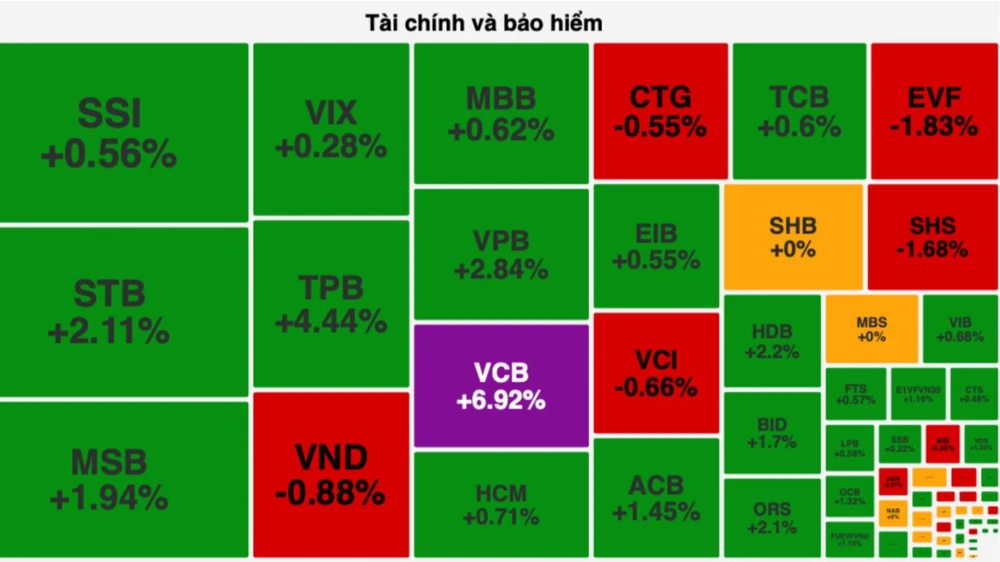

Banking stocks and the Vingroup trio increased sharply, pushing the VN-Index above 1,250 points. Of which, Vietcombank's VCB stock alone increased to the ceiling, contributing about 8 points out of the 17 points of the VN-Index's increase.

The stock market continued to increase strongly on February 28 thanks to large-cap stocks. In particular, the banking stocks that contributed the most to the strong increase of VN-Index were VCB, TPB, up 4.44%, VPB, up 2.84%, HDB, up 2.2%, STB, up 2.11%, MSB, up 1.94%, BID, up 1.7%, ACB, up 1.45%, OCB, up 1.32%; TCB, MBB, EIB, VIB, up nearly 1%.

Securities stocks also turned green: ORS increased by 2.1%, VDS increased by 1.29%; SSI, VIX, HCM, FTS, CTS increased by nearly 1%.

Vietcombank's VCB shares hit the ceiling after the bank finalized a plan to use nearly VND21,700 billion of 2022 profits to pay dividends. Accordingly, Vietcombank plans to pay 2022 dividends in shares at a rate of 38.79%, causing the bank's shares to "surprise", hitting the ceiling to VND97,400/share.

The real estate - construction group was sold off heavily, so it leaned towards red: CEO decreased by 1.35%, DIG decreased by 1.28%, NTL decreased by 1.47%; NVL, PDR, VCG, DXG, TCH, NLG, LCG, HHV, CII, BCG decreased by nearly 1%. However, the Vingroup trio increased quite strongly with VRE increasing by 5.3%, VIC increasing by 1% and VHM increasing by nearly 1%, also contributing to the strong increase of VN-Index.

In addition, the oil and gas group also traded quite positively with PVD hitting the ceiling, BSR up 3.59%, PVS up 1.92%... In addition, many manufacturing stocks also increased quite well: BAF up 6.35%, DBC up 1.68%, DCM up 1.19%, DPM up 1.01%, MSN up 1.04%...

At the end of the trading session, VN-Index increased by 17.09 points (1.38%) to 1,254.55 points with 309 stocks increasing, 180 stocks decreasing and 67 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index decreased slightly by 0.22 points (0.09%) to 235.16 points with 97 stocks increasing, 82 stocks decreasing and 62 stocks remaining unchanged. Liquidity decreased slightly compared to the previous session but remained high with a total trading value on the HOSE floor of about VND22,700 billion, down about VND400 billion compared to the previous session.

Foreign investors continued to net buy for the third consecutive session on the HOSE floor with a total purchase value of nearly 222 billion VND.

Nhung Nguyen

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)