Tien Phong Commercial Joint Stock Bank (TPBank - HoSE: TPB) has just announced that it has been approved by the State Bank of Vietnam (SBV) to contribute capital and purchase shares to acquire Viet Cat Fund Management Joint Stock Company (VFC) with a maximum amount of VND 125 billion.

Previously, TPBank's 2023 Annual General Meeting of Shareholders approved the policy of contributing capital and purchasing shares to acquire a subsidiary operating in the field of fund management.

According to TPBank, the acquisition of the fund management company is part of the bank's development strategy for the period 2023 - 2028 and vision to 2035, aiming to become a modern financial group with coverage in the fields of banking, finance, and securities;

Payment intermediary services, providing diverse financial products and services on a modern, advanced technology platform, bringing the best benefits and experiences to customers.

TPBank is responsible for carrying out procedures for capital contribution and share purchase of VFC in accordance with legal regulations, in which, the bank must ensure compliance with regulations on safety ratio in operations, real value of charter capital before and at the time of completion of capital contribution and share purchase as approved by the State Bank.

Within 12 months from the date of approval, TPBank must complete the capital contribution and share purchase in VFC.

Viet Cat Fund Management JSC was established in 2008 with a charter capital of VND 25 billion. VFC provides fund management services and investment portfolio services according to specific requirements for customers with separate investment needs.

The current General Director of Viet Cat Fund Management is Ms. Vo Anh Tu - Bachelor of Economics from National Economics University, Master of Science in International Business from Maastricht University (Netherlands).

With 20 years of experience working in the Finance - Banking industry at large securities companies and fund management companies such as VNDirect Securities, SSI Fund Management Company Limited, and has held the position of Deputy General Director of An Binh Securities Investment Fund Management Joint Stock Company for many years.

She is also a member of the Board of Directors of several companies in the fields of electronics, information technology, and construction: Viettronics Dong Da JSC, Viettronics Construction JSC.

Regarding business performance, at the end of the third quarter of 2023, VFC recorded net revenue of VND 184 million, down 89% from VND 1.7 billion in the same period last year. During the period, VFC's financial revenue jumped from VND 5 million in the third quarter of 2022 to nearly VND 1.2 billion.

However, financial costs increased sharply from VND61,200 to VND602 million and business management costs remained high, causing the company to report a loss after tax of nearly VND756 million.

In the first 9 months of 2021, VFC recorded net revenue of VND 739 million, a sharp decrease of 88% compared to the revenue of nearly VND 6.2 billion last year. The company's net loss after tax was nearly VND 2.7 billion, down from the profit of VND 766 million in 2022.

VFC's total assets as of September 30, 2023 reached VND 24.8 billion, a slight decrease of 4% compared to the beginning of the year. On this date, the company's liabilities were VND 553 million, a decrease compared to the beginning of the year and VFC did not use any borrowed capital .

