In 2024, the Vietnamese primary corporate bond market will record a total issuance value of VND443,000 billion, a sharp increase compared to VND311,240 billion in 2023.

In 2024, real estate will still face many difficulties - Photo: TU TRUNG

Although the amount of money mobilized is large, banks still hold the leading position with the value of corporate bond issuance reaching nearly 300,000 billion VND, showing that the recovery of the real estate group and other sectors still has many things to discuss.

Speaking to Tuoi Tre , experts said that the above figures reflect that businesses are still having difficulty accessing long-term capital and financial pressure remains high.

The bond market, which was expected to reduce the burden on banks, is now a channel for banks to borrow and then lend to businesses.

Why are banks rushing to issue bonds?

In its 2024 corporate bond report, Fiinratings, a Vietnamese credit rating agency, said that Vietnam’s primary corporate bond market recorded a strong breakthrough with a total issuance value of VND443,000 billion. This is a positive sign, reflecting the great attraction of this capital mobilization channel.

However, according to Fiinratings, the banking industry still holds the leading position with an issuance value of nearly VND300,000 billion, accounting for 67.1% of the total market.

"Bank dominance not only demonstrates financial strength but is also an important driving force for economic recovery," Fiinratings assessed.

The real estate sector saw a significant decline of -18.7%, with issuance tenors shortening to 2.65 years from 3.72 years in 2023 and coupon rates rising to 11.13% from 10.93% last year.

This figure, according to the report's publisher, reflects the difficulty in accessing long-term capital and the great financial pressure of real estate enterprises in the context of the market not yet strongly recovering.

According to MBS's statistics, some banks with the largest corporate bond issuance value since the beginning of the year include: ACB (VND 36,100 billion), HDBank (VND 30,900 billion), Techcombank (VND 26,900 billion)...

Mr. Nguyen Quang Thuan - Chairman of Fiinratings - said that looking at the structure of corporate bond issuance in 2024, banks dominate while bonds mobilized directly for production and business are still very limited at VND 145,000 billion.

Not to mention, capital mobilization through issuing shares on the stock market reached 75,000 billion VND mainly due to bank and securities stocks.

"Mobilizing medium and long-term capital for investment in the private enterprise sector is still too limited, we cannot rely solely on FDI forever. This is a challenge for Vietnam's target of high economic growth of 8% in 2025 and the coming years," Mr. Thuan commented.

Associate Professor Dr. Nguyen Huu Huan, senior lecturer at Ho Chi Minh City University of Economics, said that banks have increased issuance through the bond channel to stabilize capital sources.

"Deposit interest rates are gradually increasing, issuing bonds is more popular because of its stability. Even though deposit interest rates are higher than bonds, in return, with long terms of 5-7-10 years, there is no need to worry about withdrawals affecting liquidity, banks will be more proactive in calculating capital sources," said Mr. Huan.

Explaining why the production and business sector is "absent" from the bond market, Mr. Huan said that this channel is mainly aimed at businesses that want to mobilize medium and long-term capital such as real estate, energy...

Meanwhile, many manufacturing enterprises often want to supplement short-term working capital. Not to mention, there are not many enterprises qualified to issue, the issuance cost is very high and the interest rate must be attractive.

"It is even more difficult to issue to the public. It must meet the issuance standards from the management agency, have prestige, and have a high credit rating to hope for investors to buy...", Mr. Huan said.

