Vietnam Prosperity Joint Stock Commercial Bank (VPBank - HoSE: VPB) has just announced the Board of Directors' Resolution on the first private bond issuance in 2024.

According to VPBank, the bank plans to use the proceeds from the bond issuance and offering to lend to individual and corporate customers.

Plan to use capital raised from temporarily idle bond issuance in case of disbursement according to schedule, capital raised from bond issuance will be maintained by VPBank in the bank's demand deposit account opened at the State Bank of Vietnam transaction office.

Accordingly, VPBank plans to issue 4,000 bonds to the market, each worth 1 billion VND, equivalent to a total issuance value of 4,000 billion VND.

This is an unsecured, non-convertible, non-warrant bond, not a subordinated debt of VPBank. The bond code is VPBB2427001, with a term of 3 years. The expected issuance date is August 16, 2024.

Bonds are issued in the form of book entries, whereby ownership of the bonds is recorded in the register; or book entries, electronic data or another form as prescribed by relevant laws.

Bonds may only be traded between institutional investors who are also professional securities investors, except in cases of implementation pursuant to a court judgment or decision that has come into legal effect, an arbitration decision, or inheritance in accordance with the provisions of law.

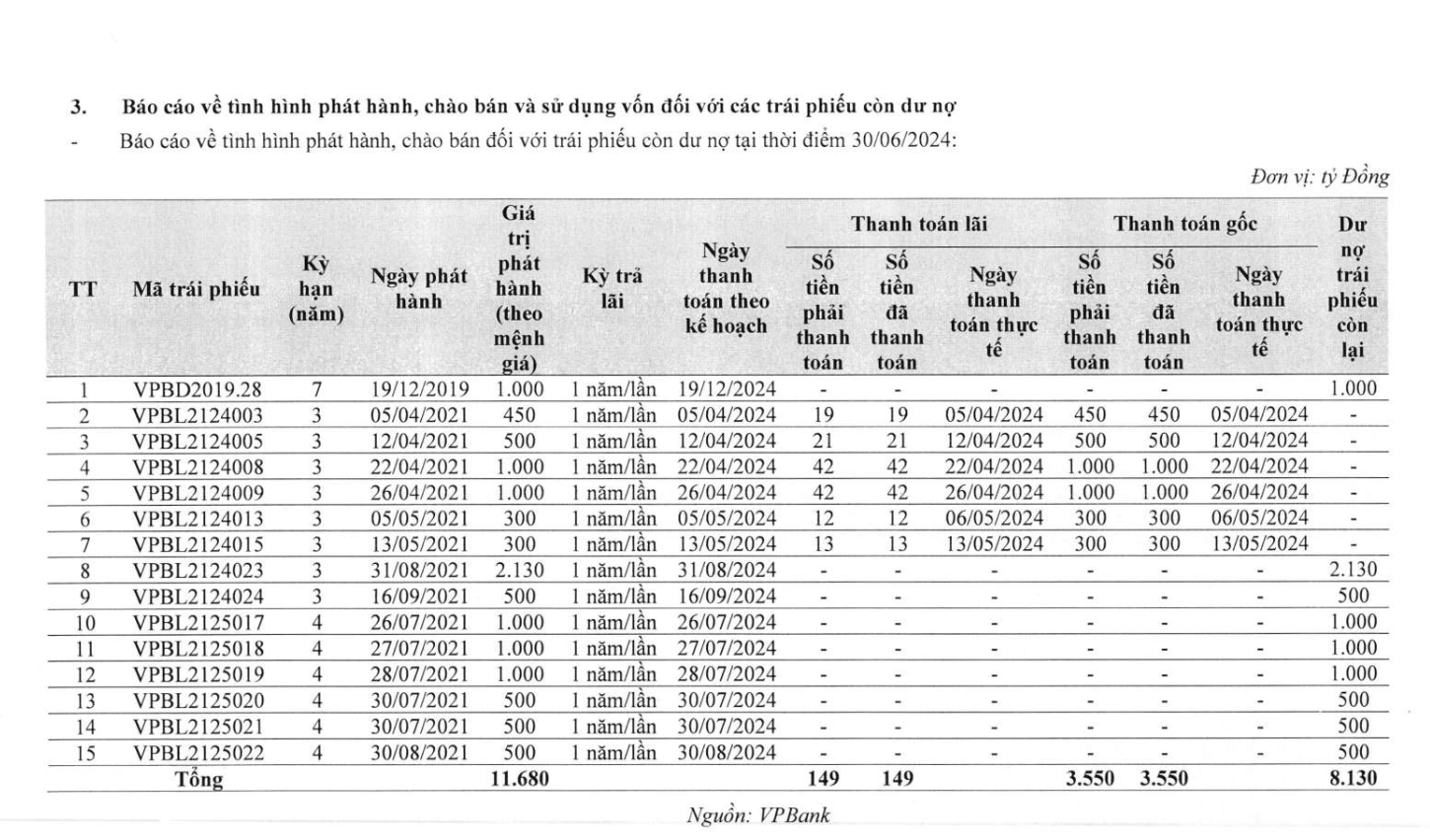

VPBank bond issuance report.

According to information from VPBank reporting on the issuance and offering of outstanding bonds as of June 30, 2024, the bank currently has 15 bond lots. Of which, the bank has paid VND 149 billion in interest and VND 3,550 billion in bond principal. The remaining bond debt is VND 8,130 billion.

According to VPBank, the bank plans to use the proceeds from this bond issuance and offering to lend to individual and corporate customers.

Plan to use capital raised from temporarily idle bond issuance in case of disbursement according to schedule, capital raised from bond issuance will be maintained by VPBank in the bank's demand deposit account opened at the State Bank of Vietnam transaction office.

At the same time, VPBank's Board of Directors also approved a Resolution on the plan to buy back bonds before maturity.

Accordingly, the cases of buying back VPBank bonds in the first phase of 2024 before maturity are that any bond owner has the right to request the issuer to buy back all owned bonds before maturity.

When the bondholder exercises this right, the issuer is obligated to buy back all bonds before maturity.

At the same time, the issuer has the right to request bondholders to resell all bonds they own before maturity.

Bonds are redeemed on the interest payment date of the first interest period or the interest payment date of the second interest period or the following business day if the above interest payment dates are not business days,

In addition, in 2024 or the first quarter of 2025, VPBank also plans to issue sustainable international bonds in a private form to a number of investors.

The type of issuance is non-convertible, unsecured, unwarranted bonds. The issuance currency is USD with a maximum issuance volume of 400 million USD, term of 5 years.

The purpose of issuance is to provide credit for plans, projects, and funding needs that meet green and social criteria eligible under the bank's sustainable bond framework.

Source: https://www.nguoiduatin.vn/vpbank-sap-huy-dong-4000-ty-dong-trai-phieu-dot-1-nam-2024-204240815193615044.htm

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)