Allowing individual investors to buy individual bonds will contribute to promoting the development of the bond market when the number of individual investors still accounts for a large proportion. However, there must also be "accompanying" conditions for the issuing organization...

According to the draft amendment to a number of articles of the Securities Law, individual investors will be allowed to buy, sell, trade, and transfer individual bonds - Photo: QUANG DINH

Many experts have affirmed this after the draft amendment to a number of articles of the Securities Law, submitted to the National Assembly on October 29, included provisions allowing professional individual investors to buy individual bonds when the issuing enterprise has a credit rating, has collateral or a payment guarantee from a bank.

Should be ranked with bond lots

Speaking with Tuoi Tre, the general director of a credit rating company said that instead of applying regulations "generally" to issuing enterprises, credit ratings should be required for the bonds that those enterprises issue.

In addition, only professional individual investors are allowed to purchase bonds with investment-grade credit ratings or higher.

Long-term credit ratings range from C (lowest) to AAA (highest). "The appropriate level for bonds that individual investors can buy should be BBB or higher, which corresponds to the average credit rating on the market," he suggested.

Mr. Nguyen Ly Thanh Luong, head of analysis group of VIS Rating and Research, said that unlike credit rating at the issuer level, bond rating will analyze the risk of each issuance.

"Thereby explaining the differences between bonds of different nature and limiting cases of mispricing. But up to now, no corporate bonds in Vietnam have been rated, unlike other markets in the region," said Mr. Luong.

According to Mr. Luong, investors can use the bond's credit rating and the bond's past trading price history to determine the reference for pricing bond transactions. "For example, between bonds with similar terms and conditions.

Bonds issued by organizations with better credit ratings will have lower interest rates than bonds issued by organizations with worse credit ratings," Mr. Luong analyzed.

Another expert also said that we should consider applying credit ratings to bonds and maintaining them throughout the life of the bonds instead of only requiring credit ratings for the issuer. Because the product that investors buy is a specific batch of bonds.

"Decree 155 mentions bond credit ratings, while Decree 65 only mentions credit ratings of issuing organizations but does not mention rating requirements for debt instruments or bonds," he said.

Mr. Phan Phuong Nam, deputy head of the commercial law department at Ho Chi Minh City University of Law, said that it is necessary to soon amend the decree regulating credit rating services to improve the quality of bonds, and at the same time have stricter regulations to avoid "handshakes" and "collusion" in ratings.

In addition, Mr. Nam is also concerned about the situation of "dodging" the professional investor certificate so that individuals can freely buy and sell individual bonds. "Individual investors should not be eliminated from participating in the individual bond market, but there must be regulations so that professional investors are truly professional," Mr. Nam said.

