Hoa Phat Group Joint Stock Company (HPG) has just announced its business results for the fourth quarter of 2023 with revenue reaching VND 34,925 billion, up 33% over the same period in 2023. Profit after tax recorded VND 2,969 billion, up 48% over the previous quarter. This is the quarter in which Hoa Phat achieved the best business results of the year.

Accumulated for the whole year of 2023, Hoa Phat achieved 120,355 billion VND in revenue, down 16% over the same period last year. Profit after tax was 6,800 billion VND, equivalent to completing 85% of the yearly plan.

In 2023, Hoa Phat produced 6.7 million tons of crude steel, down 10% compared to 2022. Sales of HRC steel products, construction steel, high-quality steel and steel billets reached 6.72 million tons, down 7%. Of which, construction steel and high-quality steel reached 3.78 million tons, down 11% compared to the same period last year. HRC hot-rolled coil recorded nearly 2.8 million tons, up 6% compared to 2022.

From the beginning of August 2023, Hoa Phat branded container shell products were also introduced to the market. In addition, other sectors such as livestock, home appliances, etc. also brought good business results.

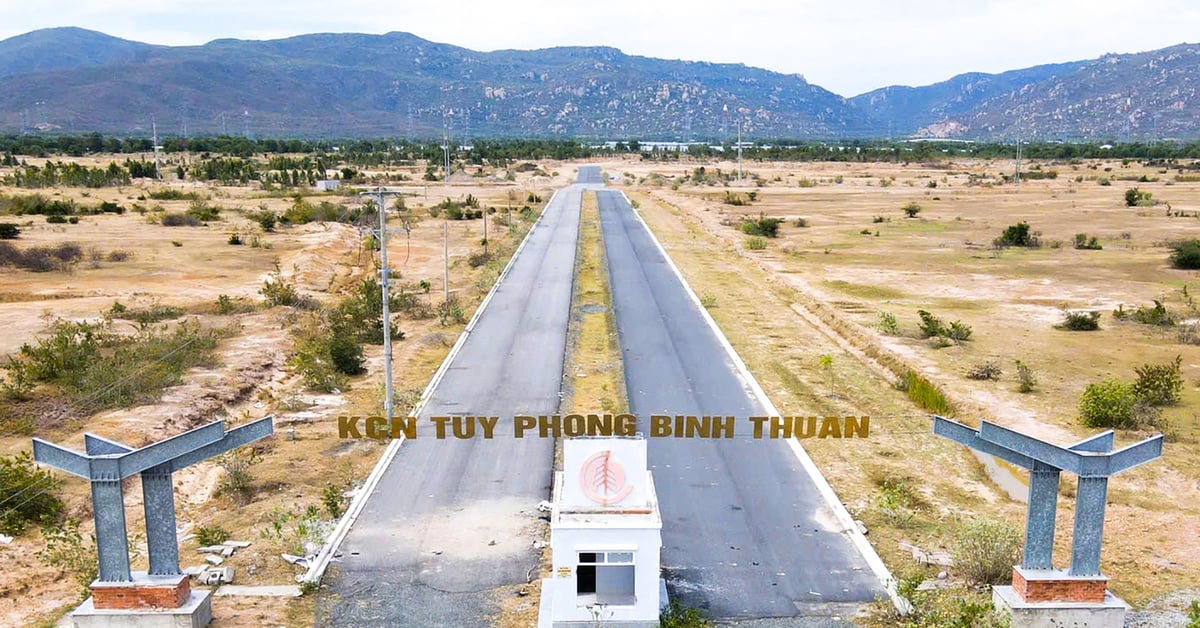

Sharing at the 2023 Shareholders' Meeting at the end of March 2023, Mr. Tran Dinh Long said that in 2023, HPG will not pay dividends in cash or shares to have investment. The total investment in phase 2 for Dung Quat in fixed assets alone is 75,000 billion (over 3 billion USD). According to Mr. Long, by the end of 2024 or early 2025, when Dung Quat 2 factory comes into operation, Hoa Phat will increase its revenue by another 80,000 - 100,000 billion VND, from the base of 150,000 billion as last year.

Up to now, Dung Quat 2 Project has achieved 45% progress, in line with the plan. When completed, the Group's steel production capacity will reach more than 14 million tons of crude steel/year, putting Hoa Phat in the Top 30 largest steel enterprises in the world from 2025.

Mr. Long affirmed that the most difficult period of the steel industry has passed. The internal strength of the steel industry and Hoa Phat is currently very good. However, everything now depends on market demand.

Recently, Forbes magazine (USA) has just announced the list of world billionaires in 2023. Vietnam has 6 representatives. Chairman Tran Dinh Long rose to the 3rd position among Vietnamese businessmen, with 1.8 billion USD, after a period of decline (and once falling off the list).

