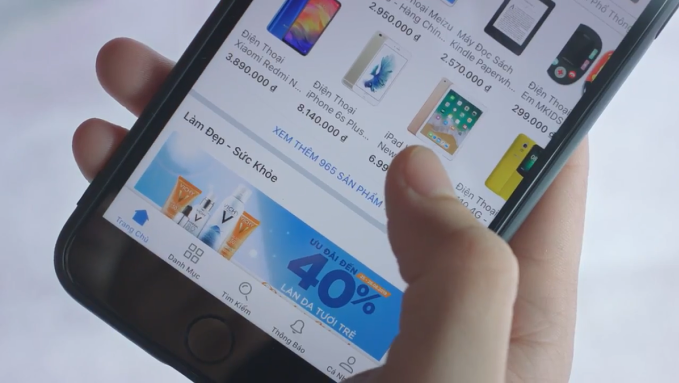

E-commerce has been growing at a "lightning" pace in recent years.

The above content was stated at a meeting of the General Department of Taxation on specific solutions to combat tax losses from e-commerce, last weekend.

Currently, online sellers must pay value-added tax and personal income tax if their revenue from online business exceeds VND100 million per year. However, it is not easy for tax authorities to fully manage revenue sources, identify taxpayers, tax bases, clearly distinguish types of income, and control business transactions and cash flow, according to Director General of Taxation Mai Xuan Thanh.

Tax authorities have confirmed that in the coming time, the agency will continue to tighten tax collection management from e-commerce. The list of online sellers with tax debts will be made public on mass media. At the same time, the agency will enforce, including measures to ban exit of taxpayers who have not fulfilled their obligations.

These measures have been applied to individuals and business representatives who have not fulfilled their tax obligations in recent years. For e-commerce sellers, tax authorities mainly promote, encourage and urge business organizations, individuals and third parties to voluntarily declare and pay taxes.

The Law on Tax Administration 2019 and Decree 126/2020 stipulate temporary suspension of exit for taxpayers who are being forced to execute administrative decisions on tax administration. The head of the agency directly managing the taxpayer has the right to decide to suspend, extend, or cancel the temporary suspension of exit.

According to the Ministry of Finance, before this authority was added, individuals with tax debts, business owners, especially those with foreign elements, "ran away" before the Customs agency requested a temporary suspension of exit. However, to prevent loss of state budget revenue and recover tax arrears from individuals and businesses that are slow to pay, this regulation is necessary to prevent tax debtors from fleeing.

At the meeting, Deputy General Director Mai Son also noted that relevant units should study how to manage and collect data on households and online businesses through owners of e-commerce trading floors, foreign suppliers without business establishments in Vietnam, shipping units, payment intermediaries, etc.

According to current regulations, e-commerce trading floors must provide information about sellers. In particular, floors with online ordering functions such as Shopee, Lazada, Tiki, Sendo must also provide additional revenue of each seller.

The Ministry of Finance also signed agreements and coordinated information provision with the Ministry of Industry and Trade, the Ministry of Information and Communications, the Ministry of Public Security and is in the process of drafting a Coordination Agreement with the State Bank.

Based on this information, the tax authority will review to put many individuals and organizations under management, request appropriate declarations to adjust revenue or handle additional collection.

From 2022, the tax industry will have an e-commerce portal to support platforms in declaring taxes on behalf of sellers. Currently, this portal is a place for parties to provide seller information and support them in declaring on behalf of business individuals. Individual sellers can also declare directly on the portal.

Statistics show that by the end of last year, 74 foreign suppliers had registered, declared and paid taxes through the portal. The total amount of tax paid was more than VND8,000 billion, of which nearly VND6,900 billion was declared and paid directly through the portal and VND1,200 billion was deducted and paid by Vietnamese parties on their behalf.

The e-commerce information portal recorded 357 e-commerce trading floors providing information by the end of 2023. Revenue from e-commerce with domestic organizations and individuals reached more than 536 billion VND.

According to the Ministry of Industry and Trade, in 2023, the size of Vietnam's retail e-commerce market will reach about 20.5 billion USD, an increase of about 4 billion USD (equivalent to 25%) compared to 2022. Vietnam's e-commerce growth rate is ranked among the top 10 countries with the highest e-commerce growth rate in the world, as of December 2023, according to Statista.

TH (according to VnExpress)Source

Comment (0)