All enterprises, organizations and individuals, if they have business activities with tax obligations, must self-declare, self-pay and be responsible for their obligations to the state budget.

The above information was shared by Mr. Mai Son, Deputy General Director of the General Department of Taxation at a press conference on January 7. According to statistics nationwide, the total number of individuals engaged in e-commerce business activities subject to tax liability review is 76,428 people; of which, about 30,000 people have been handled for violations, with the total amount of arrears and fines being 1,223 billion VND.

Mr. Mai Son noted that according to the law, all enterprises, organizations and individuals who have business activities with tax obligations must self-declare, self-pay and be responsible for their obligations to the state budget.

Tax authorities are responsible for propagating and supporting taxpayers in fulfilling their tax obligations; having solutions to inspect, examine, and handle violations, if any, to ensure fairness and transparency in taxpayers' activities.

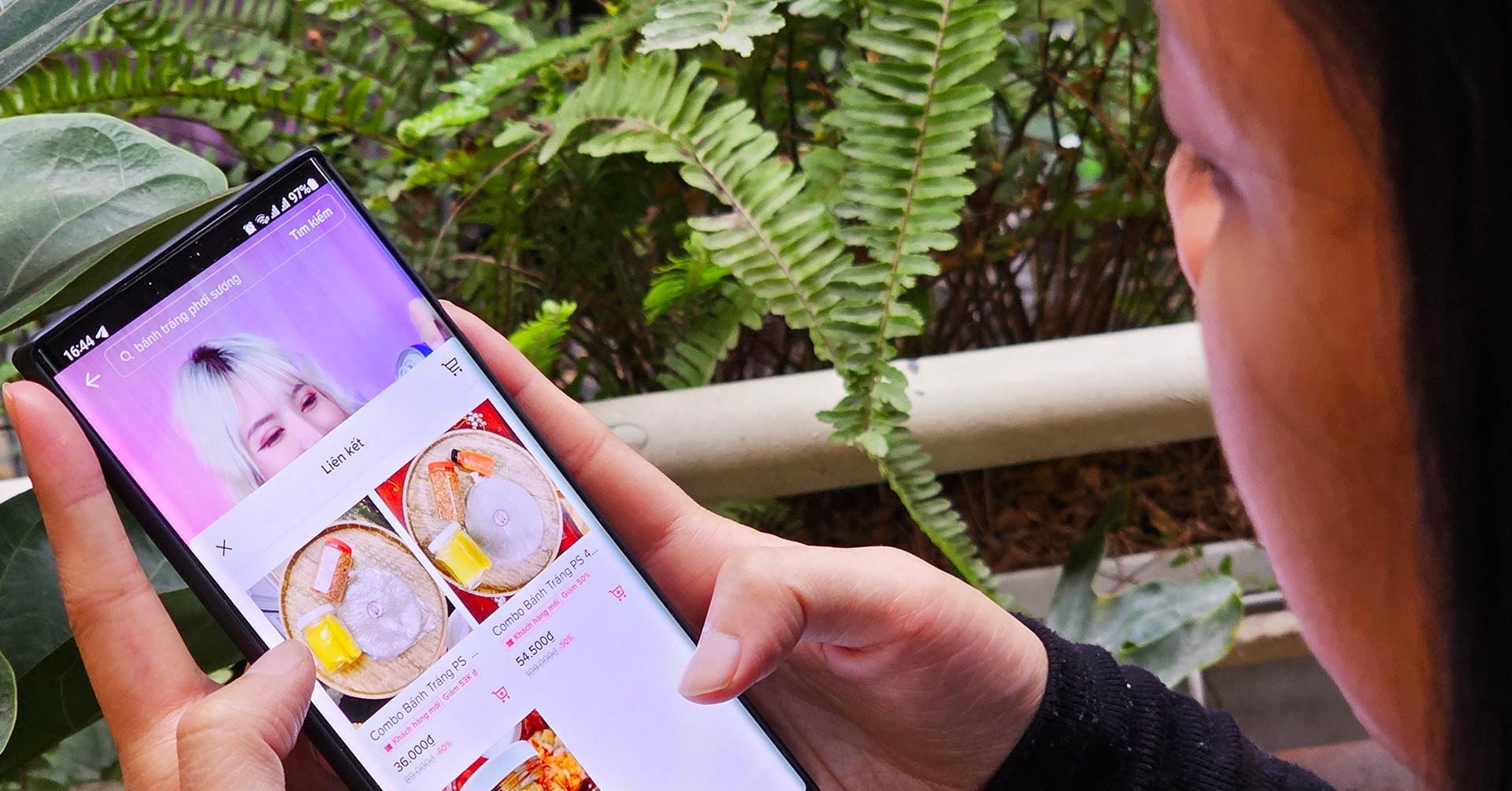

“In the past, we have had management activities for famous people. In particular, in some cases of famous people and influencers (KOLs) participating in livestreaming or affiliate marketing, online sales, the General Department of Taxation has directed tax authorities at all levels to strengthen management. First of all, this activity is concentrated in Hanoi and Ho Chi Minh City,” said Mr. Son.

Deputy Minister of Finance Nguyen Duc Chi emphasized: Organizations and individuals, regardless of whether they are famous or not, if they incur tax obligations under tax laws, are responsible for fulfilling their obligations according to the provisions of the Law on Tax Administration and guiding documents.

“The General Department of Taxation and relevant agencies have built and enriched the database related to business activities of organizations and individuals doing business on e-commerce platforms and social networks. We have large data, will conduct inspections, checks and strictly handle violations. We hope that taxpayers are aware of their obligations, do not unintentionally violate and be heavily fined,” Deputy Minister Nguyen Duc Chi warned.

Source: https://vietnamnet.vn/30-000-nguoi-ban-hang-online-bi-truy-thu-va-phat-1-223-ty-dong-tien-thue-2361063.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)