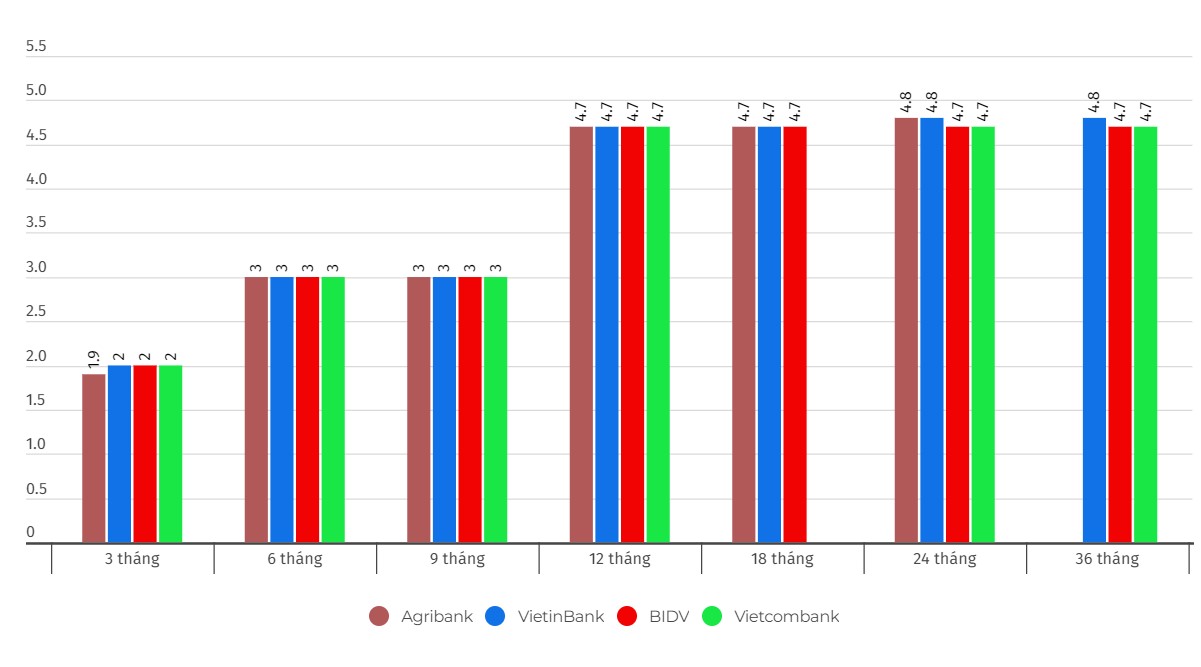

Latest interest rates of Agribank, VietinBank, Vietcombank and BIDV

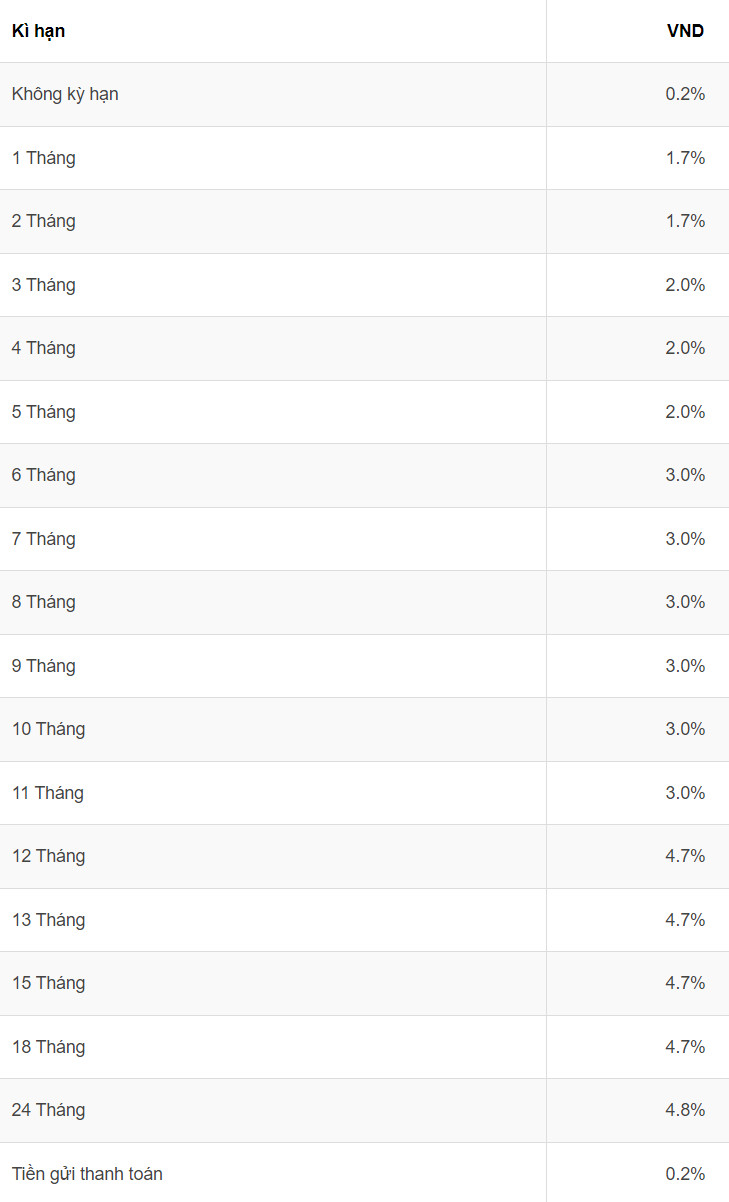

According to Lao Dong reporters' records with 4 banks Vietcombank, Agribank, VietinBank and BIDV on August 5, 2024, the mobilization interest rate table is currently listed around the threshold of 1.6-4.8%/year.

Of which, VietinBank has the highest interest rate (4.8% for terms over 24 months); Agribank fluctuates between 1.6-4.8%/year. Following is BIDV's interest rate currently fluctuating between 1.7-4.7%/year, Vietcombank's interest rate currently fluctuates between 1.6-4.7%/year.