Thu Huong

Source

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

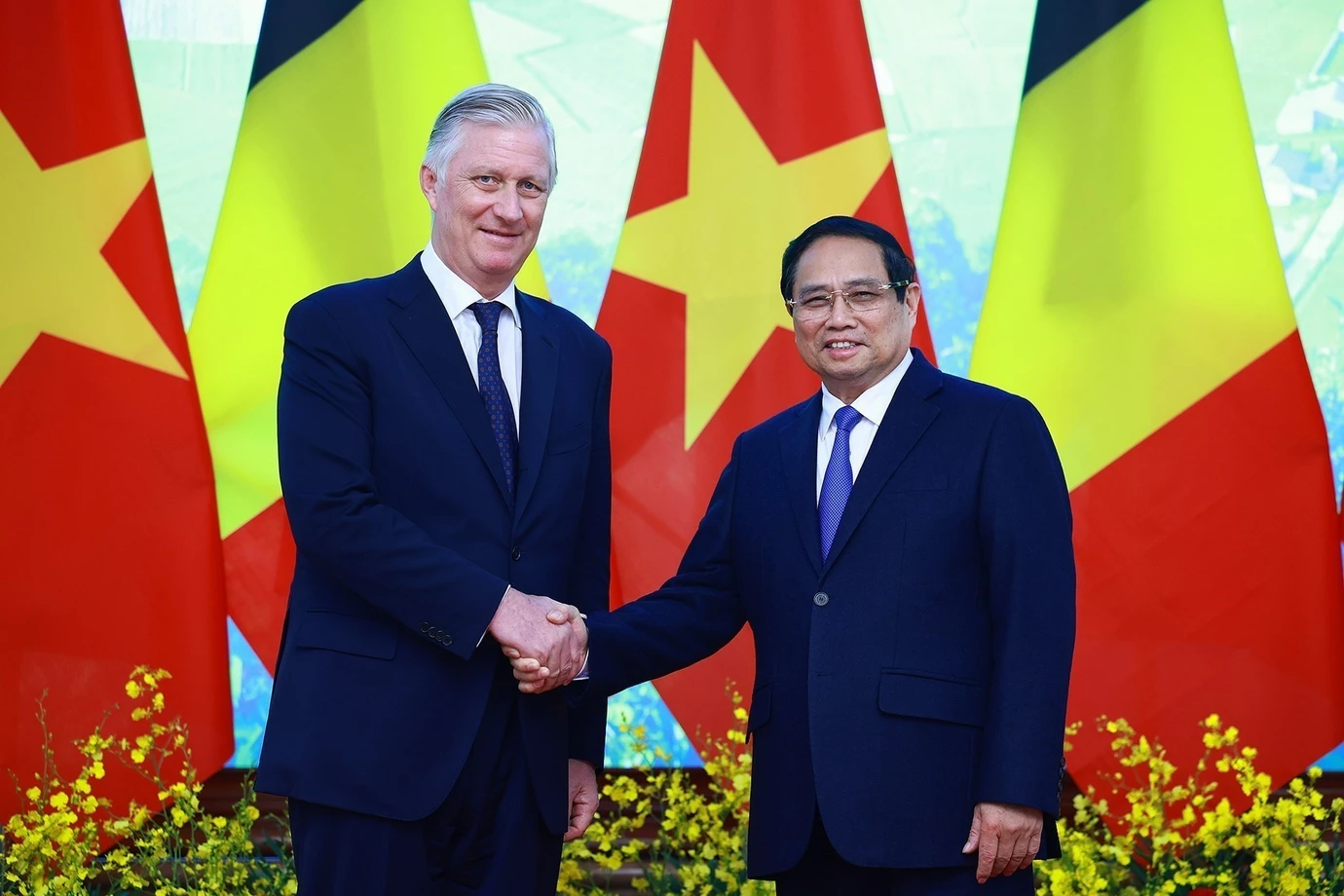

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

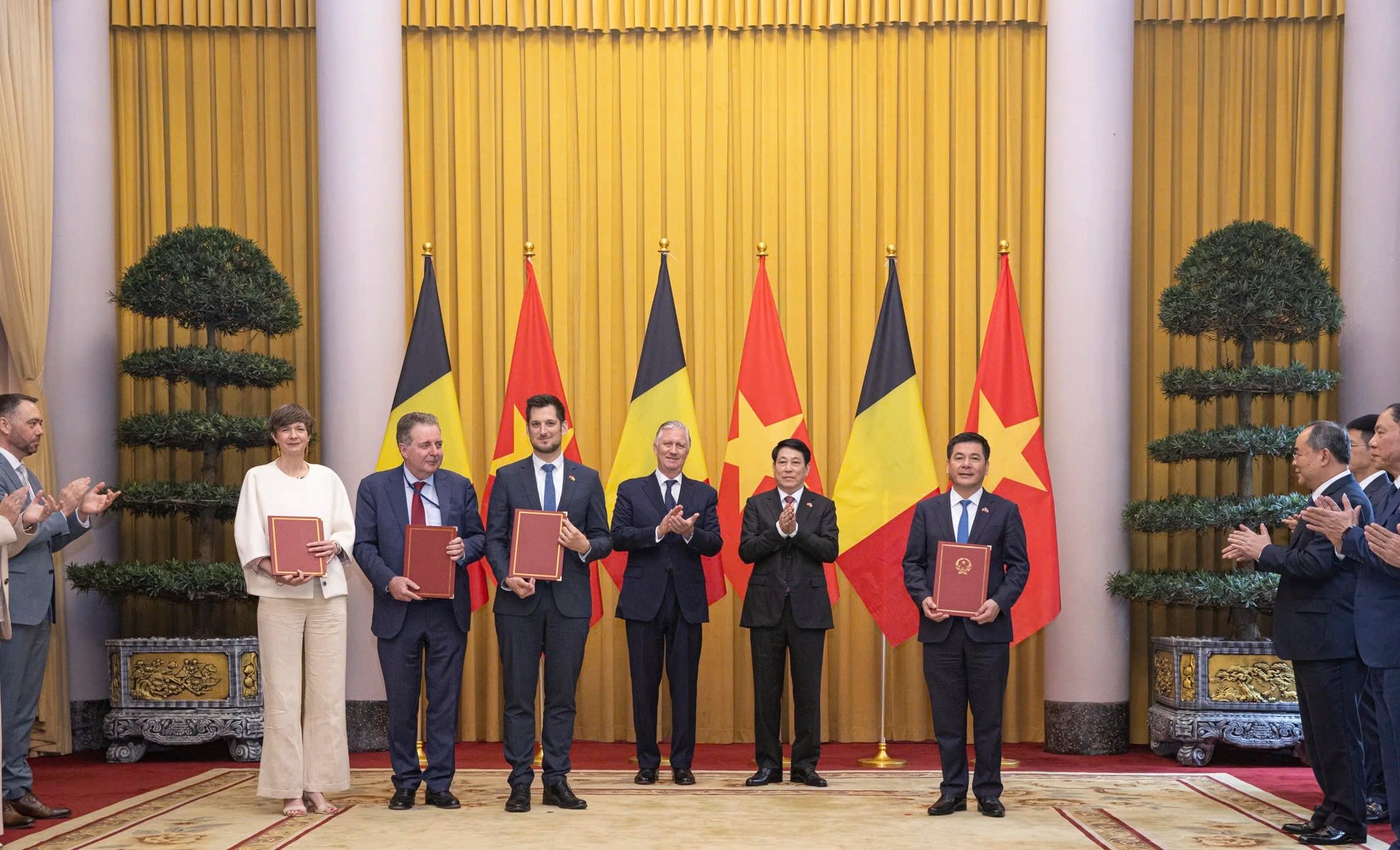

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)