(NLDO) – Foreign investors returned to net buying in the session of December 24, along with the demand for bottom-fishing stocks, which is expected to help VN-Index trade better tomorrow.

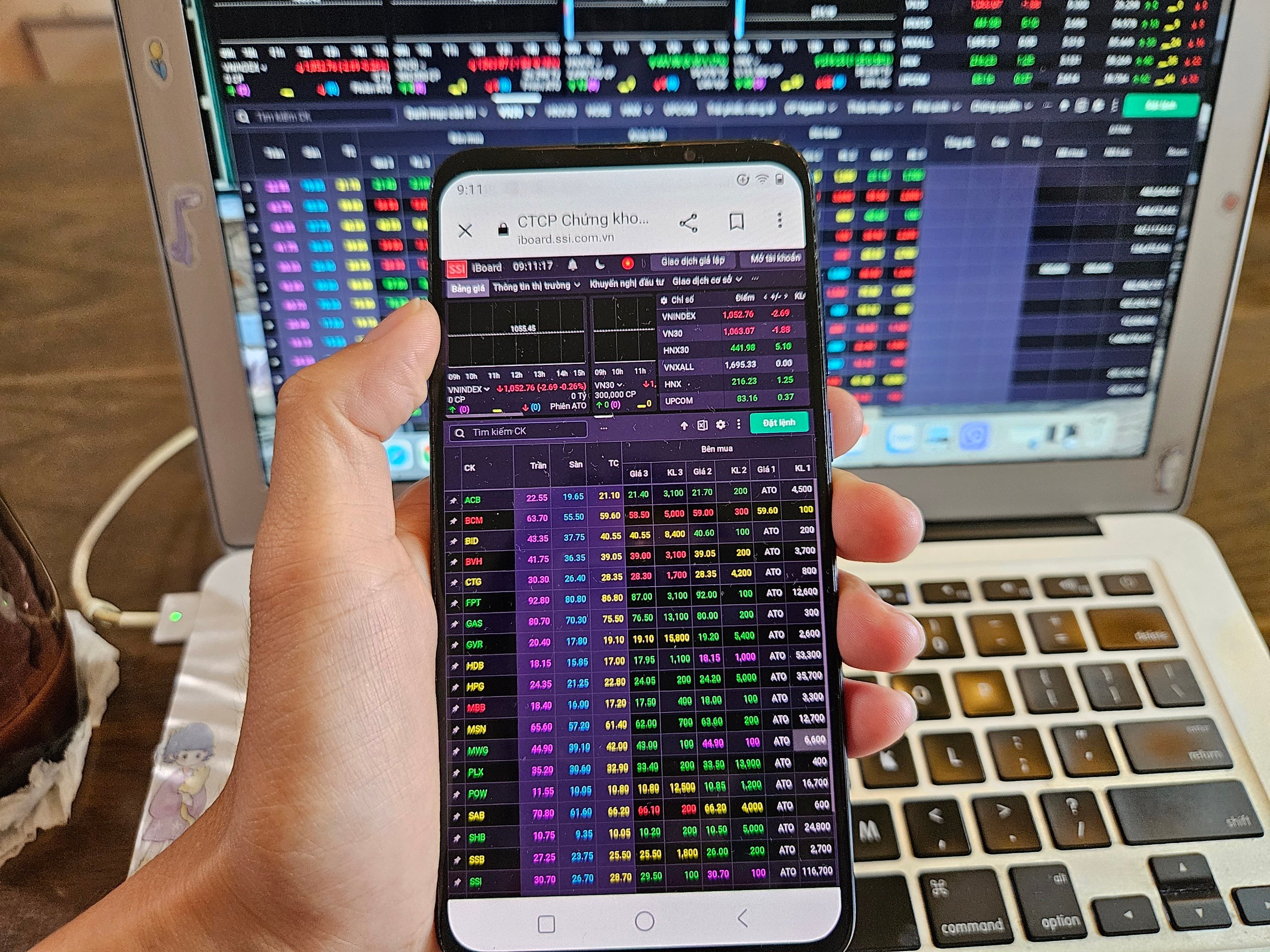

The trading session on December 24 was quite surprising when selling pressure increased sharply, causing the VN-Index to lose nearly ten points at times. The VN-Index only recovered when bottom-fishing demand appeared in the afternoon session, focusing on the VN30 group of stocks.

At the end of the session, VN-Index decreased by 2.4 points to close at 1,260.36 points; HNX Index decreased by 0.15 points to close at 228.36 points. The real estate group caused the market to decrease with the negative fluctuations of DXG stock (-6.8%), spreading to other stocks in the industry such as HDC, DPG, PDR... On the contrary, some real estate stocks, industrial park real estate stocks improved with the strong increase of LHG, HBC.

The total value of matched transactions of VN-Index reached 12,063 VND, up 28.9% compared to the previous session. Foreign investors also "turned around" to net buy 45.17 billion VND on HOSE, focusing on SSI, MWG, STB...

Although liquidity increased sharply, selling pressure dominated, showing a cautious sentiment. Foreign investors had a positive change when they reversed their net buying, helping to narrow the decline in the afternoon session. However, this improvement was not enough to turn around the overall situation when demand was not strong enough.

Tomorrow's stock market is expected to continue to have the participation of cash flow to catch the bottom of stocks.

Commenting on tomorrow's trading session, December 25, Mr. Vo Kim Phung, Head of Analysis at BETA Securities Company, said that the market has not shown any signs of improvement in the short term. Increasing selling pressure and investor caution are holding back the recovery trend.

"Investors should prioritize an observation strategy and wait for clearer signals. They can focus on stocks in industries with positive business results expected in the fourth quarter of 2024, especially businesses with solid fundamentals and long-term growth prospects," said Mr. Phung.

Experts from Vietnam Construction Securities Company (CSI) also maintain the view of holding the portfolio and patiently waiting for an explosive signal, consolidating the uptrend to increase the proportion of stocks.

SHS Securities Company believes that in the short term, the strong differentiation of VN-Index depends largely on the intrinsic quality of enterprises. The market is waiting for new growth drivers such as growth in business results in the fourth quarter of 2024 and prospects for 2025.

"The market is expected to overcome the accumulation trend that has lasted since the beginning of the year, especially stocks with large capitalization ratios in banking and real estate. Investors should maintain a reasonable proportion and still consider selectively disbursing good fundamental stocks, with investment targets aimed at leading stocks" - SHS securities experts recommended.

Source: https://nld.com.vn/chung-khoan-ngay-25-12-xuat-hien-luc-cau-bat-day-co-phieu-khoi-ngoai-nhap-cuoc-196241224175015545.htm

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)