Last year, Mr. Long made a large stock transaction to sell to his son. Mr. Tran Vu Minh bought 16.32 million shares from Mr. Tran Dinh Long on November 1, 2023.

Listed company news

The stock market has a number of other important events of listed companies.

* HAG : Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc, Chairman of the Board of Directors of Hoang Anh Gia Lai JSC, bought 1 million shares on January 19 by order matching. Ms. Hoang Anh currently owns 11 million shares, accounting for 1.19%.

* POM : Ms. Do Thi Kim Cuc, sister of Mr. Do Duy Thai, Chairman of the Board of Directors of Pomina Steel JSC, registered to sell all of her more than 3.14 million shares. The transaction is expected to take place from January 25 to February 22 by negotiation and order matching.

* NLG : Mr. Van Viet Son, CEO of Nam Long Investment Corporation, registered to sell 120,000 shares from January 26 to February 24 by negotiation and order matching.

* TNC : Ms. Duong Thi Kieu Anh, an individual related to Mr. Le Trung Duc, a member of the Board of Directors of Thong Nhat Rubber JSC, sold all of her nearly 390,000 shares, a ratio of 2.03%. The transaction was carried out on January 17 by negotiation.

* EIB : Eximbank said that pre-tax profit in 2023 reached VND 2,720 billion, down 26.7% compared to 2022. By the end of 2023, the bank's total assets were VND 201,399 billion.

* FPT : In 2023, FPT recorded revenue of VND 52,618 billion and pre-tax profit of VND 9,203 billion, up 19.6% and 20.1% respectively over the same period last year. After-tax profit for parent company shareholders reached VND 6,470 billion, up 21.8%.

* DGC : Duc Giang Chemicals Joint Stock Company announced its financial statements for the fourth quarter of 2023 with net revenue in the quarter reaching VND 2,388 billion. The company's gross profit reached VND 784 billion, down 39% over the same period. Accumulated for the whole year of 2023, DGC recorded VND 9,748 billion in net revenue and VND 3,109 billion in profit after tax for shareholders of the parent company.

* TCB : Techcombank reported pre-tax profit of VND5,773 billion in the fourth quarter of 2023, up 22% year-on-year. Full-year profit reached VND22,888 billion.

* DHB : Ha Bac Fertilizer and Chemical Joint Stock Company announced its business results for the fourth quarter of 2023 with an extraordinary profit of VND 1,649 billion.

* SGB : SaigonBank announced pre-tax profit in the fourth quarter of 2023 reaching 84 billion, up 9,249% over the same period. Accumulated in 2023, SGB's pre-tax profit was 332 billion VND, up 40%.

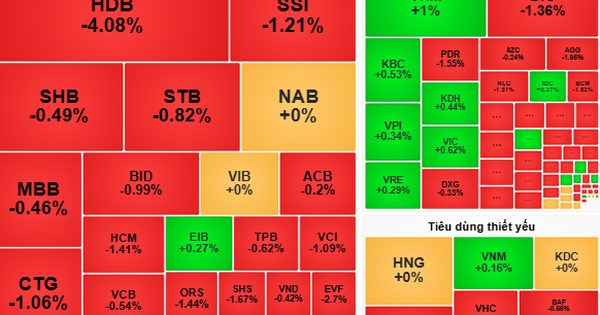

VN-Index

At the end of the session on January 22, VN-Index increased by 1.36 points (+0.12%), to 1,182.86 points. Total trading volume reached approximately 890 million units, worth VND 18,739.2 billion.

HNX-Index increased 0.29 points (+0.13%) to 229.77 points. Total matched volume reached 63.78 million units, worth VND1,179.86 billion.

UPCoM-Index increased by 0.25 points (+0.25%), to 87.72 points. Total matched volume reached more than 30.43 million units, worth 496 billion VND.

According to Yuanta Vietnam Securities, the market is likely to continue its upward trend and the VN30 index may rise to 1,210 points in the next session. At the same time, cash flow tends to return to the Midcaps group of stocks, so the market breadth is showing more positive developments and short-term risks remain low.

Although the VN-Index and VN30 are entering the short-term resistance zone, investors can buy and hold short-term portfolios, especially there are still many new buying opportunities in this period.

KB Securities Vietnam (KBSV) believes that the VN-Index formed a candlestick pattern with a short leg, along with increased liquidity and a few leading sectors, helping the index avoid a negative decline. It is likely that the index can continue to maintain its upward momentum to the expected target area set around 1,185 (+/-10) points.

Investors are recommended to flexibly buy/sell in both directions with low proportions at support/resistance zones, specifically around 1,145 (+/-5) points and around 1,185 (+/-5) points.

Source

Comment (0)