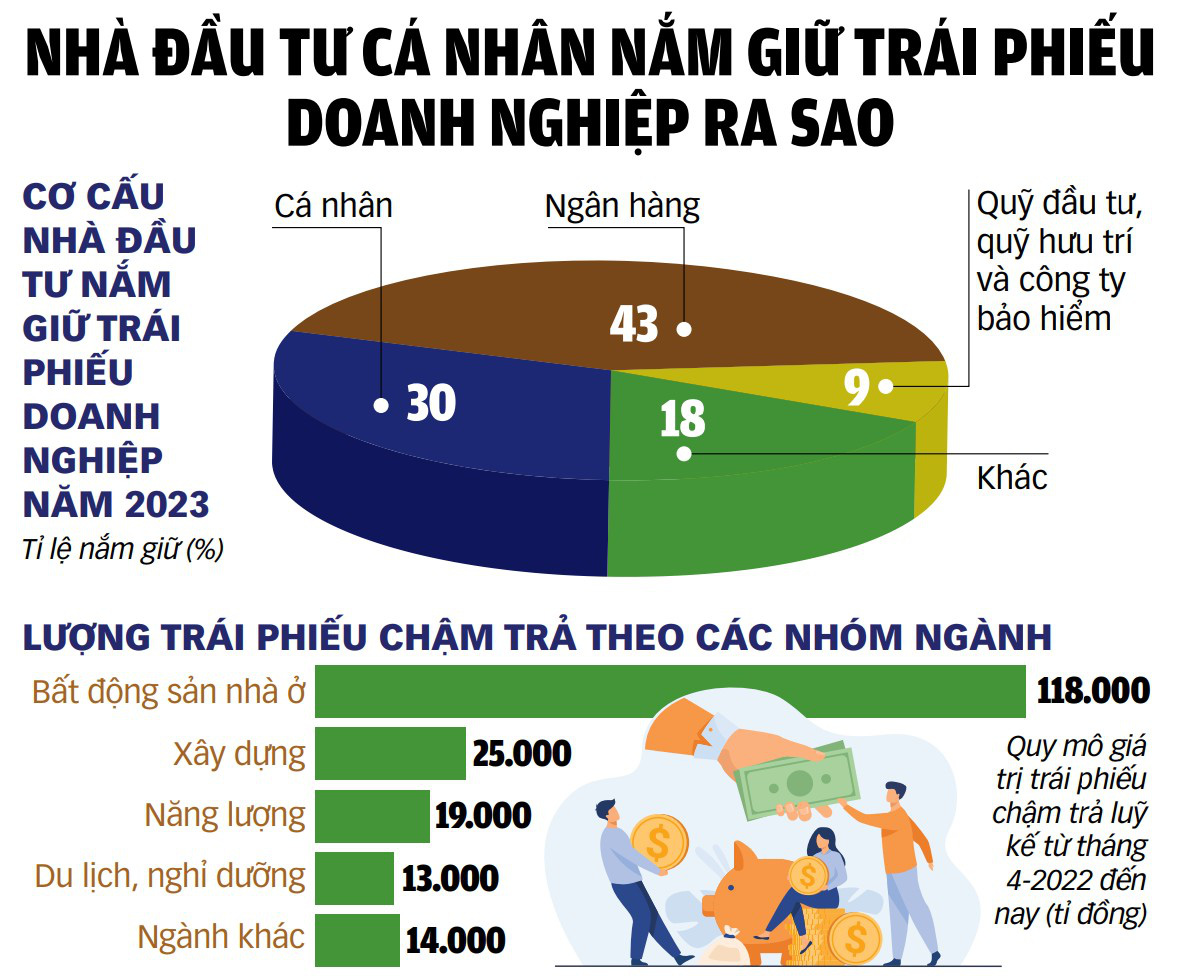

Source: Fiinratings, Vis Rating - Data: BINH KHÁNH - Graphics: TUAN ANH

Is bank guarantee possible?

In addition to credit rating, according to the draft, the issuing enterprise must have collateral or a payment guarantee from a credit institution to be eligible for individual investors to participate.

Mr. Nguyen Quang Thuan, General Director of FiinRatings, said that unlike an issuance guarantee, a payment guarantee is a guarantor who will make a commitment to pay part or all of the debt obligations of the issuing organization in case the issuing organization cannot fulfill the committed debt obligations.

"In the corporate bond market, there have been a number of bond lots guaranteed for payment by commercial banks and the rest are mainly corporate guarantees made by companies within the same group for corporate bond issuers," said Mr. Thuan.

However, according to Mr. Thuan, the number of guaranteed bonds is still small and mainly bonds purchased by insurance companies. Bonds offered to the public are almost never guaranteed for payment by a bank or a financial institution with financial potential and high credit rating.

Therefore, Mr. Thuan believes that Vietnam should consider forming a legal framework to establish a number of organizations providing credit guarantee services, including bond guarantees performed outside of credit institutions. This guarantee organization can be established by private individuals and operated by large financial and investment institutions in Vietnam and international organizations.

Mr. Huynh Hoang Phuong - FDIT's asset management consultant - also said that many bonds have not paid principal and interest on time in the past two years even though the issuing organization still has collateral.

However, the assets mortgaged/pledged as collateral for bonds are mostly tied to the business cycle of the issuing organization, such as stocks.

Some collateral assets have low liquidity, such as suburban real estate, and even the legality of projects used as collateral does not meet the requirements... Therefore, if there is a payment guarantee from a bank, private bonds are safer than bonds issued to the public.

However, according to Mr. Phuong, in reality it will be very difficult to implement. Most organizations will choose the option of meeting the collateral requirements, instead of choosing the bank's payment guarantee. "The payment guarantee fee is usually calculated by the bank as a percentage of the guarantee value during the entire guarantee period, so the cost for the issuing enterprise will be very large," said Mr. Phuong.

Must "tighten" valuation activities

Mr. Huynh Hoang Phuong said that handling collateral assets is a difficult process for banks, not just bondholders. This requires time, effort, money and human resources...

Therefore, according to Mr. Phuong, the activities of valuation companies/units should be "tightened" more, and there should be stricter regulations on assessing the value, risks, and legality of assets in the issuance dossier.

According to Mr. Phan Phuong Nam - Ho Chi Minh City University of Law, instead of tightening the "pre-inspection" mechanism, there should be a "post-inspection" mechanism. Because the prominent cases that have caused loss of trust in TPDN in recent times are mainly due to improper use.

Therefore, it is necessary to improve the mechanism to control the use of capital by enterprises after issuance. "It is necessary to increase sanctions and have strong measures to handle when the issuing organization uses it for the wrong purpose. There must be timely warnings to investors," Mr. Nam noted.

* Mr. NGUYEN DUC CHI (Deputy Minister of Finance):

Many regulations to improve bond quality

Mr. NGUYEN DUC CHI (Deputy Minister of Finance)

To limit risks for individual investors in the private corporate bond market and overcome past limitations, the draft Securities Law has added regulations to improve the quality of bonds.

In order for professional investors, whether individuals or organizations, to participate, we recommend that the individual corporate bond issuer must have a credit rating.

Enterprises issuing individual corporate bonds must have collateral or a payment guarantee from a credit institution.

We also propose to amend the decision process for issuing corporate bonds to the public to create more favorable conditions for qualified enterprises to be quickly considered and granted certificates for issuing bonds to the public to raise capital.

For bonds issued to the public, all individual and institutional investors, regardless of whether they are professional or non-professional, can participate. However, the new policy needs time for the market to adapt. Therefore, these regulations are expected to be submitted to the National Assembly for approval to take effect from January 1, 2026.

Source: https://tuoitre.vn/thuc-day-phat-trien-thi-truong-trai-phieu-20241030225753083.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)