Since the beginning of this year, Slovakia-based security firm ESET says it has observed an alarming increase in fraudulent lending apps on Android that pose as “legitimate personal lending services, promising quick and easy access to personal consumer funds.”

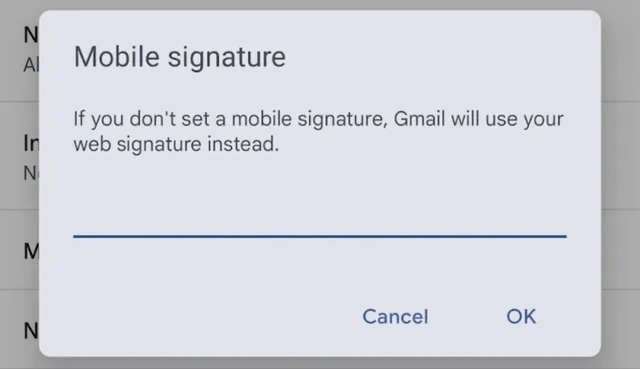

There are about 12 million installs of SpyLoan app from Play Store

“Despite their appealing descriptions, these services are in fact designed to defraud users by offering them high-interest loans while harvesting victims’ personal and financial information for blackmail purposes,” ESET said. As such, ESET has identified these apps as SpyLoan, a direct reference to their spyware functionality combined with their loan offers.

A report by Dark Reading said that SpyLoan apps pose as legitimate financial services for personal loans, promising easy access to funds. This is done to trick users into signing up for high interest payments. During the registration process, the scammers also collect victims’ personal and financial information to extort money from them. Victims of SpyLoan apps said that the annual cost of loans offered on these apps is much higher than regulated and the loan terms are shorter. These loans are marketed through SMS messages and social media.

The list of 17 SpyLoan apps that have been removed by Google from the Play Store includes AA Kredit, Amor Cash, GuayabaCash, EasyCredit, Cashwow, CrediBus, FlashLoan, PréstamosCrédito, Préstamos De Crédito-YumiCash, Go Crédito, Instantáneo Préstamo, Cartera grande, Rápido Crédito, Finupp Lending, 4S Cash, TrueNaira and EasyCash.

ESET said the apps targeted users in Southeast Asia, Africa, and Latin America. ESET also said it identified 18 SpyLoan apps and reported them to Google before 17 of them were removed from the Android app store. These apps had a combined total of more than 12 million downloads before they were removed. The only remaining app in the report has now changed its behavior, so ESET no longer recognizes it as a SpyLoan app.

Source link

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)