After a boom period, foreign investment in Vietnam through capital contributions and share purchases has slowed down significantly. The market is waiting for big deals, so that mergers and acquisitions (M&A) activities can become active again.

|

| On April 9, 2024, CDH Investment announced that it had completed the purchase of 5% of Bach Hoa Xanh's capital. Photo: Duc Thanh |

Hesitant to contribute capital and buy shares

There is important information about the situation of attracting foreign investment since the beginning of the year, that is, while newly registered capital and additional capital increased sharply compared to the same period, respectively reaching nearly 10.8 billion USD, up 35.6% and reaching nearly 5 billion USD, up 19.4%, investment capital through capital contribution and share purchase is still on a downward trend.

Specifically, according to the Foreign Investment Agency (Ministry of Planning and Investment), in the first 7 months of the year, there were 1,795 capital contribution and share purchase transactions by foreign investors, with a total capital contribution value of nearly 2.27 billion USD, down 3.1% and 45.2% respectively compared to the same period last year.

This is not the first and only year that investment activities through capital contribution and share purchase by foreign investors have decreased. In the past 5 years, 2019 is considered the year of explosion in this form of investment.

At that time, reporting on the situation of attracting foreign investment, Mr. Do Nhat Hoang, Director of the Foreign Investment Agency, said that investment in the form of capital contribution and share purchase tended to increase sharply and accounted for an increasingly large proportion of total foreign investment capital. Specifically, in 2017, investment in this form accounted for 17.2% of total registered capital; in 2018, it accounted for 27.9% and by 2019, it accounted for 40.7% of total registered capital.

Statistics show that in 2019, the country had 9,842 capital contributions and share purchases by foreign investors, with a total capital contribution value of 15.47 billion USD, an increase of 56.4% over the same period in 2018. However, since that peak period, investment capital in this form has begun to decline. The figure for 2020 was 7.47 billion USD, down 51.7%; in 2021 it was 6.9 billion USD, down 7.7%; in 2022 it was 5.15 billion USD, down 25.2%. In 2023, although the figure has increased to 8.5 billion USD, up 65.7% compared to 2022, it is still only more than half of the "peak" of 15.47 billion USD in 2019.

The difficulties of the 3 years of Covid-19, combined with the "double blow" of geopolitical instability, have caused global investment flows, including investment in the form of M&A, to decline. In 2023, according to data from the London Stock Exchange Group (LSEG), the global M&A market will only reach a transaction value of 2,900 billion USD, down 17% compared to 2022. This is the first time since the global financial crisis of 2008 - 2009 that the world M&A market has witnessed a decrease of more than 10% for two consecutive years. Of which, the M&A market in the Asia - Pacific region alone decreased by 25%.

In the first half of 2024, according to Mr. Le Xuan Dong, Director of EY Parthenon - Strategy Consulting, EY Consulting Vietnam Joint Stock Company, the M&A market in Southeast Asia tends to decline in both total value and number of deals. And Vietnam is no exception. In that context, it is easy to understand why the investment flow through capital contribution and share purchase in Vietnam also decreased.

Waiting for big deals

Although no large-scale deals have been finalized since the beginning of the year, according to a recent report by Savills Vietnam, there have been some notable M&A deals. For example, Kim Oanh Group (Vietnam) cooperated with NTT Urban Development, Sumitomo Forestry, Kumagai Gumi Co Ltd (Japan) to develop The One World, a 50-hectare residential area in Binh Duong province. Or Nishi Nippon Railroad (Japan) acquired 25% of shares in the 45.5-hectare Paragon Dai Phuoc Project from Nam Long Group (Vietnam) for about 26 million USD.

In particular, Tripod Technology Corporation (Taiwan) acquired an 18-hectare industrial land plot in Ba Ria - Vung Tau from Sonadezi Chau Duc. After receiving this land, Tripod Technology invested 250 million USD to build an electronic components factory here, like many other Taiwanese investors who are continuously pouring capital into Vietnam in this field.

According to Mr. Troy Griffiths, Deputy CEO of Savills, the industrial real estate sector will witness stable demand, supported by foreign investment flows and infrastructure development. Accordingly, M&A deals in this sector are expected to be active again.

Recent economic experts also believe that with laws related to the real estate market, such as the 2024 Land Law, the 2023 Housing Law and the 2023 Real Estate Business Law taking effect from August 1, 2024, M&A activities in the real estate sector will be "fueled".

However, the market is still "waiting" for big and solid deals, not only in the real estate sector, but also in the retail, manufacturing, finance - banking sectors... as before.

Some M&A deals have been made recently, but mostly on a small scale. For example, CDH Investment, a Beijing-based asset management company, acquired 5% of Bach Hoa Xanh; or Levanta Renewables (Singapore) acquired a rooftop solar power project from related companies of Tien Nga Joint Stock Company, one of the leading logistics providers in Vietnam.

Meanwhile, Sembcorp Solar Vietnam Pte Ltd - a 100% owned subsidiary of Sembcorp, has also completed the acquisition of the majority of capital contributions in 3 subsidiaries of the Gelex Group system, and is expected to continue to purchase 73% of shares of the 4th subsidiary in the Gelex system in the second half of 2024...

According to a report by the Ministry of Planning and Investment, in the first 7 months of 2024, Japanese investors remained the top investors among countries and territories investing in Vietnam through capital contributions and share purchases, with a total value of nearly 595 million USD. Next came Singapore, with 500 million USD, and South Korea, with 323 million USD. Meanwhile, Taiwanese investors contributed capital and purchased shares worth 160 million USD; Cayman Islands 184 million USD; China 124 million USD, etc.

These are the investors who have long been conducting large M&A deals in Vietnam. Therefore, we will have to wait for them to “spend a lot of money” in the coming time, so that investment activities through capital contribution and share purchase can flourish.

Source: https://baodautu.vn/thi-truong-ma-cho-thuong-vu-lon-d222299.html

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

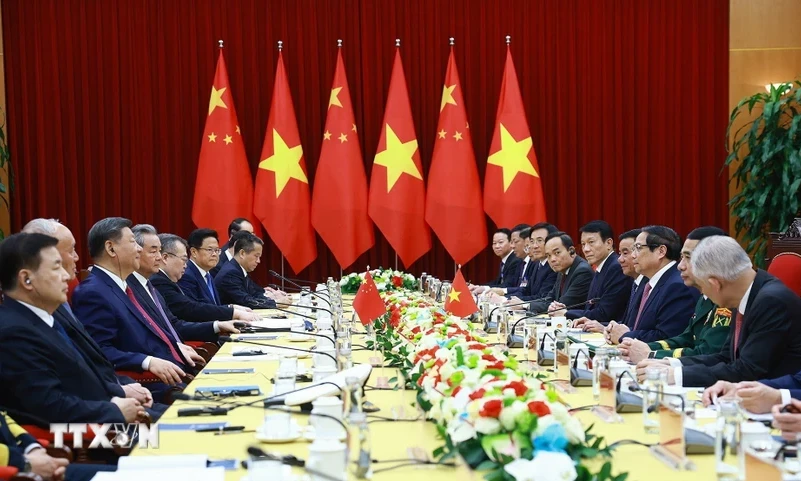

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)