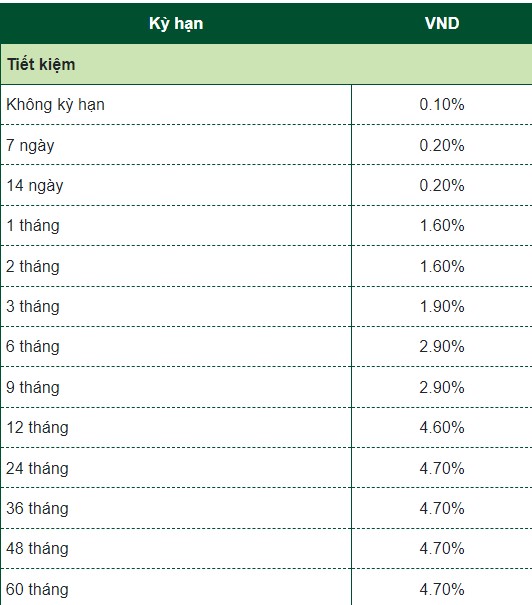

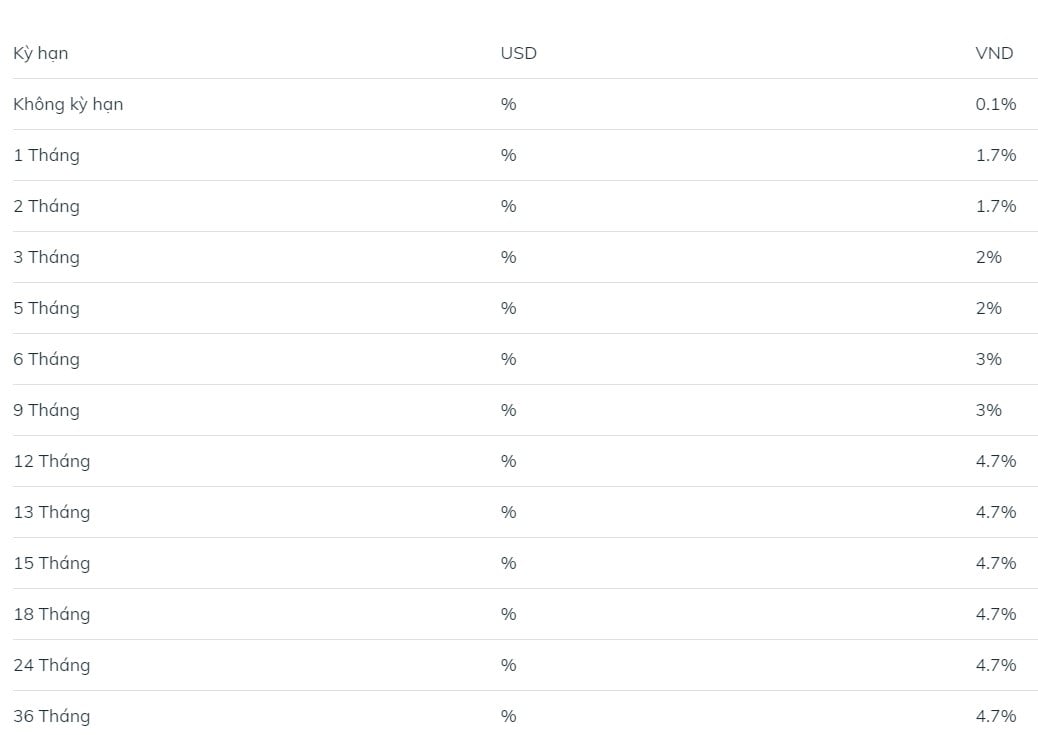

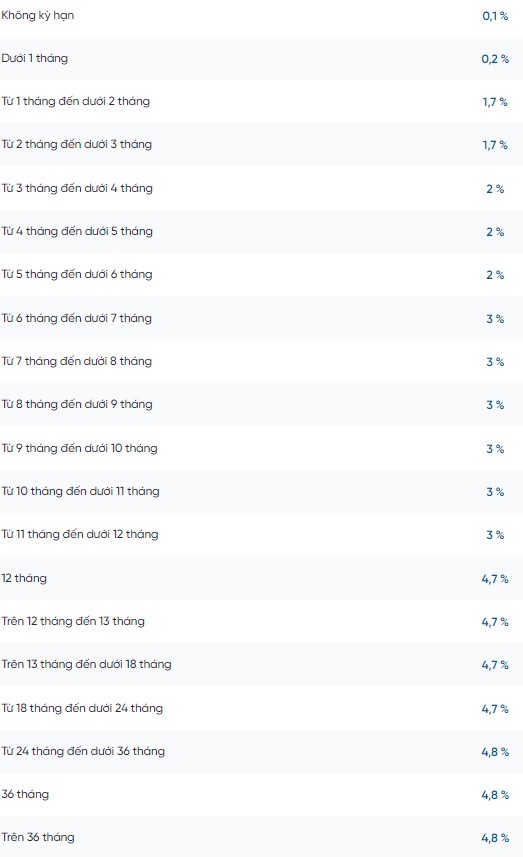

Below are the latest Big 4 interest rate details:

Below is a detailed update of interest rates of banks in the Big 4 group:

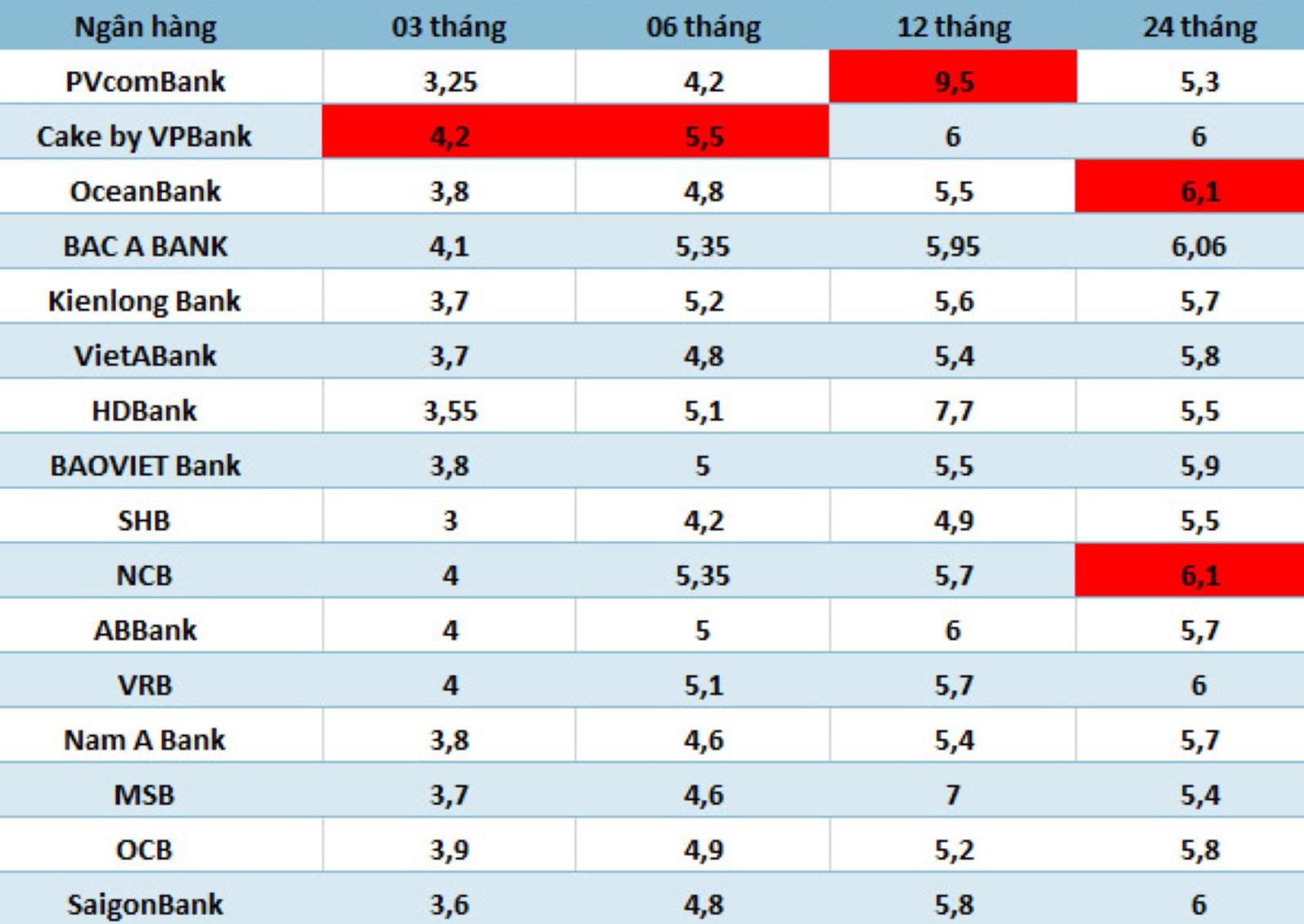

In addition, readers can refer to interest rates of some other banks through the following table:

PVcomBank's interest rate is currently the highest in the market, up to 9.5% for a 12-month term with a minimum deposit of VND 2,000 billion.

Next is HDBank with a fairly high interest rate, 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB also applies quite high interest rates with interest rates at bank counters up to 8%/year for 13-month term and 7% for 12-month term. The applicable conditions are that new savings books or savings books opened from January 1, 2018 automatically renew with a term of 12 months, 13 months and a deposit amount of 500 billion VND or more.

Dong A Bank has a deposit interest rate, term of 13 months or more, end-of-term interest with deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

NCB, VRB and OceanBank apply an interest rate of 6.1% for a 24-month term; BAC A BANK applies an interest rate of 6.05% for a 24-month term.

OCB applies an interest rate of 6% for a 36-month term; ABBank applies an interest rate of 6% for a 12-month term; BVBank and Cake by VPBank also apply an interest rate of 6% for a 24-month and 12-month term; SaigonBank applies an interest rate of 6% for a 13-, 18- and 24-month term, and 6.1% for a 36-month term.

How to receive interest if saving 500 million VND at Big 4?

To calculate interest on savings deposits at the bank, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit

For example, if you deposit 500 million VND for a 24-month term at Bank A with an interest rate of 4.7%/year, you can receive: 500 million VND x 4.7%/12 x 24 = 47 million VND.

With the same amount and term above, if you save at Bank B with an interest rate of 4.8%, the interest you receive will be: 500 million VND x 4.8%/12 x 24 = 48 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source: https://laodong.vn/tien-te-dau-tu/bien-dong-lai-suat-vietcombank-agribank-vietinbank-va-bidv-1376119.ldo

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

Comment (0)