tax rate often follows the CPI, so it takes many years to adjust. For example, the CPI from 2020 to now has increased by more than 10% but has not yet reached 20%, so the personal income tax rate remains unchanged. This has caused many salaried workers for many years, even though the price of goods and services has increased sharply, but the amount of tax payable has not been reduced, forcing them to tighten their belts.

The family deduction level has been too outdated compared to the socio-economic situation in recent years.

PHOTO: NHAT THINH

"In the Personal Income Tax Law, the method of determining the personal income tax rate is the most important. Even raising the personal income tax rate from VND11 million/person/month to VND18 million as proposed by many provinces and cities can only temporarily solve the problem in the first year. In the following years, the personal income tax rate will continue to become outdated and follow the old way. Therefore, the drafting committee should abandon the basis of the CPI index to adjust the personal income tax rate," Mr. Xoa proposed, saying that calculating based on the CPI is a "bottleneck". Moreover, the CPI index is calculated to include more than 700 goods and services, while taxpayers are only regularly affected by a number of essential groups of goods such as food, foodstuffs, electricity, and water. Not to mention, with the recent management of the Government, the CPI index will fluctuate at a low level, completely different from the previous period, so it is even more unsuitable for calculating the personal income tax rate. Therefore, the regulation of GTGC should be based on the regional minimum wage, "when the tide rises, the boat rises", each year the regional minimum wage is adjusted to be suitable for calculating GTGC. That will help to avoid the case of salary increase every year to compensate for the depreciation but tax increases, making the Government's salary increase meaningless.

Sharing the same view, Mr. Nguyen Ngoc Tu, University of Business and Technology, said that the regulation of the GTGC level according to a fixed number and when the CPI index changes by 20%, this level will be changed, making the revision very slow. Statistics in the past 15 years show that there have only been about 2 adjustments to the GTGC level and each adjustment speed is lower than the actual, which is not satisfactory for taxpayers. Not to mention, people's income in the past 10 years has increased due to rising inflation but real income has decreased, especially during the years when the Covid-19 pandemic broke out. "Since 2020, the CPI has changed a lot, but it is unreasonable to still apply the old level. If the change was automatic, the personal income tax rate would have increased to 15-16 million VND/person/month, not stagnant at 11 million VND. Not to mention the recent 30% increase in the basic salary, the increase in the regional minimum wage, as well as other indicators... Therefore, it is necessary to increase the personal income tax rate to avoid overcharging, the tax portion is getting higher and higher, causing more and more burden for taxpayers," Mr. Tu emphasized.

Not to mention, according to Mr. Tu, the regulation of fixed VAT rates will lead to the situation of having to submit to the Government for annual amendments, otherwise, it will return to the current backward state. In the long term, when amending the tax law, the drafting committee should consider basing it on the regional minimum wage. "For example, it is currently proposed to increase the minimum wage to 18 - 20 million VND/month, equivalent to 4 - 5 times the regional minimum wage. Every year, when this salary increases, the minimum wage will automatically change without having to calculate or submit to the authorities for amendment. This is a quite suitable option when changing the minimum wage. In addition, the biggest expenses of workers are for health care, education and housing. These specific costs need to be included in the law. In some special cases such as dependents with disabilities, elderly people with long-term illnesses that cost a lot of money, this rate can be equal to 70 - 100% of the minimum wage for taxpayers," Mr. Nguyen Ngoc Tu added.

Urgent matter, must be done immediately

Proposals to raise the personal income tax rate, amend tax brackets or some provisions that are no longer appropriate in the Personal Income Tax Law have been mentioned for many years. In fact, since 2021, the Prime Minister has issued a document requesting the Ministry of Finance to review and propose amendments to the shortcomings of the Personal Income Tax Law. Over the past nearly 4 years, the Government has repeatedly mentioned the need to study and review the shortcomings of this law. At many meetings of the National Assembly, delegates also pointed out many outdated regulations that are not suitable for Vietnam's economic situation, causing taxpayers to be upset. By March 2022, in order to propose amendments to the inappropriate provisions of the Personal Income Tax Law, in the document soliciting opinions from ministries and branches, the Ministry of Finance proposed to review, evaluate and make suggestions to amend the contents including taxpayers, taxable income, tax base, personal income tax, tax rates, etc. However, this story has so far been at a standstill and has not been submitted to the National Assembly.

Lawyer Truong Thanh Duc, General Director of ANVI Law Firm, said frankly: The issues and regulations of personal income tax that many ministries, branches and provinces have commented on are all basic and have been discussed a lot. This is not a new or difficult issue. Not to mention the experience of other countries is quite sufficient for reference. If the law is really amended, it will only take 6 months because it is not drafting a new law. The most important thing is the thinking and method of the law. The Ministry of Finance itself has admitted that there are shortcomings and they must be amended immediately. "If we agree to raise the personal income tax rate and change the tax rate, there is nothing to worry about. If there are any issues that have not been agreed upon, such as how much to raise, what additional expenses to deduct for taxpayers, etc., the law drafting agency can present 2-3 options for National Assembly delegates to consider and comment on," lawyer Truong Thanh Duc analyzed. He gave an example of many proposals to raise the GTGC level to 4 or 5 times the regional minimum wage, the Ministry of Finance can submit both options to the Government to present to the National Assembly. Then the National Assembly delegates will give their opinions and vote to approve, the option that is chosen by the most delegates will be applied.

"Only regulations that are not known or have not been visualized in reality will require more time to review and evaluate. Meanwhile, the shortcomings of the Personal Income Tax Law have been proposed many times. This is the expectation of taxpayers, affecting the lives of millions of families, so it should be prioritized to be implemented first, amended sooner, not hesitated and dragged on for 3-4 years. The promulgation and amendment of the law should choose the simplest and clearest option. For example, in the GTGC level, choosing to apply according to the regional minimum wage that the Government has announced every year is easy to implement, closely following the reality of people's lives", emphasized lawyer Truong Thanh Duc.

Agreeing, lawyer Tran Xoa said that raising the personal income tax rate will not affect personal income tax revenue at all, which has been proven at previous times of adjusting the personal income tax rate such as in 2023 and 2020. Personal income tax has increased its contribution to the state budget every year. For example, in 2011, this tax contributed about 5.33% to the state budget managed by the tax sector, but by 2013 (when the personal income tax rate was increased from 4 million VND/person/month to 9 million VND for taxpayers), tax revenue still increased and accounted for 5.62% of total budget revenue. By 2020 (this is also the year the personal income tax rate was adjusted to 11 million VND for taxpayers), personal income tax revenue continued to increase and its contribution also increased to 7.62% of total budget revenue. According to Mr. Tran Xoa, this issue has been causing frustration for a long time, so this year, the Government needs to consider adjusting the VAT rate for taxpayers. This adjustment is reasonable, consistent with the economic situation of Vietnam, and in agreement with the people, such as the policies to support businesses and people that the Government is implementing.

Mr. Nguyen Ngoc Tu pointed out that according to the announced roadmap, the draft Personal Income Tax Law will be submitted to the National Assembly in October 2025, approved in May 2026 and likely to take effect in 2027. This means that salaried workers will have to wait another 2 years for the change in the personal income tax rate, which is too long and too late. "This is an urgent issue, so the Ministry of Finance needs to submit an early revision of the personal income tax rate because there is no need to wait for the entire law to be revised according to the announced roadmap," said Mr. Tu.

Thanhnien.vn

Source: https://thanhnien.vn/cap-bach-sua-thue-thu-nhap-ca-nhan-185250209223939657.htm

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)