The series of articles "The Future of the Electricity Industry" analyzes existing bottlenecks, aiming to further promote investment in new power sources and necessary changes in electricity price policies.

Rapid shifts in power structure

According to data from Vietnam Electricity Group (EVN), the proportion of power sources in 2023 according to ownership structure has significantly changed compared to many previous years.

Accordingly, EVN holds 11% of the power source, 3 power generation corporations (Gencos) under EVN hold 26% of the power source. Two other state-owned enterprises, the Vietnam Oil and Gas Group (PVN) hold 8% and the Vietnam National Coal and Mineral Industries Group (TKV) hold 2%. BOT investors hold 10% of the power source, while imported sources and other sources only account for 1%.

Most notably, private sector-invested power sources have accounted for 42% of total installed capacity, mainly renewable energy.

This is a dizzying change! Before 2012, private ownership of electricity sources was less than 10%. If we count from 2003 onwards, state-owned enterprises almost controlled all electricity sources.

To provide enough electricity for socio-economic development, in addition to power plants that are dependent on EVN (electricity production accounts for 17% of the total electricity output of the entire system in 2022), EVN must purchase additional electricity (83% of the total electricity output of the system) under power purchase contracts with other power plants of PVN, TKV, power plants in the form of BOT, power generation corporations (Genco1, Genco2, Genco3), renewable energy power plants and other independent power plants.

Looking at the above power source structure, Dr. Nguyen Dinh Cung, former Director of the Central Institute for Economic Management, said that the power generation market will become increasingly competitive. Because in terms of sources, EVN and its member units control less than 40%; PVN and TKV hold 10%, the rest is private.

Investment in the development of the electricity sector in general and power source development in particular must certainly mobilize more and more participation from economic sectors, especially the private sector. Therefore, the proportion and role of EVN in power generation will increasingly decrease.

However, Mr. Cung also noted that in that context, it is impossible to assign EVN to ensure enough power for the economy!

Cheap electricity drops

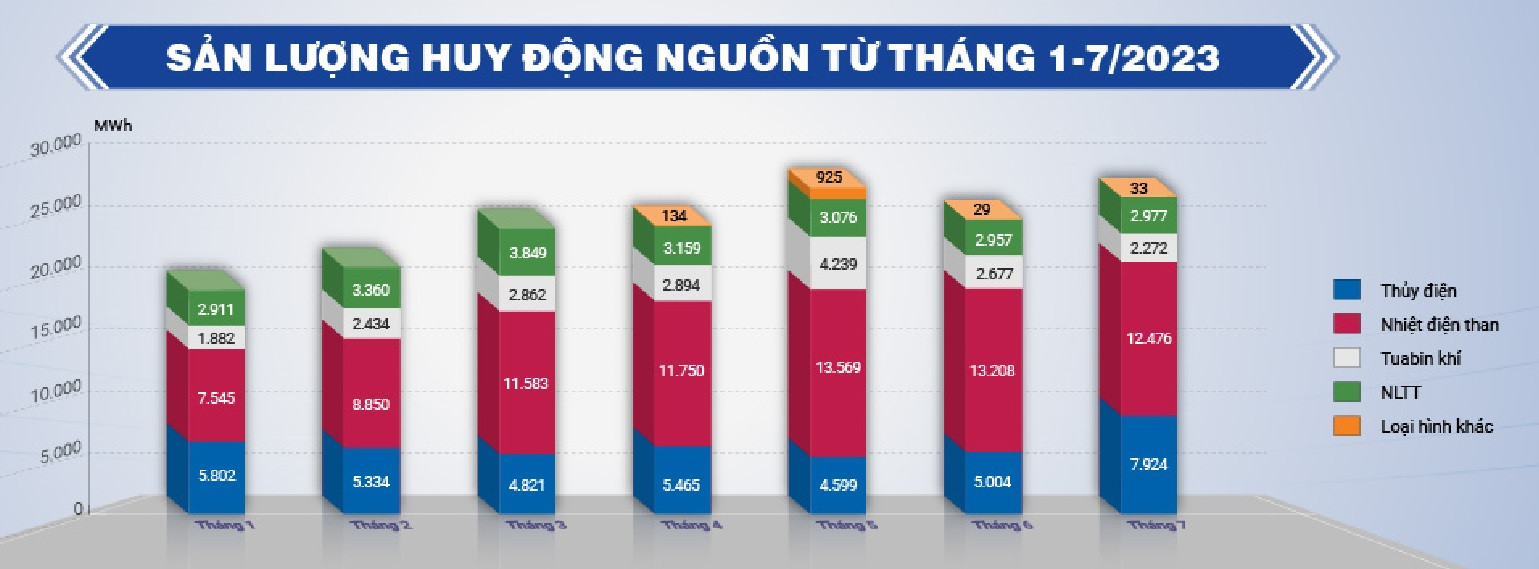

The participation of renewable energy sources such as wind and solar power is a significant difference in Vietnam's power system from 2020 to present. The proportion of renewable energy is increasing, but cheap sources are decreasing.

