Foreign capital flows from Singapore, Japan, China…

According to the Foreign Investment Agency (FIA, Ministry of Planning and Investment), in the first 8 months of 2024, the country attracted more than 20.52 billion USD in FDI capital, up 7% over the same period last year. Notably, the number of new investment projects and the number of projects registered for investment expansion both increased sharply over the same period last year. Of which, the number of new FDI projects granted investment registration certificates increased by 8.5% and the capital increased by 27%.

Associate Professor, Dr. Nguyen Thuong Lang, National Economics University, shared that 4 months ago, when FDI projects expanded investment somewhat decreased, many opinions expressed concern that the attractiveness of FDI attraction seemed to slow down. However, usually after the first quarter of the year, the increase in investment expansion has not been implemented because the financial cycle of foreign investors has just ended. Reality so far shows that both attracting new and expanded FDI projects has increased positively.

Mr. Lang emphasized: This is proof that Vietnam is still an attractive market for FDI in general. The high increase in newly registered capital shows that investors want to invest long-term in Vietnam and the profits from new investments are higher than those from capital contributions and share purchases. This is also a signal that Vietnam is still an attractive investment destination as stated in Resolution 50 of the Politburo. "The rapid increase in newly registered and expanded capital shows the market potential and positive investment prospects. That continues to affirm that Vietnam is a "promised land" for foreign corporations to promote expansion as well as attract new projects," Associate Professor, Dr. Nguyen Thuong Lang analyzed.

FDI capital into Vietnam in recent years has appeared in many high-tech projects.

Data from the Foreign Investment Agency also shows that the largest FDI capital in the past 8 months came from Vietnam's traditional partners, mainly from Asia. The top 5 countries and territories, Singapore, Hong Kong, Japan, China, and South Korea, accounted for 74% of new investment projects and more than 77% of the country's total registered investment capital. Notably, Singapore continued to lead in the past 8 months. Specifically, FDI capital from this island nation reached nearly 6.8 billion USD, up more than 7% over the same period, accounting for more than 33% of the country's total FDI capital. Next was Hong Kong with 2.4 billion USD, accounting for nearly 12%...

Associate Professor, Dr. Nguyen Thuong Lang analyzed that Singapore has chosen Vietnam as the top investment destination for many consecutive years, despite the difficult and challenging global economic situation. With leading investors such as Singapore, Hong Kong, and China only accelerating recently, the foundation to attract investment sources for projects from these three markets is industrial park (IP) real estate. A typical example is the Vietnam - Singapore Industrial Park (VSIP), which started as a joint venture between Sembcorp Industries of Singapore and Becamex Group of Vietnam. After nearly 30 years of investment in Vietnam, the VSIP model has spread throughout Vietnam with 14 IPs.

In particular, industrially developed localities such as Binh Duong, Bac Ninh, Hai Phong, Thai Binh, Hai Duong, Nghe An, Quang Ngai, Binh Dinh, etc. all have large-scale VSIP industrial parks. Therefore, this is a great advantage for Singaporean investors to easily choose Vietnam without having to spend time finding an investment location. “Singapore is a partner specializing in investing in industrial park real estate. Vietnam is a stronghold and manufacturing center in the world, so industrial park real estate continues to attract FDI. It can be said that Singapore plays a leading role in FDI capital into Vietnam's industrial park real estate with an increasingly large scale. This is a factor that stimulates the industrial park real estate market and affirms the long-term prospects as well as great benefits if investing in this segment,” Associate Professor, Dr. Nguyen Thuong Lang assessed.

The "race" to return between Bac Ninh and Quang Ninh...

In the first 8 months of 2024, FDI capital flowed into 54 provinces and cities across the country. Of which, Bac Ninh took the lead with a total registered capital of nearly 3.47 billion USD, accounting for 16.9% of the total investment capital nationwide and 2.94 times higher than the same period last year. Quang Ninh ranked second with nearly 1.78 billion USD, accounting for 8.7% of the total registered investment capital and more than 2.3 times higher than the same period. Ho Chi Minh City ranked third with a total capital of more than 1.76 billion USD...

Attracting FDI capital is still considered a "race" between provinces and cities. If before the Covid-19 pandemic, familiar names were often mentioned such as Hanoi, Ho Chi Minh City, Binh Duong, Dong Nai... then recently other localities have had spectacular breakthroughs. In addition to Ho Chi Minh City still maintaining its top position, Bac Ninh and Quang Ninh have made strong breakthroughs. In particular, Quang Ninh has risen to the top 3 in 2022 - 2023; Bac Ninh has risen to the 4th position in attracting foreign capital. However, the fact that Bac Ninh has risen to the No. 1 position in 8 months of 2024 in attracting foreign capital still surprises many people. Another name, Ba Ria-Vung Tau, also attracts attention when it is ranked 4th, even in the first 5 months of this year, Ba Ria-Vung Tau has jumped to the leading position, while in 2022, this locality is still ranked 10th...

Economist Dr. Bui Trinh said that it is not surprising that many provinces and cities such as Bac Ninh, Quang Ninh, and Hai Phong have recently risen to the top in attracting FDI capital. In recent years, the transport infrastructure in the northern region has been heavily invested. Expressways from provinces and cities around Hanoi connecting to Hai Phong and Quang Ninh ports have significantly shortened the flow of goods. In return, these localities can easily and quickly connect with the capital Hanoi - the administrative and cultural center of the country. The geographical location combined with convenient transport infrastructure is the biggest advantage in attracting FDI investment of the above localities.

In addition, these provinces and cities also show determination to develop industry and attract FDI capital. For example, Bac Ninh has the largest number of industrial parks in the country and has attracted investment capital from most of the world's corporations such as Samsung, Canon, Foxconn, Nokia, Microsoft... Following these giants are satellite enterprises and supporting industries.

