Visiting her old school in Vietnam, Tran Thi Ngoc Guong was surprised to see all the students curious about the field she works in: chip design. “People asked a lot of questions and very detailed questions,” she said.

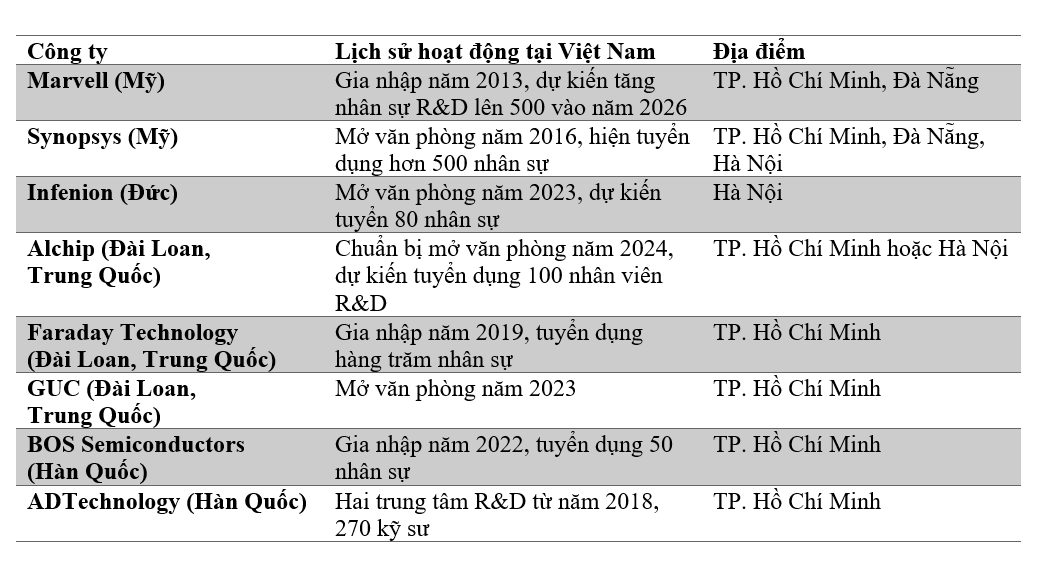

Much has changed in the five years since Guong graduated. She is now a senior physical design engineer at US chip developer Marvell. Many new students are majoring in semiconductors. The Vietnamese government aims to train at least 50,000 chip engineers and designers by 2030.

“I never thought I would work in such a hot field,” Guong, 26, told Nikkei from his office in Ho Chi Minh City.

Nikkei commented that the heat of the semiconductor industry is a combination of many factors: the demand for chip engineers has skyrocketed in the AI boom; the shift in supply chains has boosted the demand for local human resources; and a serious labor shortage in traditional chip economies such as South Korea, Taiwan (China), and the US.

Alchip Technologies, a leading provider of AI chip design services from Taiwan, is expanding its R&D team in Vietnam, where it plans to open its first office this year. The company is likely to increase its headcount to as many as 100 engineers within two to three years, Chief Financial Officer Daniel Wang said.

According to CEO and Chairman Johnny Shen, after evaluating several Asian destinations, “Vietnam’s promising engineering talent pool and strong work ethic made Vietnam a very attractive option for us. We were impressed by the dedication and commitment of Vietnamese engineers who are eager to learn and contribute.”

Also coming to Vietnam to look for young engineers are GUC and Faraday Technology, a provider of chip design services to TSMC and UMC.

South Korean companies are also turning to Vietnam, partly to offset the brain drain at home. Vietnam featured heavily in recent discussions between business leaders and Oh Young-ju, the minister of small and medium enterprises and startups, according to Nikkei.

Strategic location for developing technical talent

South Korean semiconductor company BOS Semiconductors came to Ho Chi Minh City to set up a support team. During the work between the two countries, comparing the two teams, the quality of Vietnamese engineers convinced the company to upgrade the team. “They realized this could be a major R&D center. It was really surprising,” said country manager Lim Hyung Jun.

BOS designs AI chips for carmakers like Hyundai. Mr. Lim said achieving the goal of designing SoC chips in Vietnam would demonstrate local ingenuity . “It could shape a market trend,” he said.

BOS has about 50 employees in Ho Chi Minh City, including design director Nguyen Hung Quan. He said his colleagues are “very excited” to work on issues like high-speed data transmission, which will help them gain more skills. “In Vietnam, we are in the R&D phase. Manufacturing is difficult and expensive, but this will help us move in the right direction.”

ADTechnology, a compatriot of BOS, is operating two research centers in Ho Chi Minh City.

Having tech talent available during a time of scarcity could help Vietnam achieve its goal of increasing supply chain value. Marvell describes Vietnam as a “strategic location for developing technical talent.”

Le Quang Dam, an industry veteran, helped launch Marvell’s first office here. His team has grown from just a few dozen engineers in the early years to more than 400 now. Dam, general director of Marvell Vietnam, said Vietnam will become Marvell’s third-largest chip design hub, behind only the US and India.

Marvell wants to increase its local workforce to 500 by 2026. The hiring plan includes not only staffing its Ho Chi Minh City office but also a new location in Da Nang. After 11 years, the Vietnamese team “will be able to do cutting-edge chip technology R&D,” Dam said.

Unlike low-tech sectors, Marvell’s operations in Vietnam require advanced technical skills. The majority of Dam’s team members are young – in their 20s or 30s – and more than 20% are female.

Meanwhile, Synopsys – the world’s leading chip design tool maker – is among the most active investors in Vietnam, where it has more than 500 employees in multiple design centers in cities. “The high level of interest from Vietnamese students and a trained workforce in semiconductor engineering, combined with funding and government programs, will help establish Vietnam as a semiconductor talent hub,” said Robert Li, vice president of sales for Synopsys, Taiwan (China) and Southeast Asia.

According to Li, the Synopsys team in Vietnam is tackling some of our customers’ most important challenges. A prime example is the team’s pivotal role in developing the industry’s first UCIe interconnect chiplet-based test chip, which will be announced in 2023 in collaboration with Intel.

Brian Chen, an expert at KPMG, said that the demand for high-level technical skills in Vietnam is greater than the supply as many companies move to Southeast Asia. He said there is still a lot of room for talent to grow. In the chip design field alone, he believes that each company will hire at least 300 to 500 people for the Vietnam office.

In addition, compared to Taiwan (China) or South Korea, the productivity and salary of engineers in Vietnam are also more attractive factors thanks to cost efficiency. Mr. Chen pointed out that Ho Chi Minh City is still the number one choice of foreign companies because of its quality of life and dynamism. Hanoi will be the next destination.

(According to Nikkei)

Source: https://vietnamnet.vn/viet-nam-thoi-nam-cham-cua-nganh-ban-dan-the-gioi-2312734.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)