Specifically, if considered by type of power source, the proportion of capacity of the cheapest hydropower type (the most) supplied to the system is gradually decreasing over the years because there are almost no new large hydropower sources in operation (from a capacity proportion of 36.9% in 2019, to only 28.5% in 2022).

By the end of 2022, the total capacity of wind and solar power sources recognized for commercial operation (COD) was 20,165 MW, accounting for 25.94% of the total capacity of the entire system. Only from 2019-2021 did this renewable power source develop explosively.

However, these electricity sources are not only expensive - because they are enjoying preferential pricing mechanisms, much higher than the average electricity price - but also unstable, so their contribution to the electricity system is not really effective, especially when peak hours are shifting from noon (before) to evening (as they are now).

Coal-fired thermal power plants are 25,312 MW, accounting for 32.6%; hydropower plants including small hydropower plants are 22,504 MW, accounting for 28.9%; gas-fired power plants are 7,152 MW, accounting for 9.2%.

Unstable electricity market

EVN data shows that in 2022, there will be 4 new power plants participating in the electricity market with a total capacity of 2,889 MW. To date, there are 108 power plants directly participating in the electricity market with a total installed capacity of 30,937 MW, accounting for 38% of the total installed capacity of power sources nationwide.

Thus, the proportion of power plants participating in the electricity market remains low because most of the newly operated sources are not subject to or have not yet participated in the electricity market (renewable energy, BOT).

It is worth noting that in recent years, the proportion of power sources directly participating in the electricity market has tended to decrease because most of the new power sources put into operation are BOT and renewable energy types.

According to the assessment of the National Power System Dispatch Center (A0), the low proportion of sources directly participating in the electricity market has a great impact on the level of competition and efficiency of electricity market operations. As the market share decreases, the electricity market price will not accurately reflect the marginal cost of electricity generation of the system. This makes it difficult for the next steps of electricity market development.

According to an EVN representative, under the current mechanism, these power plants are “guaranteed” to be paid for about 80-90% of their output according to the power purchase contract price, while the remaining 10-20% of their output is adjusted according to market prices. Meanwhile, the average market price of electricity tends to increase over the years.

In particular, in 2022, the electricity market price increased by 53.6% compared to 2021, leading to a huge increase in profits for power plants participating in the market (in addition to the profits stipulated in the power purchase agreement and the electricity price agreed by the parties and approved by the Ministry of Industry and Trade). EVN must bear this additional cost as the sole buyer.

Assoc. Prof. Dr. Truong Duy Nghia, Chairman of the Vietnam Thermal Science Association, assessed: Only hydropower plants, coal-fired thermal power plants, and gas-fired thermal power plants can participate in the competitive electricity generation market. According to the market mechanism, power plants with low electricity prices will be mobilized to generate more electricity, power plants with high prices will be mobilized when the system requires or put into reserve power generation.

In reality, there are shortcomings that make regulation according to market mechanisms impossible.

Specifically, according to Associate Professor Truong Duy Nghia, although hydropower plants have the lowest electricity production cost, they can only generate maximum capacity when the reservoir is full of water, or when water needs to be discharged (through turbines). In many cases, they have to discharge the bottom (not through turbines) to release floodwaters. In other cases, they have to generate electricity in moderation to save water. The maximum capacity operating time per year (Tmax value) of hydropower plants in Vietnam is only about 4,000 hours/year.

At BOT power plants (including coal and gas), the electricity price and electricity output have been guaranteed, so they are almost outside the competitive electricity market. Renewable and biomass power plants are also not mobilized according to market mechanisms. High-cost power plants such as gas-fired power plants, in fact, should not be mobilized according to market principles, but to ensure security of electricity supply, to meet the requirements of covering the peak and the middle of the load curve, they are still mobilized. Currently, according to Power Plan VIII, gas-fired power plants are also mobilized to run at the bottom.

“Thus, the competitive electricity market is mainly for coal-fired thermal power. The above shortcomings make competitive electricity generation completely not follow the market mechanism,” Mr. Nghia commented.

Changes in the structure of power sources, owners of power source projects, and the current incompleteness of the electricity market require fundamental changes in policies for the electricity sector.

This is an urgent requirement to minimize the risk of power shortages in 2024 and the following years after experiencing a power shortage in the North from late May to June 22, 2023.

The leader of EVN's Business Department said: The demand for electricity continues to increase, forecasted at an average of 9%/year, corresponding to an increase in capacity of 4,000-4,500 MW/year. Meanwhile, the power source expected to be put into operation in 2024 is only 1,950 MW and in 2025 is 3,770 MW, mainly concentrated in the Central and Southern regions.

The reserve capacity of the Northern power system is low but electricity demand grows by 10%/year; therefore, the North is likely to lack peak capacity during the hot season in June-July 2024 (shortage of 420-1,770MW).

This raises the issue of finding ways to speed up investment in power source projects to supplement the electricity shortage in the North.

Lesson 2: Who is responsible for investing in power sources: Private sector or state-owned enterprises?

Source

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)