Vietnam Aims to Become Asia's Next Industrial Hub

Each country in the Asian region has its own competitive advantages, but Vietnam has the outstanding characteristics to aim for the position of the region's next industrial hub.

|

| Opportunities for the Vietnamese market lie in a number of industries, including rubber and plastic products. Atnh: Le Toan |

Significant opportunities in Southeast Asia and India

The global economy is highly integrated. Free trade networks, infrastructure development, global mobility and technology are just some of the factors that have supported globalization over the past 30 years. Economies are arguably more interconnected than ever before in history. However, the evolving geopolitical landscape is impacting this global interconnectedness.

This is especially true for manufacturing industries. Many countries and companies are looking to develop their supply chain networks by moving production and manufacturing “closer to home.” For example, domestic policies such as the US Science and Chips Act, the German Supply Chain Act, and the UK Critical Imports Council are promoting reshoring or reshoring.

In the Asia-Pacific region, this trend is evident in the China+1 strategy, a diversification strategy in which companies increase their manufacturing bases outside of China. The goal is to minimize the risk of supply chain disruption by reducing dependence on one country.

The relocation of manufacturing outside China has had a relatively small impact on China’s share of global exports. Meanwhile, the impact has been felt mainly in the host countries, especially Southeast Asia and India, leading to increased manufacturing opportunities in these regions. Governments are recognizing these opportunities and are implementing more policies to promote domestic manufacturing industries.

Companies are starting to respond, but need to be flexible in the face of ongoing uncertainty. Location and capital choices will be key to companies’ success. Alternative financing sources and new leasing options are becoming more available. This is helping manufacturers set up quickly and be able to pivot as needed, should global trade and supply chains change again.

The wave of foreign direct investment (FDI) in global manufacturing has been shaped by a complex interplay of economic, technological and geopolitical factors. Companies need to carefully evaluate various factors such as cost, market access, infrastructure, labor and government support before determining their global manufacturing investment strategy.

The above development context has created significant opportunities in Southeast Asia and India. This is reflected in the significant increase in FDI. The driving force behind this trend is not only the need to diversify supply chains, but also to take advantage of the region’s favorable fundamentals. These fundamentals include a large population and labor force, favorable costs, and various incentives.

From a manufacturing investment perspective, these factors position Southeast Asia and India as new important manufacturing hubs for the global market.

