There are many reasons why these two sectors are stimulating investors and businesses globally to want to make more M&A deals.

The M&A market in 2025 will have many "huge" deals in the healthcare and education sectors.

There are many reasons why these two sectors are stimulating investors and businesses globally to want to make more M&A deals.

Mega deals up 18%

According to the recently released PwC Global M&A Trends: Outlook 2025 report, deal value increased by 5% in 2024, mainly due to an increase in the average value of each deal. Although transaction volume decreased by 17% due to macroeconomic uncertainties surrounding inflation and interest rates, M&A activities (mergers and acquisitions) for small and medium-sized deals.

The M&A market saw a significant increase in the higher-end segment, with more than 500 deals worth more than $1 billion, up from 430 deals in 2023.

Additionally, mega-deals increased 18%, with 72 deals worth more than $5 billion announced in 2024, compared to 61 the previous year.

CEOs are also optimistic about M&A plans in 2025, according to the report. According to PwC's 28th Global CEO Survey, 81% of CEOs who have made at least one major M&A deal in the past three years plan to make one or more M&A deals in the next three years.

Healthcare and pharmaceuticals actively enter the M&A race to quickly transform business models

According to the Report, by 2025, product shortages, supply chain risks, and new policies are driving M&A activities in the healthcare industry.

In the pharmaceutical and life sciences sectors, deals have focused primarily on biotech to deal with expiring patents and divestitures of non-core assets to optimize portfolios.

At the same time, these companies are also restructuring their portfolios in the process of innovation. In addition, the growing interest of private equity funds in medtech and digital health creates many attractive exit opportunities for companies invested by private equity funds.

|

| Retail healthcare businesses, selling over-the-counter (OTC) drugs with the trend of separating into independent legal entities or divesting capital are also actively participating in the M&A race to quickly transform their business models. |

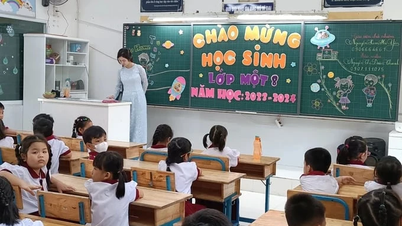

PwC forecasts that by 2025, the M&A market in the Vietnamese healthcare sector is expected to be vibrant, mainly due to the increasing demand for high-quality healthcare services and the rise of the middle class. Private hospitals and specialized medical facilities, especially in the fields of ophthalmology and oncology, will become the focus of M&A activities.

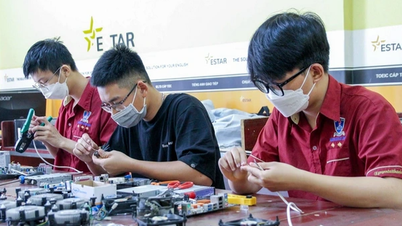

Meanwhile, globally, the M&A sector in the education sector is witnessing strong growth, with the active participation of private equity funds, accounting for 50% to 70% of the total investment portfolio. Education technology (EdTech), especially in the field of digitalization of general and higher education, is the focus of attention.

The rapid development of technology and the ever-increasing demand for quality education are driving strong growth in M&A activities in this sector.

PwC's report analyzed that with strong foreign investment incentive policies and no restrictions on investment capital in educational institutions, the M&A market in the education sector in Vietnam is becoming extremely attractive.

M&A activity in 2025 is expected to be vibrant, driven by investment incentives and growing demand for private education. Strategic partnerships and investments in higher education and vocational training will improve quality and infrastructure. Supportive government policies will create a favorable environment for both domestic and foreign investors, creating many opportunities for M&A activities.

The barriers

According to Mr. Ong Tiong Hooi, Deal Advisory Services Leader, PwC Vietnam, entering 2025, global M&A activities are on the path to strong recovery, driven by signs of economic improvement and strategic acquisitions.

This trend is also reflected in Vietnam, with increased deal activity across a variety of sectors. Domestic companies are taking the lead in high-value deals, while foreign investors are also returning to the market, focusing particularly on two potential sectors: healthcare and education.

However, PwC also pointed out factors that will impact M&A deals in 2025. These include geopolitical influences and the “Trump effect”. According to PwC, deal makers and market researchers are still assessing the impact of elections taking place in many countries in 2024 and subsequent policy changes, especially the impact of the new Trump administration in the US.

In addition, interest rate cuts in many countries in the second half of 2024 have supported renewed M&A momentum. However, long-term interest rates are rising again, and the timing and extent of future rate cuts will depend on the strength of each country's economy and whether inflation continues to cool, leading to uncertainty for deal makers.

Source: https://baodautu.vn/thi-truong-ma-nam-2025-co-nhieu-thuong-vu-khung-o-linh-vuc-y-te-va-giao-duc-d248016.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

Comment (0)