Producing garments for export at Binh Duong Garment Joint Stock Company. (Photo: HOANG ANH)

Vice President and General Secretary of the Vietnam Textile and Apparel Association (Vitas) Truong Van Cam said that in 2024, textile and garment exports to the United States will reach 16.6 billion USD, accounting for 38% of the industry's export turnover; imports from the United States will reach nearly 1.2 billion USD, accounting for 4.8%, of which cotton imports will be 681 million USD, fabric 46 million USD, and raw materials and accessories 469 million USD.

Deputy Chief of Office of the Board of Directors of Vietnam National Textile and Garment Group (Vinatex) Hoang Manh Cam said that the US's suspension of the 46% reciprocal tax for 90 days and reduction of the tax rate to 10% during this period will help businesses proactively adapt to market uncertainties, boost production and export of goods to soon reach the set goals.

Mr. Hoang Manh Cam also said that regardless of the tax rate of 10% or any other amount, it will affect consumer demand in the United States, because increased taxes lead to decreased consumer demand. Textiles and garments are sensitive products so they will certainly be affected.

In addition, US importers are negotiating and requiring production units in Vietnam to share at least 50%, or even 100% of the increased costs with consumers; that is, the selling price remains unchanged, the increased cost is borne by the production unit. This leads to disadvantages when businesses have to face reduced orders and unit prices. If they do not agree, customers will move to other countries with lower production costs.

Mr. Hoang Manh Cam said that the Government needs to consider solutions to stimulate the domestic market to make up for the shortage; reduce VAT, reduce personal income tax for people, and at the same time not increase electricity prices and regional minimum wages to reduce pressure on input costs and reduce the burden on businesses.

Chairman of the Board of Directors of Vietnam National Textile and Garment Group (Vinatex) Le Tien Truong said that increasing import taxes will reduce consumer demand in the US market, so businesses need to be calm and clear-headed in coming up with sustainable solutions such as strengthening management, improving production efficiency, and improving workers' skills to increase competitiveness in the market. In addition, negotiating with customers and brands in the spirit of sharing difficulties and ensuring stable production forces.

As soon as US President Donald Trump announced a 90-day suspension of reciprocal tariffs on Vietnamese goods, businesses urgently ramped up production and negotiated with customers to resolve signed and under-production orders.

According to Chairman of the Board of Directors of Hung Yen Garment Corporation (Hugaco) Nguyen Xuan Duong, the US market does not directly produce garments but mainly imports them, so it is also an opportunity to negotiate tax reductions.

In addition, businesses need to change their production methods, gradually switching to FOB (buy raw materials, produce, sell finished products), ODM (original design manufacturing)... to increase value and enhance their position in the supply chain.

At the same time, businesses need to diversify markets, take advantage of FTAs, and develop potential markets such as Russia, the Middle East, America, Africa, etc.

Chairman of the Vietnam Textile and Apparel Association (Vitas) Vu Duc Giang said that Vietnam's garment exports to the US currently have different tax lines such as items subject to 0%, 7%, 12% tax or jackets currently subject to 27%. The government is implementing solutions and actively negotiating to consider, apply and enforce tax lines in the coming time.

In addition to response solutions, businesses need to control, trace the origin, and provide transparency in information about the supply of raw materials, to avoid violating regulations and causing disadvantages to production and export activities.

Source: https://baotuyenquang.com.vn/xay-dung-giai-phap-ung-pho-bien-dong-thi-truong-209933.html

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

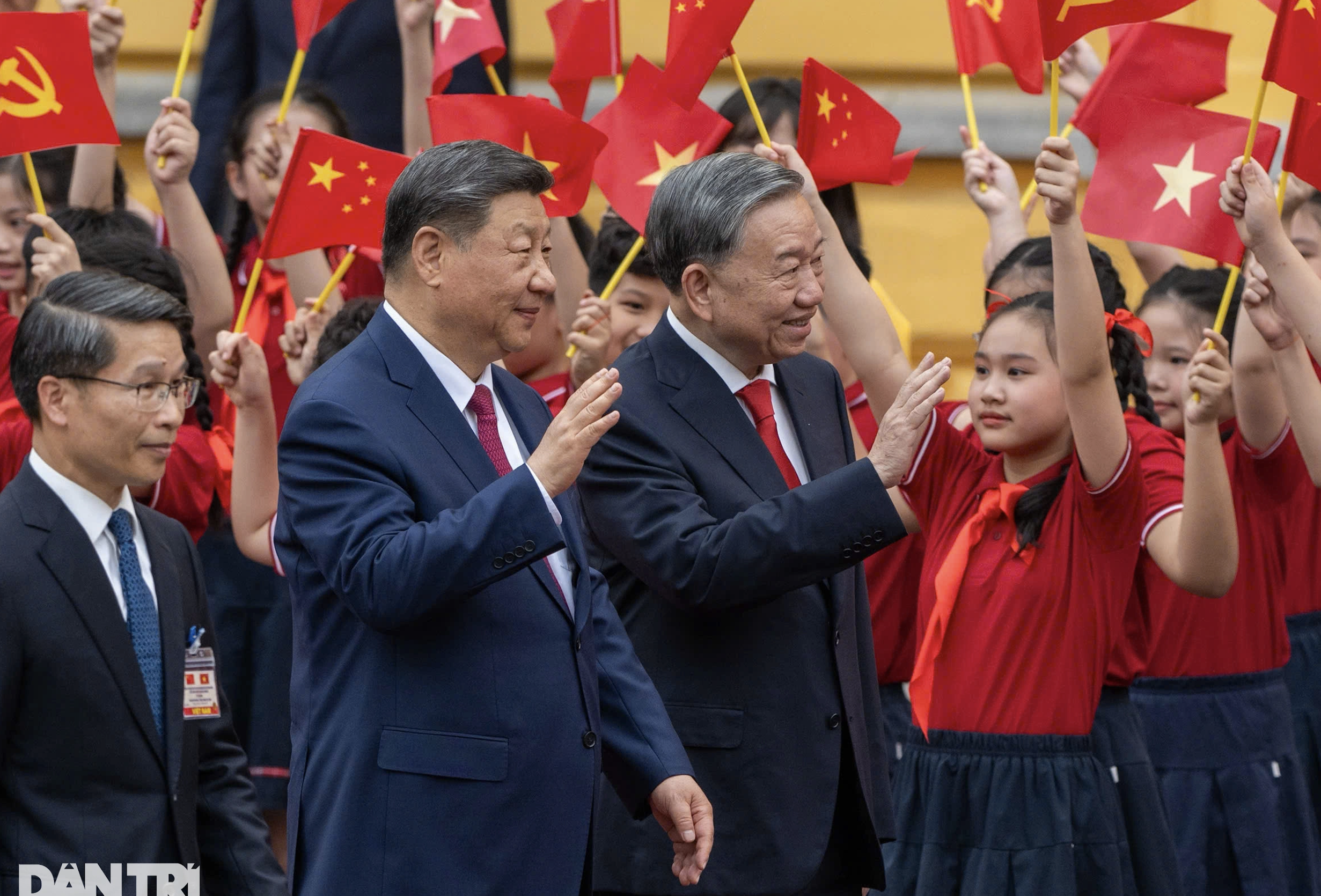

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)