|

| Ms. Trang Le, Senior Director of Research and Consulting, JLL Vietnam |

The case of Vietnam

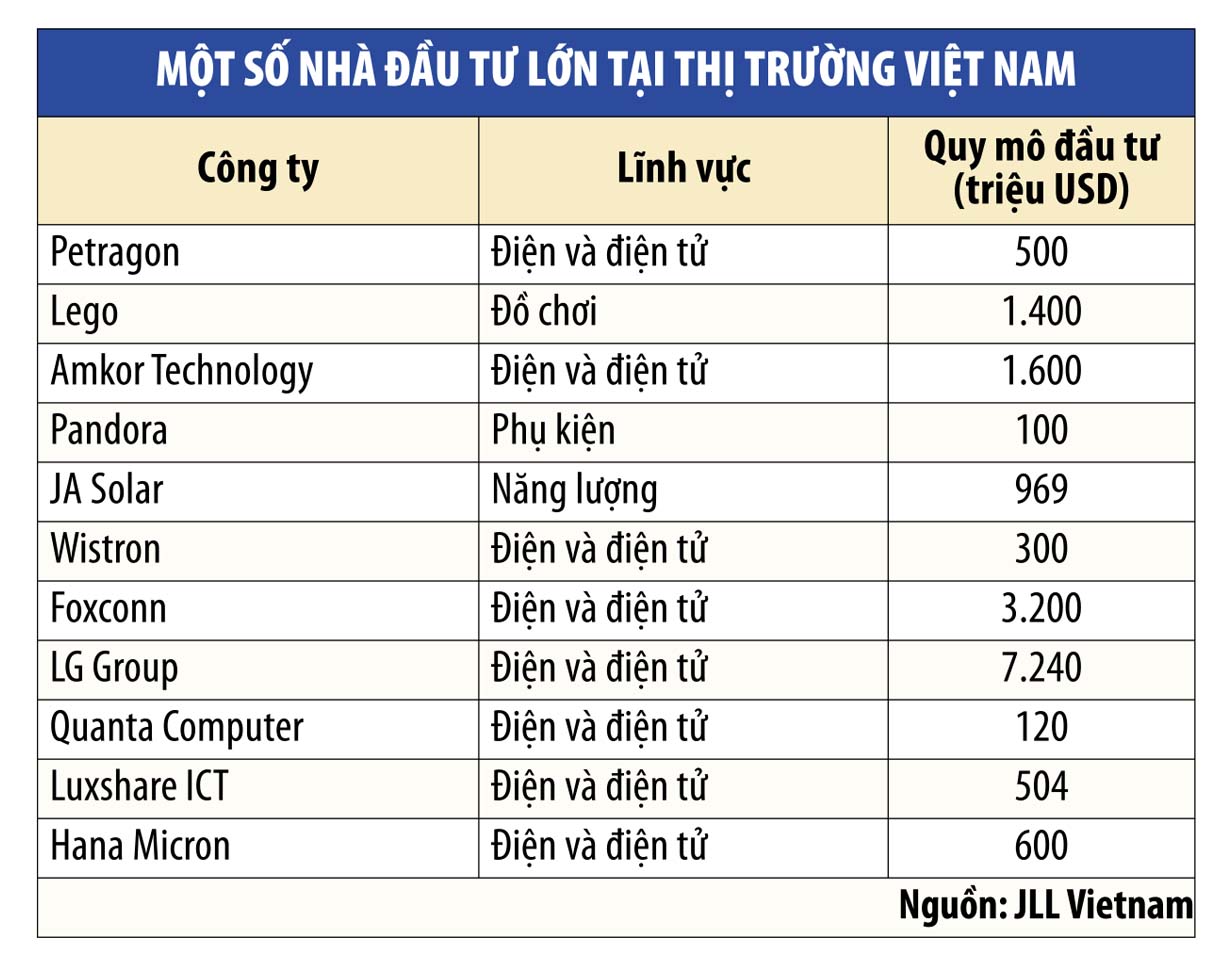

One of the key questions for manufacturers when deciding to invest in developing additional production facilities in the Southeast Asia - India region is which country should be their destination. Each country has its own competitive advantages, but Vietnam's industrial base has outstanding features for manufacturers to set up facilities here. This brings opportunities and potential in developing production facilities, as well as demand for warehouse and supply chain services and utilities in the future.

From the young, growth stage, through the development stage and moving to the highly developed stage, manufacturing products and value-added services have progressed from basic products with little added value content, to mostly high-tech products with a few intermediate industries.

In terms of resource use, the Vietnamese market is shifting from labor-intensive when it was young to less labor-intensive processes and the proportion of capital-intensive industries is gradually increasing.

In terms of industrial real estate types, from low construction density, mainly concentrated near ports and airports, low construction technical standards, Vietnam is witnessing the launch of higher quality warehouse real estate products, more efficient design and also more attention to sustainability factors.

The market is also witnessing the participation of diverse players. From a market that was purely a playground for the public sector or domestic enterprises, Vietnam is welcoming the participation of professional and foreign investors with a lot of development experience in recent years.

Opportunities for the Vietnamese market lie in the computer and electronics, chemicals, fabricated metal products, rubber and plastic products, textiles and food processing industries. Of these, electronic computers are the largest industry in Vietnam, accounting for 17.8% of the country's output.

|

In 2023, Vietnam exported $57.3 billion worth of electronic equipment, computers and computer components; and $52.4 billion worth of phones and related parts, accounting for 31% of the country's total export turnover. Vietnam has advanced from 47th place in 2001 to become one of the world's top 10 electronics exporters in 2021.

The industry is poised to play a key role in Vietnam’s economic development and is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% from 2024 to 2028.

The total export value of fabricated metal products is expected to reach USD 16.3 billion by 2023. The industry is forecast to grow at a CAGR of 8.7% from 2024 to 2028.

Rubber and plastic products are also leading the market with a total value of USD 25 billion by 2022 and expected to grow at a CAGR of 8.6% from 2023 to 2027.

Vietnam is the third largest textile and garment exporter in the world. In 2023, the export value reached about 40.3 billion USD (to more than 100 markets), expected to increase to 44 billion USD by the end of 2024.

Last but not least is food processing. With a turnover of about 18 billion USD in 2022, Vietnam's food processing market ranks third in Southeast Asia. The market is forecast to grow at an average annual rate of 8.2% from 2023 to 2027.n

(*) Senior Director of Research and Consulting, JLL Vietnam

Source: https://baodautu.vn/viet-nam-huong-den-vi-the-trung-tam-cong-nghiep-tiep-theo-cua-chau-a-d220968.html

Comment (0)