(PLVN) - Currently, many opinions proposing amendments to the Personal Income Tax Law suggest that the family allowance deduction and tax brackets need to be changed. In the latest submission on amending the Personal Income Tax Law from the Ministry of Finance , these issues have been specifically addressed.

(PLVN) - Currently, many opinions proposing amendments to the Personal Income Tax Law suggest that the family allowance deduction and tax brackets need to be changed. In the latest submission on amending the Personal Income Tax Law from the Ministry of Finance, these issues have been specifically addressed.

The personal allowance deduction levels will be revised and supplemented accordingly.

In its submission, the Ministry of Finance cited the 2023 Household Living Standards Survey Report by the General Statistics Office ( Ministry of Planning and Investment ), which showed that Vietnam's average monthly income per capita in 2023 (at current prices) was 4.96 million VND, and the highest-income group (comprising the wealthiest 20% of the population) had an average income of 10.86 million VND per month per person. Therefore, the Ministry of Finance argued that the current tax deduction for taxpayers (11 million VND per month) is more than 2.21 times the average monthly income per capita (much higher than the common level applied in other countries), equivalent to the average income of the wealthiest 20% of the population.

|

The tax brackets are too narrow and need to be revised. (Photo: ST) |

However, the Ministry also acknowledged that there have been opinions recently suggesting that the personal allowance deduction is still low. Furthermore, there have been opinions that the personal allowance deduction should be regulated based on the regional minimum wage, and that the deduction in urban areas and large cities should be higher than in rural and mountainous areas due to the higher cost of living.

The Ministry of Finance affirms that, in essence, the regulations on deductions before tax calculation ensure the principle that individuals need to have a certain level of income to meet essential needs of life such as food, housing, transportation, education, medical examination and treatment, etc. Therefore, only income above this threshold is subject to tax. The application of deductions also aims to exclude low-income earners from the scope of personal income tax. The family allowance deduction for taxpayers and their dependents, as stipulated by personal income tax law, is a specific amount based on the general social standard, without distinction between high and low income earners or those with different consumption needs.

The Ministry of Finance also affirmed that the current personal allowance deduction, applied since 2020, needs to be reviewed and re-evaluated to propose amendments and additions that are appropriate to new conditions. The specific personal allowance deduction level needs to be carefully studied and calculated to ensure it is consistent with price fluctuations and the increase in living standards of the population in the past period, as well as forecasts for the future. At the same time, it should not diminish the role of personal income tax policy in the tax system. An "excessively high" deduction level would obscure the role of personal income tax policy in fulfilling its functions (ensuring social equity and regulating income) and would inadvertently revert personal income tax policy to a "tax policy for high-income earners" as in the past.

Widen the tax brackets.

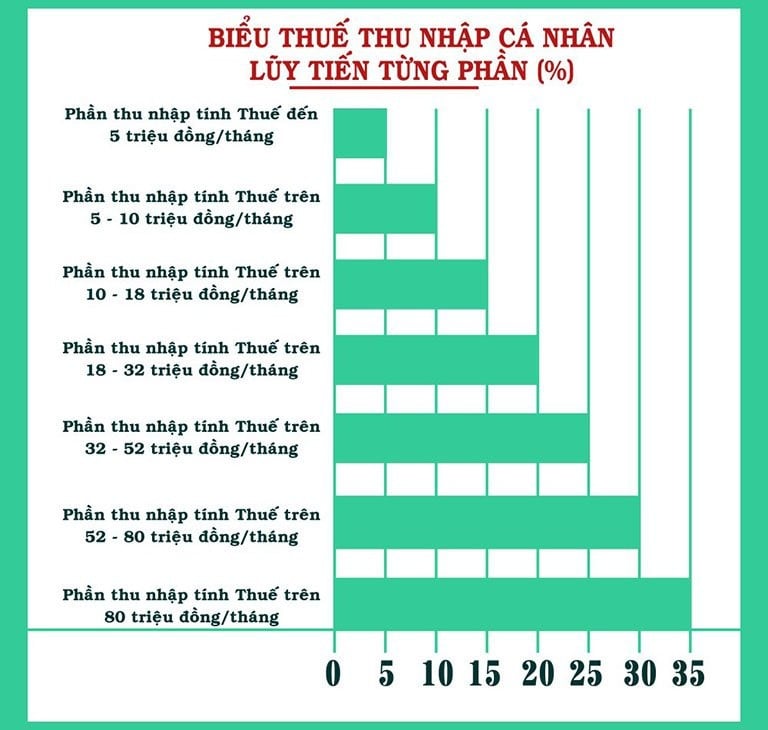

Currently, under existing regulations, the gap between tax brackets is too narrow. Taxable income in bracket 1 (0-5 million VND) is taxed at 5%. Bracket 2 (5-10 million VND) is taxed at 10%; and bracket 3 (10-18 million VND) is taxed at 15%. Furthermore, experts argue that the progressive tax rate system, implemented 15 years ago in 2009 when the base salary was only 650,000 VND/month, has now increased to 2,340,000 VND/month, a 3.6-fold increase. However, taxable income remains unchanged. Therefore, a strong and comprehensive change to the taxable income brackets is necessary.

The Ministry of Finance also stated that, based on practical implementation, some believe that the current progressive tax rate schedule is unreasonable, with too many brackets and too narrow intervals between brackets, easily leading to tax bracket jumps when aggregating income at the end of the year, increasing the amount of tax payable and the number of tax settlements unnecessarily, while the additional tax payable is not significant.

Therefore, after reviewing the current tax structure and studying the trend of improving living standards in the coming time, as well as international experience, the Ministry of Finance believes that it is possible to study reducing the number of tax brackets in the current tax schedule from 7 to a more appropriate level; at the same time, consider widening the income gap within the tax brackets, ensuring a higher level of regulation for those with higher incomes in the tax brackets.

The Ministry affirmed that the revision of the Personal Income Tax Schedule will be thoroughly studied and considered, and must be consistent with the direction set out in the Strategy for Tax System Reform until 2030, ensuring it is appropriate to the socio -economic context, income and living standards of the people, and international practices, especially with countries with similar conditions, while simultaneously protecting the rights of workers, encouraging the development of the labor market in the context of international integration, and ensuring revenue for the state budget.

Source: https://baophapluat.vn/nhieu-de-xuat-sua-doi-luat-thue-thu-nhap-ca-nhan-post539482.html

Comment (0)