Japan is one of the countries heavily affected by the US-China rivalry, although the economies of Tokyo and Beijing appear to be decoupling, in reality the two sides are just going through a period of structural change.

|

| As of 2023, China is Japan's largest trading partner, and Tokyo is Beijing's second-largest trading partner after the United States. (Source: China Daily) |

Japanese initiative, not US-China competition, is driving structural changes in Tokyo's economic security policy.

China's sudden restriction of rare earth exports to Japan in 2010 amid the Senkaku/Diaoyu Islands dispute was a wake-up call for Japan, and since then, Tokyo has made efforts to reduce its over-reliance on Beijing.

Japan has a roadmap to address this situation. In 2020, the Ministry of Economy, Trade and Industry introduced measures to help Japanese companies shift production from China to Southeast Asia or domestically.

Tokyo will also enact a sweeping Economic Security Law in May 2022, providing a legal basis for economic security policies. Under the law, Tokyo will align its policies with Washington and Amsterdam by tightening export restrictions on technologies related to semiconductors and quantum computing.

In the same year, China accounted for about 20% of Japan's imports and exports, showing a downward trend as Japan's main exports to China are products related to the semiconductor industry.

Recent developments have also shown a decoupling of the Japanese and Chinese economies. After Mitsubishi Motors withdrew from China, Honda immediately planned to reduce its manufacturing workforce in the country of a billion people. In addition, the fact that only 60-70% of Japanese companies are profitable in China has caused 30-40% of Tokyo companies to gradually withdraw from Beijing's market.

But these trends do not reflect a decoupling of the two economies, but rather the dramatic structural changes that the Japanese and Chinese economies are undergoing.

Asia-Pacific is still moving towards regional economic integration, despite the emergence of counter-globalization in many places. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Regional Comprehensive Economic Partnership are examples of this, which will come into effect in 2018 and 2022, respectively.

Japan, China and South Korea have agreed to resume negotiations on a trilateral free trade agreement at a summit in May 2024, signaling that the leaders of the three countries continue to value and strengthen regional economic relations.

The goal of Japan’s economic security initiative is to build “small yards, high fences.” Of the 87 companies that received government subsidies in June 2020, most produce strategic materials such as aircraft parts and medical equipment. As such, JETRO projects are only for small and medium-sized enterprises.

Most importantly, Japanese companies are adjusting the way they do business and most are not separating themselves from China.

Faced with challenges such as rising labor costs and tense political relations between the two countries, Japanese companies began adopting the “China plus one” strategy in the early 2010s. This strategy encourages companies to diversify their supply chains and production activities outside of China to reduce risks, typically by shifting business operations to ASEAN countries.

In addition, to cope with the disruptions in supply chains caused by the Covid-19 pandemic, many Japanese companies have adopted a “China for China” strategy. That is, instead of manufacturing goods and selling them elsewhere, businesses are developing deeper into China’s growing domestic market.

Like many global companies doing business with China, Japanese companies have undergone a significant change in how they formulate business strategies since the Ukraine conflict, prioritizing geopolitical considerations over macroeconomic forecasts.

The change in mindset of Japanese companies also contributes to strengthening the “China for China” strategy they are adopting.

New technology has created a new business model for trade between the two countries - e-commerce. In 2022 alone, Chinese consumers bought $14.4 billion worth of Japanese products via e-commerce platforms.

The economic interdependence in Japan-China relations may not be easily broken. As of 2023, China will remain Japan's largest trading partner, and Tokyo will be Beijing's second-largest trading partner after the United States.

Source: https://baoquocte.vn/vi-sao-nhat-ban-chua-the-tach-roi-kinh-te-voi-trung-quoc-276584.html

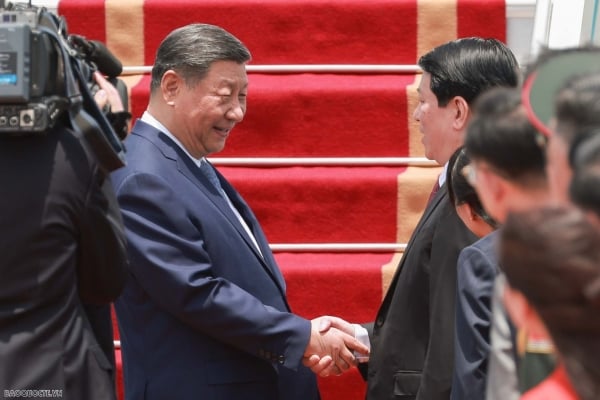

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)