According to the Economic Times, gold prices in India in the 2023-2024 financial year have increased by 11%, nearly double the country's retail inflation index of 5.7%. Compared to the international market, Indian gold prices have also grown significantly compared to the 10% growth of international gold prices on the Comex floor.

|

| Gold jewelry in India. Photo source: Dhiraj Singh, Bloomberg. |

According to Ms. Kavita Chacko, Head of India Research at the World Gold Council, the reason for the high gold price in India comes from the slow growth of the US economy, which has led to a decrease in the USD and US Treasury bond interest rates, along with geopolitical tensions in the past year.

According to a survey by the Economic Times, investors in India are optimistic about the prospects of gold in the next financial year, amid the loosening of global monetary policy and the expectation of the US Federal Reserve (FED) to cut interest rates later this year. Moreover, the recovery of the Chinese economy and geopolitical concerns are likely to push gold prices higher.

Forecasting the future of gold prices next year, Mr. Anuj Gupta - Head of Commodities & Currencies at HDFC Securities Finance Company, expects the spot price of gold on the Comex floor to reach $2,250 - $2,300/ounce. Similarly, Mr. Naveen Mathur, Director of Commodities & Currencies at Anand Rathi Shares, predicts that gold prices could reach a record high of $2,280/ounce in the first half of 2025.

Moreover, demand for gold could increase next year as central banks buy gold to diversify their reserves. “This is a great opportunity for investors,” Praveen Singh, vice president of currencies and commodities at investment bank BNP Paribas, told the Economic Times. He predicted gold prices would reach $2,600 an ounce in the future.

However, Mr. Praveen Singh also warned of potential risks from inflation in the US, in the context of the US economic growth that could force the Fed to pause or narrow its monetary easing plan. If the Fed continues to raise interest rates this year, the yield on 10-year US bonds will skyrocket, which could put pressure on gold prices.

Forecasting that gold prices may fluctuate in the future, Mr. Praveen Singh suggested that consumers should only invest in gold once the market has cooled down. A representative of the financial research company Equitymaster (India) also advised investors to keep a minimum of 5-10% of their investment in gold. In particular, in recent times, gold prices in the world have continuously fluctuated and reversed.

|

| World gold price fluctuation chart, recorded at 11:20 on March 25, 2024 |

As of 11:20 a.m. on March 25, 2024, the world gold price was at nearly 2,170.47 USD/ounce, an increase of about 5.16 USD compared to the previous day (March 24).

On the Kitco floor, the gold price closed the weekend session at 2,164 USD/ounce. The gold futures price for April 2024 delivery on the Comex New York floor traded at 2,166 USD/ounce.

|

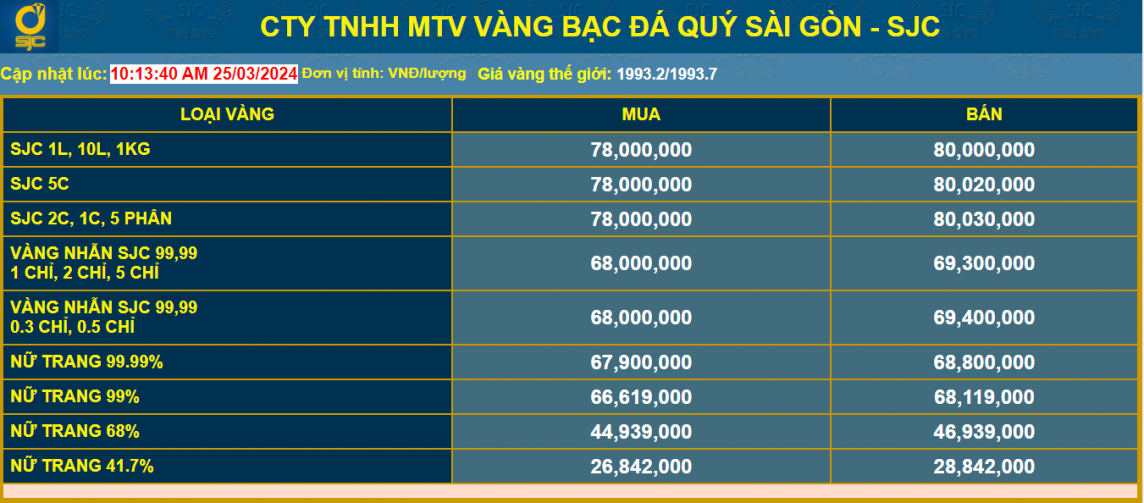

| Gold price at Saigon Jewelry Company Limited - SJC, recorded at 11:20 on March 25, 2024 |

Early morning of March 25, 2024, SJC's 9999 gold price increased by 300 thousand VND/tael in buying price and remained unchanged in selling price compared to the closing price of last weekend's trading session, at 80.3 million VND/tael (selling price).

Recorded at 11:20 a.m. on March 25, 2024, the price of SJC gold at Saigon Jewelry Company Limited - SJC was at 78 million VND for selling, and 80 million VND for buying.

According to experts, the price of SJC gold cooled down quickly and narrowed the gap with the world in the context of the market expecting new moves on proposals to manage gold bars in the direction of removing the monopoly of SJC gold, granting licenses to a number of qualified businesses to produce SJC gold and gold rings.

In the context of gold prices continuing to fall sharply, many experts recommend that investors and people who buy gold at a price lower than the purchase price at this time should consider selling gold to make a profit. The reason is that the domestic gold market is being affected by the world gold market after the announcement of a dovish statement from the FED. Not to mention, the domestic gold market is "holding its breath" waiting for specific management instructions from the Government and the State Bank.

Source

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)