Unreasonable in calculation

Ms. Bui Thi Kim Phuong in Ngoc Chau Ward (Hai Duong City) has just completed her 2023 tax settlement. She works in a revenue-generating public service unit, and her income has continuously decreased by 8-10% per year over the past few years. Compared to 2019, before the Covid-19 pandemic, Ms. Phuong's total income in 2023 decreased by nearly 30%.

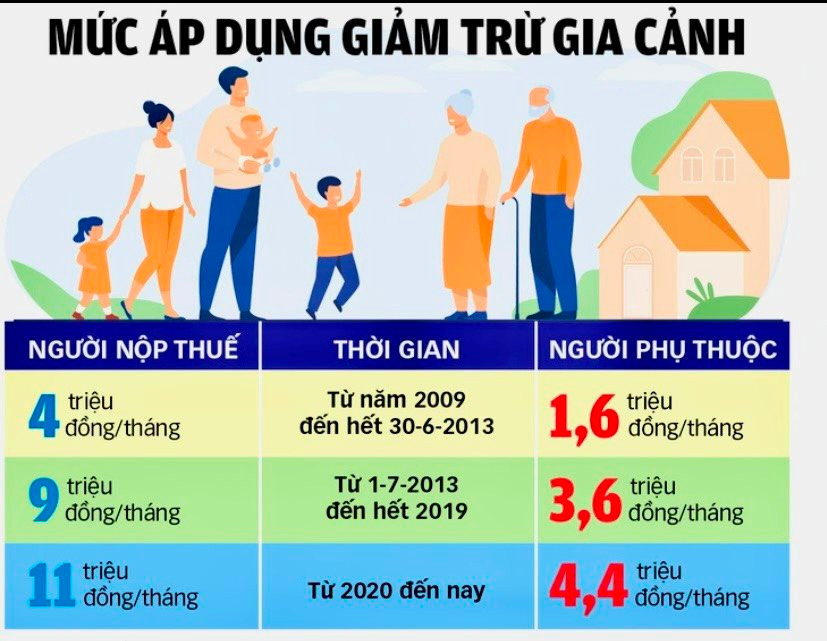

Although her income has decreased, the amount of personal income tax she has to pay has increased because of the irregular income that has been deducted at 10%. While her income has decreased, expenses such as the education of her two children and family living expenses have increased. "My eldest child's full-time public university tuition is already 4.2 million VND/month, so the deduction for dependents of only 4.4 million VND/month is too low, not enough to cover the minimum needs of food, accommodation, transportation, and education," Ms. Phuong cited.

Mr. Nguyen Van N., Director of an accounting service company, analyzed: It is unreasonable that the highest personal income tax rate for salaried employees is 35%, higher than the corporate income tax (only 20%). While manufacturing enterprises are allowed to deduct all travel expenses, purchase of working tools, and then calculate 20% tax when they have profits, employees, no matter how much income they have, can only deduct 11 million VND/month, which is not enough to cover the basic expenses of current life. The expenses of renting a house, buying a car, clothes, bank interest... of salaried employees are not included in the deductible expenses. "Salary employees only need to have an income of over 80 million VND/month to pay 35% tax. Meanwhile, people who win a billion-dollar lottery from the sky, without having to work hard, only pay 10% tax," Mr. N. analyzed further.

According to Ms. Nguyen Thi Phuong, a tax accounting service provider in Tu Ky town, the family deduction is being implemented at a "leveling" level while the Government regulates the minimum wage according to 4 regions, which is also an unreasonable point in calculating personal income tax.

Paradox to be solved

In recent years, people's lives have encountered some new difficulties, but personal income tax revenue in Hai Duong province has continued to increase. Specifically, according to data compiled by the Hai Duong Provincial Tax Department, in 2021, the province collected over 980 billion VND in personal income tax, in 2022 it collected nearly 1,052.5 billion VND, an increase of nearly 7.4% and in 2023 it collected nearly 1,112 billion VND, an increase of nearly 6%. Personal income tax regularly accounts for 8-10% of total domestic tax revenue, often only lower than the budget revenue from foreign-invested enterprises, non-state economic sectors and land use fees.