Similarly, Hai Phong has also emerged as a destination to attract FDI capital recently thanks to its geographical advantages and convenient transportation when connecting to international seaports and airports. In 2023, LG Innotek Company increased its investment capital by 1 billion USD in Hai Phong and built a third factory, and is currently the largest investor in Hai Phong. South Korea's SK Group also built the first high-tech biodegradable material factory Ecovance following the logic of "buying with friends, selling with partners". Many foreign corporations may prioritize choosing investment locations when there are some "compatriots" who have come before and operated stably...

Dr. Bui Trinh emphasized: Promoting FDI capital attraction to provinces and cities is a necessary trend. We do not need to encourage investment capital in Hanoi because this is the capital, the administrative and cultural center, not to promote production. Ho Chi Minh City needs to attract FDI in the service and trade sectors rather than building factories. At that time, considering the capital alone, it will not be as high as industrial production projects, so there is no need to compete in the leading group.

Foreign capital still flows into traditional sectors

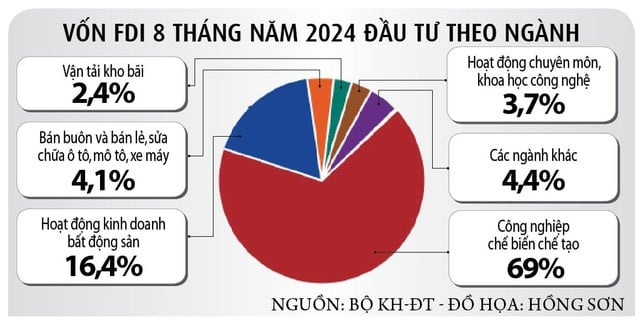

In terms of structure, FDI capital still flows into the manufacturing and processing industry, accounting for 69% of the total newly registered FDI capital. According to economic experts, FDI capital flows into Vietnam in recent years have gradually become selective, with many projects appearing in the high-tech sector, with widespread effects. For example, in addition to the factories that have existed for many years of Intel, Samsung, Canon, Foxconn, LG..., recently we can mention the world's largest semiconductor factory of Amkor Group with an investment capital of 1.6 billion USD in Bac Ninh; Hana Micron Vina Company (Korea) with a semiconductor factory in Bac Giang; Quanta (Taiwan) also signed an agreement with Nam Dinh to develop a computer manufacturing and processing project... However, capital flows into the high-tech and semiconductor sectors still account for a low proportion of the total FDI capital into Vietnam.

Expert Bui Trinh analyzed that, looking at the overall data, there has not been much change in the investment structure of foreign investors. Capital flows into professional activities, science and technology are lower than those in the wholesale and retail industry and far behind the real estate sector. The reason is partly because many countries are also competing to attract this capital flow. On the other hand, Vietnam has not yet developed basic technology. For example, when it comes to semiconductors or artificial intelligence (AI), Vietnam does not have any truly outstanding technologies that it has invented or mastered, so in the future it may still "rely" on FDI to develop this field.

“Foreign corporations increasing their investment in Vietnam shows that they still highly appreciate Vietnam’s development potential, especially when the trend of choosing countries to invest in other than China is still ongoing. The most important thing is to retain foreign investors in the long term after attracting FDI. The first factor is the stability of policies in Vietnam so that investors do not panic or worry,” Mr. Bui Trinh added.

Prof. Dr. Nguyen Mai, Chairman of the Association of Foreign Investment Enterprises, said that a big challenge is that Vietnam is shifting its priority to attracting FDI in future technology, innovation, and clean energy industries, but there are no corresponding policies and mechanisms; some investment incentive policies have been issued but have not met the demands of investors. Meanwhile, there is a shortage of skilled labor, electricity supply is not guaranteed in quality, and there is a shortage of local raw materials in some industries and localities. Therefore, to adapt to the restructuring of the supply chain, Vietnam needs to improve many factors to enhance its competitiveness and attractiveness to foreign investors, of which infrastructure and supply chain connectivity are especially important; improve the quality of human resources and innovation capacity to elevate the value chain, participate more effectively and deeply in the global supply chain.

There is no clear mechanism for attracting investment in wind power.

Recently, after Orsted (Denmark), Norwegian wind power investor Equinor has also confirmed the cancellation of its offshore wind power investment plan in Vietnam. According to energy experts from the Science Council - Vietnam Energy Association, there are some persistent problems in the implementation of offshore wind power projects, such as the unclear authority to assign sea areas, allowing organizations to use sea areas to carry out measurement, monitoring, investigation, exploration, and survey activities to serve the establishment of offshore wind power projects. A series of regulations need to be added to the Electricity Law, the Law on Natural Resources and Environment of Seas and Islands... The fact that for a long time Vietnam has not yet found a clear and unified policy and mechanism, especially the mechanism for selecting investors, the price mechanism and electricity purchase and sale... has somewhat discouraged famous wind power investors in the world.

Attracting FDI focuses on local advantages

To continue attracting FDI in the coming time, the special focus is on planning green industrial parks, low net emissions, energy balance, selecting high-tech investors, green energy. In particular, directing investment to selected fields with effective protection and incentive mechanisms. For example, the Southern and Central regions have the greatest advantage in renewable energy. FDI attraction policies of these regions must show investors their immediate benefits related to the use of renewable energy. In addition, factors of transparency, reducing informal costs, increasing friendliness and perfecting regulations on green transformation, digital transformation, circular economy, netzero in attracting FDI also need to be focused on each industrial park, locality based on the existing policy framework such as the Politburo's orientation resolution, Power Plan 8, etc.

Associate Professor, Dr. Nguyen Thuong Lang

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)