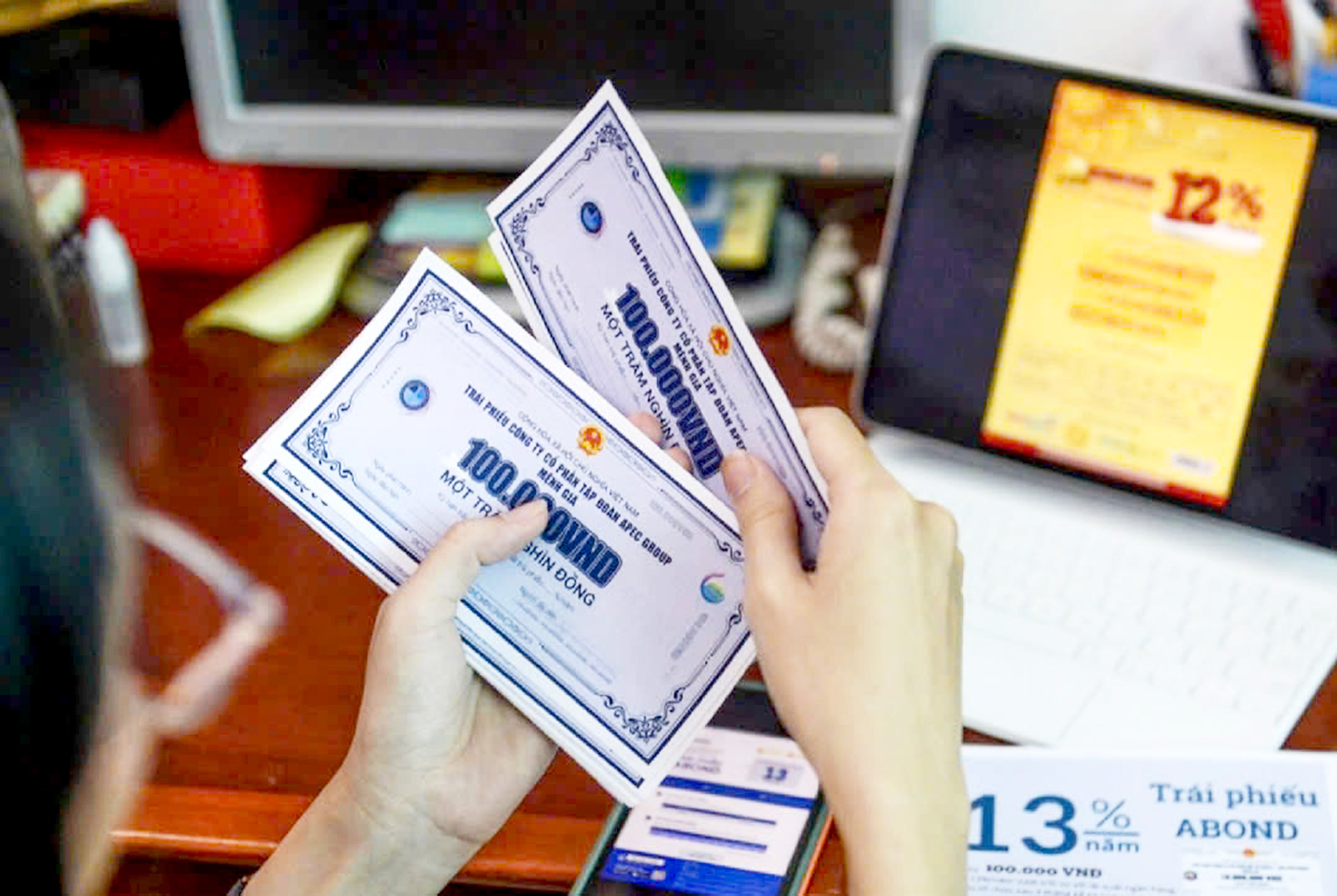

Real estate corporate bonds have not recovered - Photo: QUANG DINH

2025 will be better

Mr. Duong Thien Chi - analyst of VPBank Securities (VPBanks) - said that the real estate market in general and the corporate bond market in particular have not really been cleared despite many efforts from the Government.

According to data from VPBanks, the total maturity value in 2025 will reach more than VND221,000 billion. Of which, real estate accounts for 48%, reaching nearly VND107,000 billion. "Maturity pressure in 2025 will be concentrated in the second half of the year and less pressure in the first half of the year.

However, we believe that in the first half of 2025, the market will continue to face many challenges and opportunities, depending on a series of macroeconomic factors, management policies, and capital needs of enterprises," Mr. Chi commented.

Mr. Nguyen Huu Huan predicts that in 2025, banks will still be the "dominant" group in the corporate bond market with a high issuance volume. However, the expert is concerned that this trend is not reflecting the true role of the corporate bond market.

Normally, enterprises will borrow directly through corporate bonds or borrow indirectly from financial institutions, including credit institutions.

"Banks are now borrowing large amounts in the bond market, then lending them back to businesses, enjoying the interest rate difference," Mr. Huan worries, wondering if the bond market is "distorted".

"The bond market, which was expected to ease the burden on banks, is now a channel for banks to borrow and then lend to businesses. It should have created a vibrant playground for businesses and "creditors" to meet directly, not through intermediaries, to ensure capital sources with attractive interest rates, thereby promoting a reduction in capital costs and increasing profit margins," Mr. Huan analyzed.

The expert emphasized the need for solutions for businesses to directly participate in the capital market, mobilize capital with reasonable interest rates, promote production and business, and ensure that the corporate bond market will reduce the burden of credit capital.

At the same time, further promoting the secondary trading market, increasing liquidity for bonds, Mr. Huan proposed. "The trading floor already exists but is not really vibrant and close to investors," Mr. Huan said, adding that the legal corridor for corporate bonds needs to be strict but not "suffocating".

Mr. Huan also predicted that real estate bonds in 2025 will improve more positively following the recovery cycle of the real estate market.

"There will be no strong acceleration, real estate bonds will still recover slowly, but more surely. The most difficult thing for real estate bonds is to regain investors' trust after the recent collapse and crisis," said Mr. Huan.

Meanwhile, a long-time expert in the corporate bond market said that the current problem does not lie in the capital market because the infrastructure, products, and investor platforms have been basically formed. "The problem now is mainly the quality and business capacity of the issuing organizations," he said.

In general, if issuers cannot improve their management capacity, professionalism, transparency, reputation, quality, and real efficiency, they will not be qualified to participate in the market and if they do participate, investors will not be very interested.

Enterprises that operate transparently, professionally and effectively always find it easy to issue bonds or raise capital through various channels, and even face competition from investors looking for ways to lend or invest.

Ms. Tran Thi Khanh Hien - Director of Research at MB Securities (MBS) - said that banks are the group with the highest issuance value and a sharp increase compared to 2023 with a weighted average interest rate of 5.6%/year, average term of 5.1 years.

According to MBS's statistics, some of the banks with the largest value since the beginning of the year include: ACB (VND 36,100 billion), HDBank (VND 30,900 billion), Techcombank (VND 26,900 billion).

"We believe that banks will continue to increase bond issuance to supplement capital to meet lending needs. From the beginning of the year to December 7, credit increased by 12.5%, higher than the 9% in the same period last year," said Ms. Hien.

According to MBS experts, normally banks will have to pay higher costs when mobilizing through bonds, but in return this channel helps them have Tier 2 capital, meeting the safety ratio according to regulations.

"Since the end of last year, banks have had to reduce the maximum ratio of using short-term capital for medium- and long-term loans to 30%, instead of 34% as before," said Ms. Hien.

Source: https://tuoitre.vn/trai-phieu-doanh-nghiep-hoi-phuc-voi-443-000-ti-ngan-hang-nao-phat-hanh-nhieu-nhat-20250104231002156.htm

Comment (0)