In the first quarter of 2024 alone, personal income tax in Hai Duong province collected over 440 billion VND, reaching 43% of the annual estimate and increasing by 14% over the same period last year.

According to Ms. Huynh Thi Quynh Thuong, Chief Accountant of a company in Lai Vu Industrial Park (Kim Thanh), personal income tax revenue in recent years has been greatly contributed by salaried workers. Due to the frozen real estate market, personal income tax revenue from real estate transfers has decreased.

The Law on Personal Income Tax was promulgated on November 21, 2007 and took effect from January 1, 2009. After more than 15 years of implementation, many limitations and shortcomings of this tax have not been completely resolved despite many amendments and supplements. The effectiveness of a tax must ensure the criteria of simplicity, ease of implementation, low compliance costs, fairness, etc.

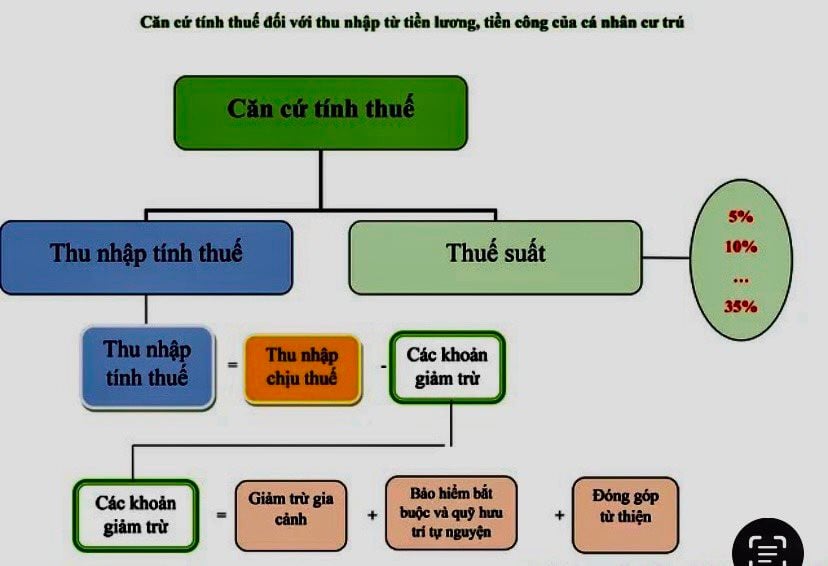

With personal income tax, there are up to 7 increasing levels, but the amount of money is not the same, making calculation and implementation very difficult. Specifically, after family deductions, the tax is calculated at 5% for the additional 5 million VND; 10% for the next 5 million VND; 15% for the next 8 million VND; 20% for the next 14 million VND; 25% for the next 20 million VND; 30% for the next 28 million VND; and finally 35% for income over 80 million VND/month.

With the current family deduction regulations, low-income salaried employees who have additional bonuses and commissions subject to a 10% tax provision must file a tax finalization at the end of the year to receive a tax refund.

According to Ms. Nguyen Thi Viet Nga, Deputy Head of the National Assembly Delegation of Hai Duong province, in fact, recently, the prices of many essential goods and services have increased sharply, making the lives of wage earners more difficult. Meanwhile, the family deduction level has been slow to change and update. This leads to disadvantages for those subject to personal income tax... It is expected that from July 1, our country will reform the salary policy for officials and civil servants as well as propose to increase the regional minimum wage and pension. If the salary adjustment is carried out in parallel with the amendment of personal income tax, it will ensure the connection of policies. The deduction level for taxpayers and dependents must be comprehensively re-evaluated and adjusted immediately in the spirit of nurturing revenue sources. “Instead of focusing on the easy-to-collect group of salaried workers, tax authorities need more tools and resources to exploit new revenue sources such as e-commerce, cross-border services... If there are breakthrough policies, these new revenue sources can offset revenue from personal income tax when raising the family deduction level,” Ms. Nga suggested.

TRANG LAMSource

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)